Keeping an eye on Silver Chef

Summary: Silver Chef had an excellent year in 2015, with its share price growth and strong dividend leading us to add it to the income first watchlist. The hospitality financing business needs to purchase assets to rent out and these depreciate over time, making SIV a capital-intensive operation. While its balance sheet is strong, the business relies on strength of the hospitality and construction sectors for growth. Given SIV has high demands on its cash flow for growth, I'd like to see a higher dividend yield. |

Key take out: SIV's yield looks pretty healthy, but it remains on the income watchlist until cash flow can cover more of the company's reinvestment. |

Key beneficiaries: General investors. Category: Shares. |

Last year I pointed out that Silver Chef (SIV) was firmly on the income first watchlist. It is a company that has been growing and is paying a strong dividend yield, forecast to be near 4.3 per cent plus franking in FY16. While I am not yet ready to put the company in the portfolio, the business might suit some income investors and is one I will continue to watch closely as a candidate for inclusion after its financial report this February.

The stock performed incredibly well in 2015, with the share price lifting from $5.98 to $9.05 at the end of the year, a return of 51.34 per cent. The company also announced 36 cents in fully franked dividends, so investors had a very happy year. This performance, along with some strong historical financial performance, led us to put SIV on the watchlist for the income first model portfolio.

What does SIV do?

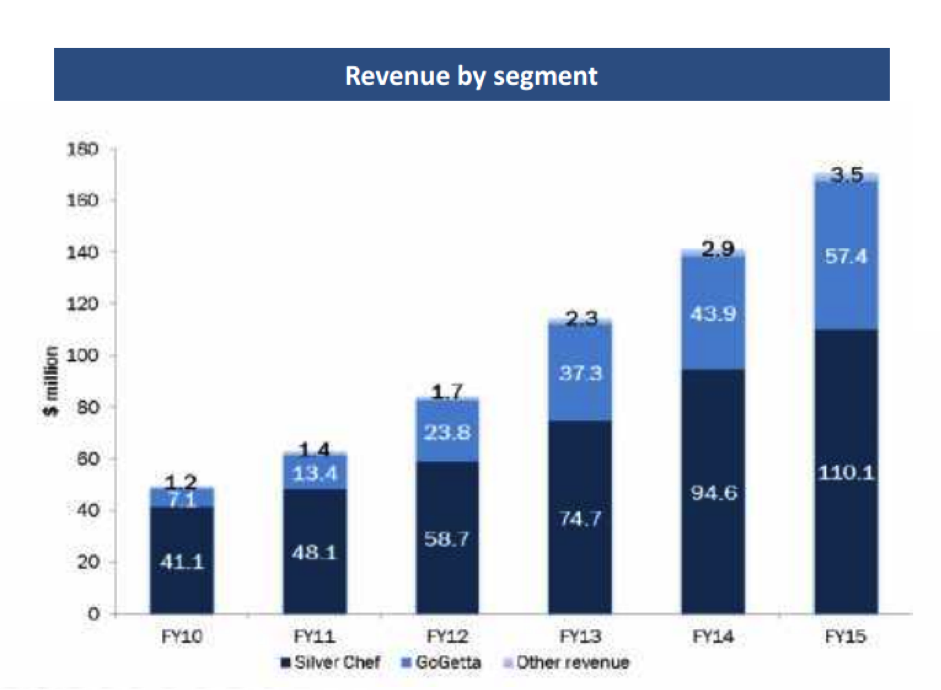

SIV is a finance business, focusing on restaurant equipment financing, as well as transport and logistics equipment financing through the GoGetta brand. Financial performance has been impressive in recent years, and this has catalysed the share price run. Here is the company's divisional revenue performance over the past 6 years:

Source: SIV FY15 results presentation announced to ASX

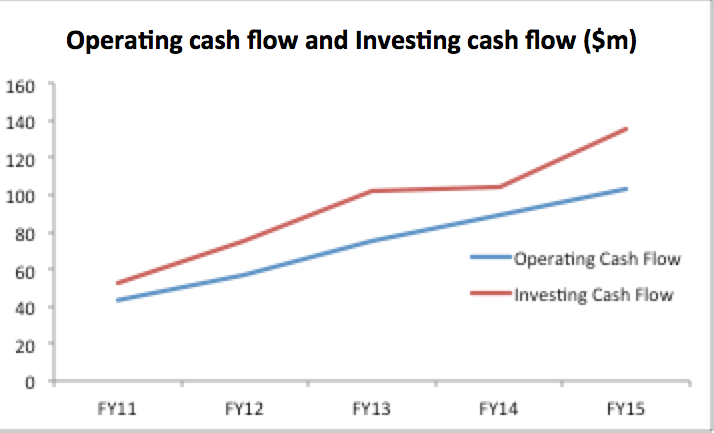

The company buys assets (hospitality equipment, transport or earthmoving equipment), and then leases or rents this equipment out – it is an asset management and financing company. This means there is high level of capital intensity to the business as it invests up front in equipment that it depreciates over that equipment's life. While the business is growing, and we can see from the above chart that it certainly is growing strongly, the company is investing its cash flow into new assets and equipment at a high rate. Here is a chart showing the company's operating cash flow versus the investing cash flow over the past 5 years:

As can be seen, SIV is investing more in its business than it is generating from operations on an ongoing basis. The shortfall in cash is being funded by both debt and equity. Since 2010, SIV's gearing has been quite consistently high. Here is a table of the company's net debt to equity over the last five years:

Interest bearing liabilities | Equity ($m) | Cash ($m) | Net Debt / Equity | |

FY11 | 51.8 | 31.1 | 1.5 | 162% |

FY12 | 66.9 | 45.2 | 0.7 | 146% |

FY13 | 92.2 | 58.2 | 1.3 | 156% |

FY14 | 109.5 | 67.7 | 1.5 | 160% |

FY15 | 141.1 | 84 | 1.6 | 166% |

While a net debt to equity above 100 per cent might seem rather high at first, it is important that we put this number in context. SIV is a financing business, and to run this type of company for growth the balance sheet should be fully utilised – particularly in an environment with such cheap cost of debt funding. However, it does place the business at some risk should there be an adverse change that was otherwise unforeseen. I'm not saying that this is the sole reason we have decided not to include SIV in our model portfolio, but it is a contributory reason, and a risk worth highlighting.

Capital thirsty business

SIV is a highly capital intensive business. Over the last five years, SIV has needed to raise equity capital on five occasions, and has also issued additional debt (including corporate notes). While the balance sheet is healthy, as discussed above, the growth of the business and its capital intensity put it in a position whereby additional capital has been needed with relative regularity. For now, this is no issue, as the business has been growing its revenue, its receivables and its cash flow from operations at rates that underpin strong growth and justify the capital investment. That said, the company's reliance on the ability of hospitality businesses and small transport and construction businesses to perform is a risk. From a top down risk perspective a downturn in these businesses could see some pressure on the company. For now, there is no indication that this is happening, and in fact bad debts have been managed to very low levels for some time.

Strong growth opportunities

SIV forecasts in its presentations that the hospitality side of the business will see around 4.3 per cent per annum growth in its target market. This is a strong growth rate to underpin demand. Additionally, SIV is expanding overseas. The company's Canadian Hospitality operations were at a cash profit break even, and is planned to expand into the market nationally. Alongside the Canadian expansion, SIV also has a Hospitality presence in New Zealand, which provides a further avenue for growth. Overall, SIV does have a strong investment case, and growth options.

Risks are well managed

During 2015, SIV refinanced and restructured its balance sheet, reducing its cost of funding significantly. This will enhance future returns and provide some buffer to the risks I have highlighted above. Long term doubtful debt provisioning is in the range of 2 per cent to 3 per cent, and the company's client base is highly diversified, protecting the group from any client specific risks.

Still on the watchlist

Clearly SIV is a well-run business, paying a decent yield. The company has longevity in its field and appears to have a good platform for international expansion. I am definitely of the view that SIV is a good investment. The problem for me is that the business is trading on a trailing PE above 18 times, in a market that is trading below long term average levels. There is good growth in earnings, but with plenty of gearing on the balance sheet, and the potential for risks to emerge in a weaker economy, I wouldn't classify SIV as a bargain at the moment.

As I mentioned, there are some risks, borne out of the capital intensity of the business. At a price near $9, I don't feel that the risks are fully priced in. As mentioned, SIV's share price lifted by more than 50 per cent last year, in a quite weak market.

This outperformance has SIV trading at a level that I believe doesn't offer enough to our portfolio. The forecast dividend yield (if we use a DPS of 40c for the full year) is a shade under 4.3 per cent plus franking credits. This yield is pretty healthy, but for a company that has such strong demands on its cash flow for growth, I'd like to see it higher. Before we consider it for the portfolio, it is important to see operating cash flow cover more of the company's reinvestment, as well as profitability from international operations. We aren't quite there yet, but will watch with interest as SIV delivers its interim financial results in February.