Just what the doctor ordered for Telstra

Telstra’s glowing results may have stunned investors last week, but not enough to shrug off questions about the telco’s future avenues for growth.

Eyes are firmly fixed on Telstra’s burgeoning cash pool, its renewed appetite for niche technology acquisitions and its Asia-focused international division that posted a 63 per cent year-on-year increase in revenue last year.

But the focus on Telstra’s core competencies has seen many overlook an interesting little project that's been bubbling away on the side: its eHealth division.

The eHealth department hasn't been operating for long, but as last week's results showed, it earned a modest $40 million in its first year alone. That’s just pocket change for Telstra, which reported a grand total income of $26.3 billion in FY14, but it's a start nonetheless.

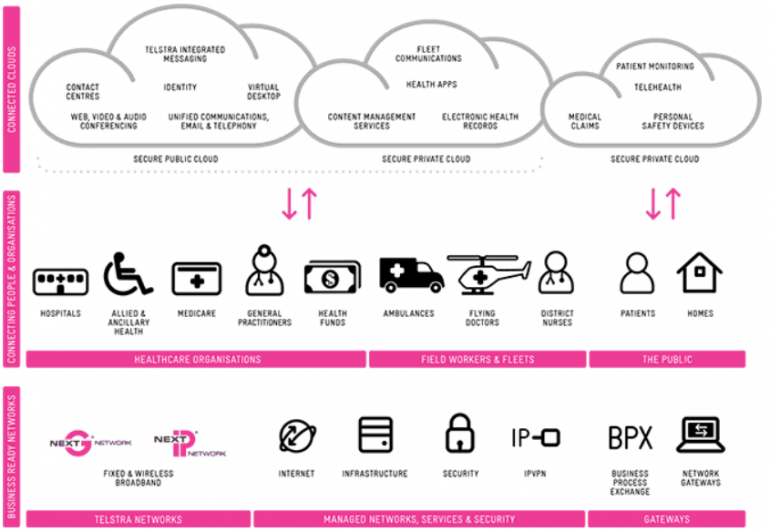

While it’s very early days for the telco’s eHealth ambitions, in true Telstra fashion the plan appears to be to corner the market early and enjoy the expected rise in eHealth services. As this blueprint from its eHealth website shows, Telstra wants to be a part of every facet of this trend.

It’s not attempting to build this division out of scratch either: the telco has bought itself a slice of each of the various elements of the eHealth movement -- most of which were acquired late last year.

As it stands, Telstra has an interest in the e-prescription market (Fred IT), national health database management (Database Consultants Australia healthcare division), digital doctor booking and appointment services (HealthEngine) and hospital focused data-management (IP Health).

Head of Telstra Health Shane Solomon declines to give a ballpark figure on how much the telco has spent in forming this unit, other than to say its investment is “substantial and continuing”. He adds that the next focus for the unit will be to integrate all of its current acquisitions into one eHealth platform.

The hope is that by jumping on this trend, Telstra will be in a position to capitalise on the growing health IT market. Analyst firm Frost and Sullivan forecast it to be worth $1.4 billion by 2018. A combination of Australia’s ageing population and increasing hospitalisation and health care costs are set to see providers further invest in IT as a means to reduce costs.

Telstra already owns part of the equation: the network needed to fuel this eHealth boom. BuddeComm analyst Paul Budde estimates that e-health related traffic will grow to take up about a quarter of the overall capacity of Australia’s next generation networks.

Despite saying Telstra will hold the “early mover advantage” in this space, he’s wary to call its eHealth play the next "Telstra monopoly''. He argues that other major IT players like IBM, Accenture and perhaps even Google may make a play for the eHealth space in the future.

Perhaps the inevitable question with Telstra’s eHealth plan is to whether it is playing in an area that is well outside its core competency. Frequent forecasts of the long-term demise of the telco business model have seen Telstra’s global counterparts move into all kinds of internet-related businesses. But is a shift into eHealth a bridge too far?

Solomon disagrees. He says Telstra's various acquisitions have seen it pull together the right expertise needed to turn this into an effective division of the company. He also says a shift into eHealth is logical for Telstra because all of its solutions revolve around Telstra’s core company, “connectivity”.

“The move into health is an adjacency, which means it is a new business but also leverages Telstra’s existing strengths,” Solomon says.

Again, it’s still early days for Telstra’s eHealth unit. It may not hit its prime for some time and there is plenty of risk involved in a strategy that involves morphing several start-ups into one coherent division. But it is one to watch, not just for the impact it will have on Telstra’s bottom line, but for the long term implications for Australia’s silently booming health sector.

Telstra already has your metadata. Soon it may also know your vitals.

Got a question? Let us know in the comments below or contact the reporter @HarrisonPolites on Twitter.