Just how good is the US market?

Summary: The sustainability of US growth is a key question on investors' minds at the moment due to falling consumer confidence and indications from the Black Friday. Sales from the period – which is often a herald for the upcoming holiday sales period – were down on the previous year. However, it's important to highlight that consumers are changing their spending habits, spending more and more online, and that the US economy's recovery is broad-based; it isn't just relying on one driver of growth. |

Key take-out: Investors don't need to be concerned about the durability of the US expansion. Indeed, the US is firing on all cylinders, with broad-based economic growth, the number of jobs strengthening, household incomes rising at a rapid rate and people saving more. |

Key beneficiaries: General investors. Category: Shares. |

One of the key concerns held by attendees at last week's international investing conference was over the sustainability of the recent surge in US economic growth.

By now, most readers know that the US economy is enjoying a strong expansion. On the latest figures, the US economy grew by 3.9% in the September quarter, which came after a 4.6% surge in the June quarter. Indeed, excluding a weather distorted first quarter, GDP is averaging growth over 4%, compared to the average around 2.5%.

There is even a much better appreciation now that the jobs market is strong – and it is – with 2.6 million jobs created in the last fiscal year. This is the best jobs growth since 1999 and an outcome that follows 2.4 million jobs created in 2013 and 2.1 million in 2012. Indeed the last four years represent the longest run of jobs growth since World War II.

Yet, notwithstanding these strong outcomes, concerns are growing in the wake of falling consumer confidence and indications from the latest 'Black Friday' sales. The Black Friday sales period (for the US) is often a herald for the upcoming holiday sales period – and headlines show that sales were down 11% compared to last year. Falling consumer confidence and sluggish sales both feed into this idea that the best is perhaps past for the US.

I don't think we need be too concerned about how sustainable this growth is, however. For a start, those headlines suggesting Black Friday sales fell 11% are a little misleading. While Black Friday sales were weaker than last year, Thanksgiving sales were strong, rising 24%. Moreover, the figures don't include online sales which, as in Australia, are surging. The fact is, the usefulness of the Black Friday sales numbers is waning.

Perhaps most importantly, recent growth outcomes in the US are broad-based. That is, they are characterised by solid consumer spending, strong business investment, residential investment and, of course, strong export growth. The advantage of this is that is shows the US economy isn't relying on just one driver of growth – the US consumer. Remember, it was these types of imbalances that helped create the GFC.

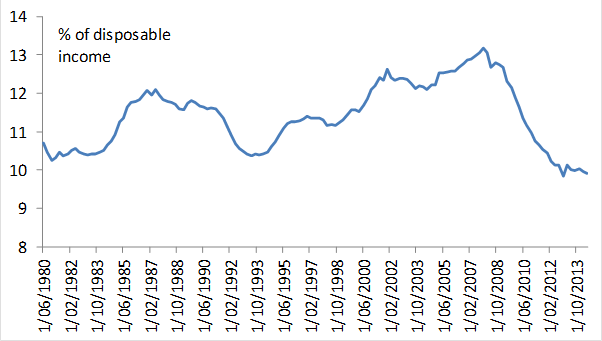

Prior to the GFC, consumer spending on housing – and stuff to fill houses with – was the primary driver of growth. That meant that imbalances developed, in the sense that consumer debt surged and, as interest rates started to rise, the consumer debt servicing ratio began to lift, reaching a peak of about 13% of household incomes. Clearly this caused some problems.

In contrast, going into this expansion, the consumer debt servicing ratio is very low; indeed, it's at multi-decade lows as you can see from chart 1 below.

Chart 1: US household debt servicing ratio at lows

Obviously this is a function of the lowest interest rates on record, but to see that debt servicing ratio lift we are going to need either a surge in interest rates or debt. On the interest rate front, I think we can agree that a spike just isn't going to happen – even when rates do eventually start to rise. On the debt front, well, consumer debt is at its lowest as a proportion of GDP since 2003. That's a very good outcome and it shows that we are a long way from any trouble zone.

That's doubly so when you look at the rapid pace of household incomes growth. Policy makers and many investors lament the fact that US wages growth has been so modest. It's true to say that wages have been sluggish, but they're still rising – by about 2.6% annually. At the same time, household incomes growth has been very strong, rising by an average of 4.5% per quarter (annualised) over the last three quarters.

In effect, household incomes are rising well above household spending. That means that consumers have built up a sizeable buffer of savings as well, at around 5% of disposable income or about 4.4% of GDP. Thought of another way, that's a buffer that could be used to lift growth even further. And it may be used. Remember that it's not unusual for consumers to have negative savings rates.

Overall, looking at this backdrop, you get a good sense as to just stable this growth profile is at the moment. There is very little sign of any of the imbalances that caused the GFC and indeed there is no sign of the usual downturn indicators: An excess of housing or business investment.

Instead we have broad-based economic growth, with the US firing on all cylinders. Jobs growth is strong, household incomes are rising at a rapid rate and savings are high.

With all that in the background, investors don't need to be concerned about the durability of the US expansion especially on the basis of a dip in some confidence indicators.