June enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

In recent quarters the spot STC pricing profile has seen the spot price soft early in the quarter with stronger prices following as the final compliance period draws closer. Indeed such an outcome is in line with the prevailing logic surrounding both the cost of carry and the fact that more buyers are expected to come out close to compliance. In Q2 2014 this profile has been turned on its head proving the STC market can still surprise. Meanwhile the Palmer United Party’s support of the RET has restored some confidence in the industry moving forward though the SRES remains particularly vulnerable to non legislative changes.

The strong pricing outcomes witnessed in the spot STC market in May were unable to be replicated in June with the market spending most of the month with the $39.00-$39.20 price bracket. Having witnessed the $39.45 high in May there were those who became seriously optimistic for the remainder of the quarter given the prevailing logic which suggested that the spot price would be higher close to the middle/end of the quarter than it would at its beginning. Once again certain pundits made their predictions that the Clearing House would finally clear.

The reality across June was quite different. The spot price softened marginally in the early part of the month to reach the low $39s and remained there till late in the piece when the spots fell through the $39.00 for the first time since mid May with the market ultimately closing the month at $38.90.

The developments appear to suggest that buyers entered the market early, getting the jump on their obligations and contributing to the strong early pricing before easing off in June as their remaining obligation began to dwindle.

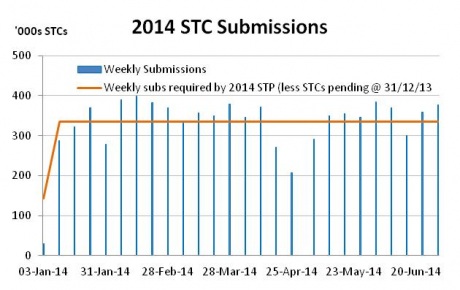

STC submissions continued to exceed the weekly run rate implied by the target in most weeks, though only modestly. With part of the surplus being eroded each time a public holiday takes place. Thus far it appears the Regulator’s forecast for STC creation in 2014 is proving very accurate.

With a nominal Q2 target of 4.66m STCs it again appears however that the Clearing House will be left unutilised with 5.2m STCs already available for surrender and three full weeks left till the final compliance date.

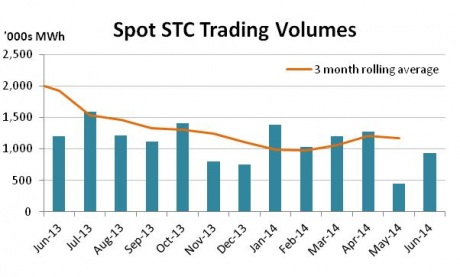

Trade activity in the spot STC market in June recovered sharply following its significant fall in May with just under 1m STCs reported.

In the forward market July (Q2) forwards remained particularly en vogue in June with many participants opting to contract forward rather than using the spot market.

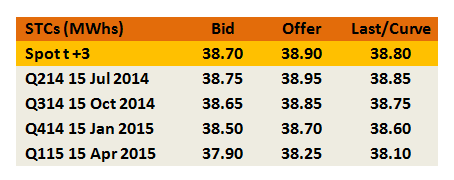

On the forward curve beyond Q2 the curve continued to improve across June with the Q3 market (Oct) increasing to $38.75 and Q4 (Dec) to $38.50. Q1 2015 also saw some improvement with several large trades for April agreed at $38.10.

While the announcement last week by the Palmer United Party about its intentions to block any attempts by the Abbott Government to alter the RET before the next election is undoubted good news for the Small-scale Renewable Energy Scheme (SRES), the SRES remains particularly vulnerable to non legislative changes that could still be employed by the minister without needing to go to the Senate. Included among these are a change to the Clearing House price and a reduction in the deeming period (number of STCs created per install). Whilst it is not clear whether the Coalition would move to make such changes in the face of opposition in the parliament, the PUP’s support for the RET clearly does not absolve the small-scale industry from potentially major changes. The RET Review Panel’s report (when it is eventually released) and, ultimately, the Abbott Government’s position will be pivotal on these issues.

Large-scale Generation Certificate (LGCs)

Clive Palmer is unlikely to be aware of his impact in 2014 on the LGC market. Indeed there would be those who would question whether he is even aware of its existence. With his announcement alongside Al Gore last week, Palmer turned the LGC market on its head for the second time this year and, on this occasion, it appears it may be more than just a flash in the pan.

2014 has been an overwhelmingly negative one in the LGC market with the Coalition Government’s distaste for renewable energy impossible to ignore and no obvious candidate in the Senate to stand in the way of the changes most expect Abbott’s army will propose. That was of course until last Wednesday night when an unlikely champion emerged from the ether that is populist politics.

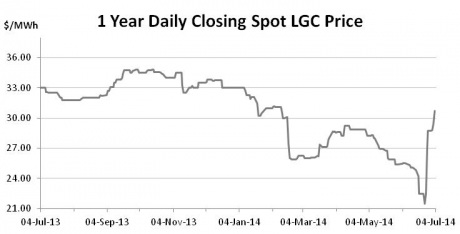

In his hasty, babbling fashion, with no less than Al Gore at his side, the leader of the Palmer United Party chastised the Coalition for preparing to break another election promise (on the RET) and threw his weight behind the RET by saying he would not support changes before the next election. This announcement, which came after the market had closed, shocked all but the most imaginative of pundits and the effects on the spot market the following day was enormous.

Having closed the previous day at $22.50, traders were looking to the market early in an attempt to determine where it would open. In the end, the first trade took place just after 9am at $28.50, a 27% increase on the previous day’s close. From there the market traded rapidly to a high of $32.00 (though a Cal 14 trade was reported at $33.50, implying a spot LGC price of closer to $33.00), before abruptly turning and heading south to a low of $26.50.

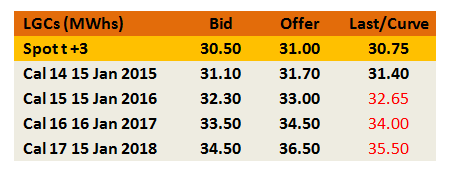

Again the market then rallied reaching $28.50 before the sellers emerged and sent the spot back to $27.00. In the days that have followed the spot has strengthened steadily to once again break through the $30 level.

The LGC market now finds itself in a benign purgatory, with the spot having recovered off the lows it plumbed in June (not seen since early 2007 before bipartisan support for the RET existed), but still sitting well below the level required for project commitments from even the most competitive wind projects.

This situation is a reflection of the considerable uncertainty that still exists, despite Palmer’s clear public commitment. In large part this has to do with the market remembering the lessons learnt from the last instance in which the Palmer United Party came out in support of the RET (which occurred in March) in the lead up to the WA Senate re-run in which the state’s candidate threw his party’s weight behind the RET only to have Palmer himself completely contradict the position the next morning in a radio interview which suggested he was not aware of the RET’s mandatory basis. With the spot market having bounced over 10% on the news it didn’t take long for the gains to be wiped out. That event, along with the unpredictability of Clive Palmer’s politics thus far means there are many who maintain a healthy scepticism as to whether the PUP will in fact block Coalition moves to alter the RET and in particular, whether or not Palmer would consider a ‘real’ 20% by 2020 to be a change or simply a matter of semantics which it appears the Coalition is likely to rely upon to defend itself against claims of broken promises.

The PUP’s position has undermined somewhat the influence of the Government’s handpicked RET Review panel. While its report will still be important (as will the Abbott Government’s response to it), Palmer has ensured that the Coalition will have a much tougher job of getting through the changes that many believe were always destined to come from the review process.

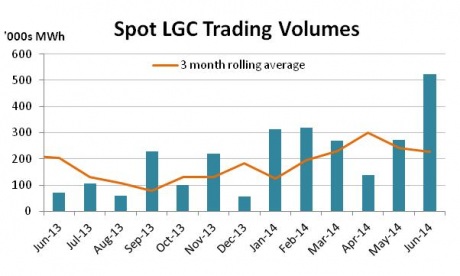

Trade activity following the Palmer announcement has been way above average with price increases reflecting renewed optimism in the future of the market among buyers and subsequently drawing out sellers that had previously been holding out for higher prices. In the month of June spot LGC volumes were the highest they’ve been in over three years.

The forward market has also come back to life following the Palmer-Gore press conference with activity in the Cal 14s and Cal 15s the main focus.

*The first table in this article initially contained a spot price of $39.70. The table has been amended to reflect the correct STC spot price of $38.70.

Marco Stella is a senior broker in environmental markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.