June 2015 - Diversified Portfolios Income Model Update

Income – Can you have too much of a good thing?

Income investors need to think more carefully about the trade off between risk and income

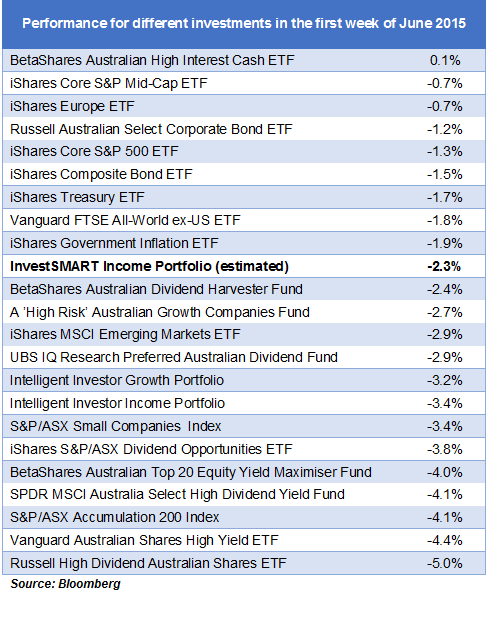

A few unexpected things happened in markets last week. The market fell by about 5% which in itself wasn’t too bad. The interesting thing was what fell most and why. Banks fell by a little over 6%, while resource heavy small company shares fell by just 3.5%. Some of the worst performing funds were ETF’s promising high levels of dividends.

This could be dismissed as a very short term blip but it is worth also bearing in mind that over the past 4 weeks banks shares have fallen by around 16% while the market was down 6%, which starts to feel a bit more serious. At some point this will result in banks becoming cheap but for now the volatility points to deeper issues.

Government bonds were also down , albeit by 1-2% depending on their maturity (as is often the case longer dated bonds fell by more). However, investors sometimes assume that bonds will do well when equities fall, but it’s not always the case.

In the past there was also no difficult trade-off to manage as income was synonymous with defensive attributes. The highest yielding assets were fixed income investments.

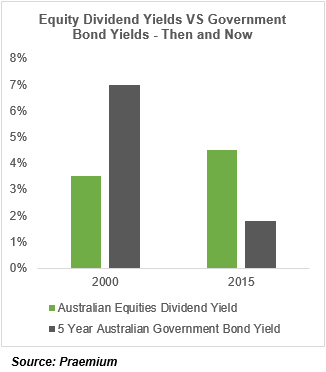

If you go back to the beginning of the last decade, Australian 5-year government bonds were yielding around 7% while Australian equites yielded a mere 3%. In that environment a portfolio that majored on defensive income was easy to build - government bonds were the mains stay.

So what has been driving the change in yields and these more counter-intuitive trends recently?

The long term picture is that back in 2000 investors were looking for, and believed in, high growth stocks. The dot com crash and especially the GFC has shaken people’s confidence and made them generally more defensive. A dividend now seems more compelling than the promises of riches far into the future.

More recently central banks have successfully forced down fixed income interest rates in order to stimulate lending and the economy. This may or may not provide long-term benefits and it has been great for existing holders of fixed income securities (prices rise as yields fall) but is not good for savers now.

Lastly, as the baby boomer generation approached retirement there are more people (probably more people like you) looking to invest to fund their retirement - income generating securities tend to be the first port of a call.

All this means that as an income investor you are now in the ‘hot’ part of the market and may be subject to the whims of other investors as well as the ability (and willingness) of central banks to keep rates low. We saw this last week when concerns about a Greek soveriegn default aloing with positive economic news in the US (meaning interest rates might have to rise sooner) effectively caused Australian bank shares and high income portfolios to fall.

What have we changed?

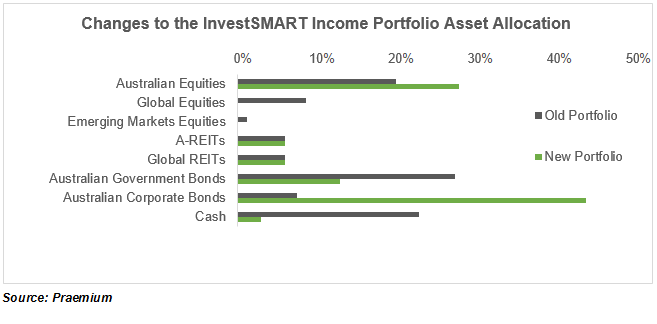

Given the changes in yields over the last few years, this portfolio already had a reasonable bias towards equities, so we haven’t changed that much. What we have done is to increase the yield slightly by increasing the allocation to relatively safe corporate bonds and decrease the allocation to Australian government bonds whose yields have fallen so much in the last year. Australian government bonds now don’t provide nearly as much income and they are starting to look a bit more volatile as the world starts to wonder if rates might rise again in the future. Even if this is a long time in the future it affects bond prices now.

Also, remember that the silver lining for income investors who are now forced to invest more in equities is that with greater equity exposure also comes the promise of more growth.

The other thing equities do better than fixed income is protect portfolios from the ravages of inflation. As the name suggests, payments form fixed income securities don't change in line with inflation so when prices rise their future buying power falls and hence the price people will pay for them now falls. Equities can suffer in the short term if this is due to inflation that doesn't come with strong economic growth but over the long term dividends will naturally rise with inflation.

Within equities we have increased the bias towards Australian equities, not so much because we think it is undervalued, but because the yield it offers is more compelling. (Most overseas markets don’t pay out as much income but their earnings might grow faster). Even more importantly is the impact of franking credits for local dividends which can add up to 1% for tax-exempt retirees.

Implications for Income Investors

This Income Portfolio is expected to yield about 4%, which we think is a realistic expectation given what the market is currently offering. Anyone promising much more than that is probably cutting a few corners and the market may question the sustainability of the income or its capital performance in a rising interest rate environment. This is what has made some of these yield chasing ETF’s perform so poorly in the last few weeks.

- If you are a retiree and you can live off around 4% of your portfolio then this might be for you.

- If you think you might have to draw on capital as well then perhaps the more conservative and less income-focused portfolio is more appropriate.

- If you actually don’t care too much about income but are seeking a higher return over the long term, (and then perhaps drawing down more later) then investing in more growth orientated portfolio might also be offering investors a better deal, if you can stomach the short-term volatility.

Frequently Asked Questions about this Article…

Focusing too much on income can expose you to risks such as market volatility and the potential for falling asset prices, especially if interest rates rise. It's important to balance income with growth to protect against inflation and ensure long-term sustainability.

Australian bank shares and high-income portfolios fell due to concerns about a potential Greek sovereign default and positive economic news from the US, which suggested that interest rates might rise sooner than expected.

Changes in yields have led to a shift in income portfolios, with an increased allocation to relatively safe corporate bonds and a decreased allocation to Australian government bonds, which have become more volatile and offer lower yields.

A diversified income portfolio is expected to yield about 4%, which is considered a realistic expectation given current market conditions. Promises of higher yields may involve higher risks and potential sustainability issues.

Equities can protect against inflation better than fixed income securities because dividends from equities tend to rise with inflation over the long term, whereas fixed income payments do not adjust for inflation, reducing their future buying power.

There is an increased bias towards Australian equities because they offer more compelling yields and the benefit of franking credits, which can add up to 1% for tax-exempt retirees, making them attractive for income-focused investors.

Retirees should consider whether they can live off around 4% of their portfolio. If they need to draw on capital, a more conservative portfolio might be appropriate. For those seeking higher long-term returns, a growth-oriented portfolio could be a better option, despite short-term volatility.

Central banks have successfully lowered fixed income interest rates to stimulate lending and the economy. While this has benefited existing holders of fixed income securities, it has made it challenging for savers seeking higher yields.