July enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

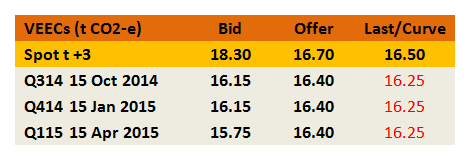

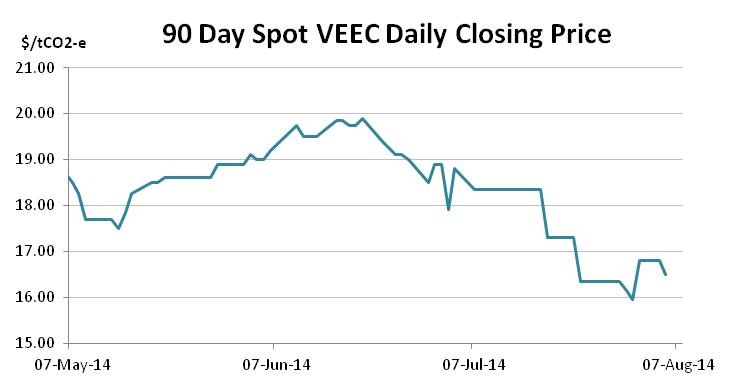

Strong creation numbers and the pursuit of scheme repeal legislation by the Napthine Government saw the VEEC market soften across one of the scheme’s busiest every periods in July. A rule change announced late in the month has so far had some impact on price. Meanwhile, a preference for spots among buyers and forwards among sellers has seen a backwardated forward curve emerge on several recent occasions.

July began with a rush of trading activity in both the spot and forward markets. Initially both traded in large volumes around the $18.50 before the spot ticked up to $19.00, leaving the forward curve to carry on trading at $18.50; a state known as backwardation. Because of the way environmental markets are structured (with a compliance date set early the following the year) the opportunity cost associated with buying spots usually means the forward market trades at a premium to (or at least on par with) the spot market. In the early days of July with forward trades going through in the hundreds of thousands at $18.50, the spot continued to trade at a $0.35-$0.50 premium.

In the second week of the month the sheer volume of forward offers began to weigh on the market and eventually caused the market to soften. By mid month the forwards were in the mid $17s. By month’s end the forwards had slumped to the $16.00 mark. In recent days the forward curve has again become backwardated.

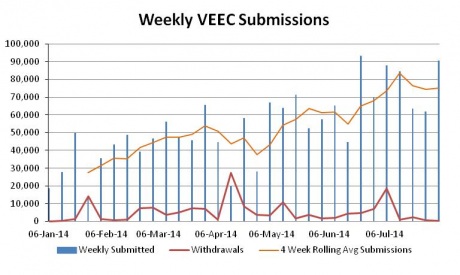

VEEC submissions during this time remained strong, with the four-week rolling average sitting at 75,000 by month’s end. In essence the uptick in submissions which occurred across both June and July suggest the 2014 target will be met within the three months and imply a rate of creation well above the 2 million target that would be introduced as part of the Coalition’s plan to bring an end to the scheme following the 2015 compliance year.

Late in the month the scheme’s regulator, the Essential Services Commission, showed it was prepared to take additional steps to preserve the integrity of the scheme on the issue of Schedule 21C which will now require a fully licensed electrician to undertake all steps of the lighting install rather than just signing off on it. There are mixed views in the market as to how much impact this change will have on the methodology which has been responsible for roughly a third of submissions since June 1.

Despite a run of bad polling the Coalition was content to carry on with its plan and introduced the repeal legislation into the Upper House during the month.*

NSW Energy Savings Certificates (ESCs)

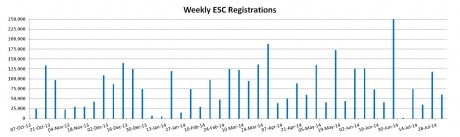

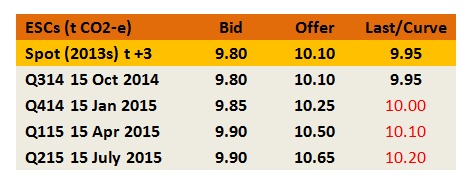

A gradual softening in the spot market on the back of infrequent trade activity and persistently large registration volumes were the hallmarks of July in the ESC market. The patient wait for an indication of what the new, post rule change supply status quo as well a genuine indication of the Baird Government’s intentions for the scheme’s future, continues.

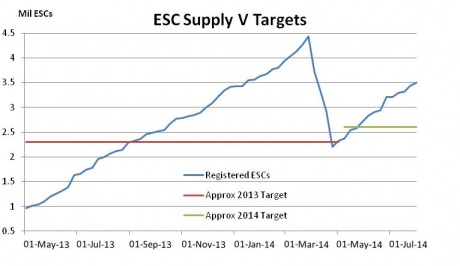

With the 2014 target already met, during July participants were always going to have a keen on eye on ESC supply in July. ESC registrations had been very strong since February with many creators churning through what has turned out to be an enormous backlog of uncreated ESCs before new rule changes take effect. July did see a moderation in the rate of registrations, though perhaps not to the extent that many were predicting and as a result spot prices softened progressively.

Having begun the month at $11.25 the spot breifly reached the $11.50 market before steadily softening to a low of $10.50 by month’s end. Overall trade actviity remained modest during this time. In recent days the spot market has fallen through the $10 mark. For the time being the forward curve shows little-to-no carry in the near-term with a modest escalation existing into early 2015.

Looking at the supply-demand equation, at present there exist 3.5 million ESCs available for surrender meaning that once the 2014 surrender the market is already 600-700,000 into the 2015 target.

With the ESC pipeline now expected to have been cleared it is hoped that the coming weeks will start to provide a better indication of the amount of activity that is taking place under the new compliance regime. Anecdotally, many suggest it is significantly below what has previously been seen as a result of the removal of some previously popular methodologies and stricter compliance on others. Softer certificate prices have no doubt also had an impact.

Yet determining whether the slide will be arrested any time soon also requires some indication of what the Baird Government intends to do with the scheme in the future. There has been little public discourse in recent months about how the NSW Government under its new premier views the review that is currently taking place; to be more specific, whether Baird shares the same view as O’Farrell that the scheme should be expanded to take on a greater responsibility for the state’s energy efficiency objectives.

The combination of an expanded scheme and considerably lower supply are the foundation stones of many participants optimism for the future of the scheme. And while it is possible that they may both be realised in the coming months, there are certainly no guarantees. The NSW Government has been alone in recent times among Coalition governments willing to take the issue of climate change and energy efficiency seriously. A considerable reduction in ESC supply would require that none of the existing or new methodologies can be made to be successful at current pricing. While the optimists see change ahead, there are many who believe the months ahead will bring little relief.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.

*NB: Yesterday, the Victorian Labor Opposition committed to extending the VEET.