Japan utilities repel renewables; UK solar feels pinch

In Japan, the flood of approved feed-in tariff applications has prompted half the electricity utilities to implement broad measures to slow down renewable energy project development. On October 1, four more regional utilities said they would stop signing contracts to buy renewable energy from mega solar power plants, citing grid access limitations. The move follows a similar announcement from Kyushu Electric Power the preceding week.

The country saw installation of solar capacity rocket up 183 per cent between end-2011 and 2013 thanks to its generous feed-in tariff. The incentive was implemented after the country's 48 nuclear reactors were shut down following the Fukushima Daiichi disaster in 2011.

The government has approved plans for some 72GW of renewable energy projects since July 2012 and developers may well be rushing to reach commissioning before the subsidy rates change. The utilities may be relieved to hear that half of the capacity approved for the feed-in tariff will not be completed, according to Bloomberg New Energy Finance's H2 2014 Japan Power & Gas Market Outlook, published on October 8.

Nonetheless, renewable capacity (excluding hydro plants over 50MW) will reach 84GW by 2020 compared with 34GW in 2013, based on our analysis. In addition, power companies are likely to boost gas and coal capacity on the back of uncertainty around nuclear restarts and aging oil plants.

In Europe, confidence in the UK energy efficiency industry strengthened in the second quarter of calendar 2014, according to the latest Energy Efficiency Trends Survey. Despite the temporary dip in confidence in Q1, market optimism is expected to continue to increase this quarter. On the consumer side, just under three-quarters of the respondents implemented an energy efficiency project in Q2, with lighting technologies seeing the highest uptake.

In the UK, the government confirmed on October 2 the final budget for the first round to allocate Contracts for Difference (CfDs), which begins on October 14. The additional budget should allow for more offshore wind capacity, according to Bloomberg New Energy Finance analysis. The government also announced that new solar projects over 5MW will be excluded from the Renewables Obligation from Q2 2015. The move was anticipated given the government's wish to cool down the UK solar market.

Developers are likely to rush to be covered by the Renewables Obligation rather than compete for CfDs against lower-cost onshore wind projects. Our forecasts suggest the UK will see some 2.5-3GW of utility-scale PV built between Q4 2014 and Q1 2015.

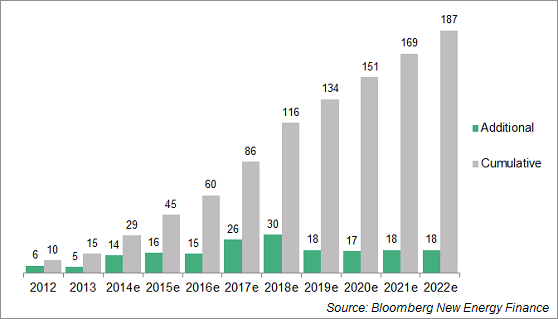

Graph of the week: China's onshore cumulative off-warranty wind capacity set to increase by more than 300% between 2014 and 2022

Originally published by Bloomberg New Energy Finance. Reproduced with permission.