January enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

Healthy pricing outcomes, large trading volumes and the ongoing wait for the announcement of the 2014 Small-scale Technology Percentage have characterised the start of the 2014 trading year. Meanwhile, speculation surrounding the Abbott government’s intentions for the scheme continues to do the rounds creating some uncertainty in the latter part of the curve.

After a slow start to the year in January 2013, it was around this time that the STC market began what ultimately proved to be an incredible bull run, culminating in a fleeting high of $39.40 reached in early September. For most of the remainder of the year, however, prices stayed lower hovering between the low $37s and the low $38s.

With participants progressively returning from the summer break and the final compliance date for Q4 (February 14) rapidly approaching, the last two weeks of January saw the market creeping towards yet ultimately falling short of the $39 mark.

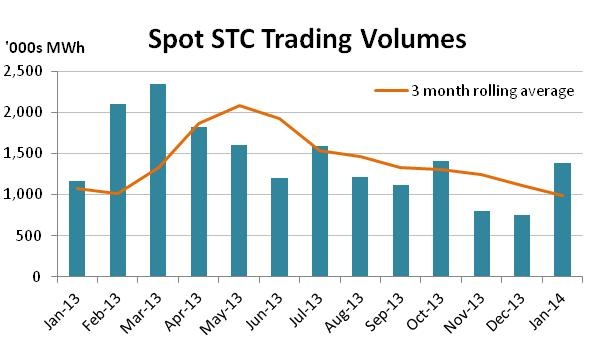

Trade activity in the spot and forward markets in recent weeks were particularly high with many larger parcels 50,000-100,000 going through along the way to the point that only October 13 posted greater trade volumes than January across the last six months.

Despite the relatively high spot price outcomes, there remains a considerable degree of unease surrounding the potential for regulatory change to the Small-scale Renewable Energy Scheme.

For starters, there has as yet been no word on the 2014 Small-scale Technology Percentage (STP). While the STP’s release is not legally required until March 31, a release before that date is clearly in the interest of all concerned and the Clean Energy Regulator has previously been very eager to release the figure well before that date.

On the face of it, it appears that the processes previously adopted for the setting of the STP (principally, the commissioning of consultants to provide their estimates of installs and STC creation) have been followed once again this year and, given the greatly improved accuracy of the CER’s forecast for 2013, it appears likely that the 2014 STP should once again prove accurate.

However, a spate of recent comments by the prime minister surrounding the cost impacts of the Renewable Energy Target, as well as some ominous signs in the preparation for this year’s RET Review (see LGC section for more detail) have many in the market concerned that politics may play a role in the establishment of the final STP.

Beyond that there are also concerns for the future of the SRES pending the outcome of the review with many in Federal Cabinet clearly prepared to consider withdrawing support for the scheme.

The proximity of the spot price to the $40 Clearing House Price (the market’s cap) along with the presence of genuine concern about the scheme’s future has left the forward curve in a state known as 'backwardation' (where the value of forward vintages is below the spot).

In terms of the actual surplus of STCs rolled over from 2013 into 2014, the numbers are far smaller than any other time in the scheme’s short history, reflecting the accuracy of the Clean Energy Regulator’s forecast of STC estimate for the year.

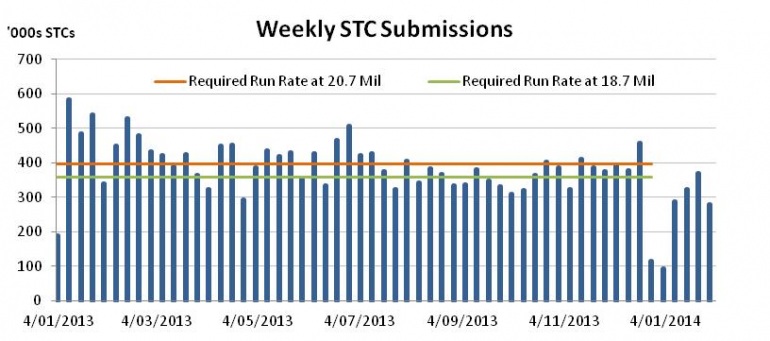

The target for 2013 STC creation of 20.7 million was set as part of the 2013 STP. Actual submissions for the year totalled 20.35 million, however once the number of STCs ‘pending registration’ as at December 31, 2012 are included that figure jumps by 2 million (which can also be depicted as a reduction in the run rate required from 20.7 million to 18.7 million (see chart above).

The final piece of the puzzle which remains is the number of STCs that will be surrendered against the Q4 liability. Owing to electricity demand once again being below forecast, it appears highly likely that fewer STCs will be surrendered in 2013 than was initially implied by the target. Precisely how big the under surrender is will be known in just under a fortnight. So far across the first three quarters of 2013 an under surrender of circa 730,000 STCs has taken place.

The fourth quarter is typically the quarter in which any exemptions which had been applied for under Section 38 AF of the Renewable Energy Electricity Act are made good, meaning the under surrender for 2013 may be less than 730,000. However there are some who believe this figure may increase, albeit only slightly.

Large-scale Generation Certificate (LGCs)

An almost ceaseless run of media reports fuelled by comments emanating from the prime minister along with speculation surrounding the review of the Renewable Energy Target have weighed heavily on the Large-scale Renewable Energy Certificate market in recent weeks.

The politics of climate change can be a tiresome and frustrating business, particularly for those that are of the view that the justification for serious action to mitigate its severity has long been established. The Abbott government appears set to push the boundaries of even the most accommodating of individuals as it apparently debates the future of the Renewable Energy Target.

While staunchly repeated support of the RET by the Coalition in the lead-up to the election was viewed with cynicism by many in the market, it appears more likely now than ever that a policy back flip is in the making. The question on everyone’s lips is will the back flip be contained to a reduction of the Large-scale Renewable Energy Target via a move from the existing fixed calculation methodology to a floating approach, or will instead it extend to further alteration of the scheme or perhaps even its abolition?

For the many in Abbott’s Cabinet whose public affirmation of human induced climate change is little more than a popular veneer, it appears strong argument is being put for wider raging cuts to the RET or perhaps its abolition altogether.

What we do know is that the rigour of a review undertaken by an independent agency like the Climate Change Authority will not occur this time around. In fact it now appears that it may not even be the Department of Environment (headed by Greg Hunt, one of the few pro-climate change ministers in Abbott’s Cabinet) who conducts the in-house review of the RET, with speculation that the prime minister will appoint a panel with the Department of PM and Cabinet taking the reins.

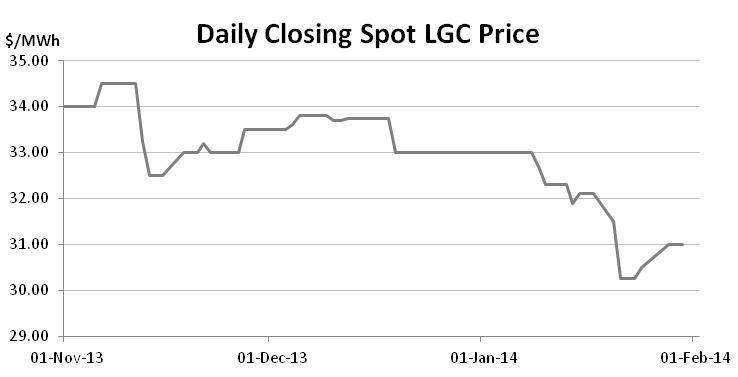

The negative news has had a significant impact on the spot LGC market across January which, having begun the year at $33, fell rapidly across the month to reach an intra-day low of $29.50 on January 21, before recovering later the same day to reach $30.25. The day’s low represented a low not seen since January 2011. The market has since recovered further to $31, though a sense of unease clearly remains.

The timetable for the latest RET review remains vague with some information (including the terms of reference) having been expected before Christmas that has still not been forthcoming. Indeed it appears unlikely that any conclusions will be drawn from the review before the middle of the year, leaving participants to speculate for months ahead as to what may or may not occur.

The situation will also guarantee that no further project commitments come during that time leaving more work to be done in the final years of the decade.

Prime Minister Abbott’s repeated comments about the scheme’s cost to electricity users coupled with the machinations surrounding the RET review may yet simply prove indicative of a PM wanting to set the stage for the fixed-to-floating target methodology change. However, it is clear that the disquiet in the Cabinet has many market participants concerned about further changes.

The forward curve, for its part, remains cost of carry driven and with the spot at the relatively depressed $31 level, compliance for Cal 15 and Cal 16 can now be met around the $33 and $34.50 mark, a level well below that required to get wind projects off the ground.

For its part the options market has remained busy over recent months reflecting the presence of the sizable regulatory uncertainty enveloping the market. Unsurprisingly, the implied volatility of options transactions has also been on the increase, making it more expensive to purchase price insurance in the market.

Marco Stella is senior broker, environmental markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.