Is the time right for the Aussie dollar to break out?

Despite a plethora of what would usually be market sensitive information, volatility in the Aussie dollar has decreased substantially in recent weeks. Central banks would normally be happy with such an outcome as increased uncertainty in financial markets can distort policy and make it difficult for targeted action to filter through to the real economy.

But sometimes, when it seems markets are conspiring against policymakers, an increase in volatility might be welcome -- so long as the markets shift asset values in the right direction investors can do the heavy lifting for authorities.

This is, of course, a major part of what central banks are attempting to do with monetary policy: to influence business and consumer ratios between spending and saving. The implications of which means changes in asset values across a broad spectrum of financial instruments, ranging from interest rates and property prices to consumer spending and employment among other key areas of economic performance.

When it comes to an openly traded currency market like the Aussie dollar, there is not much policymakers can do to directly influence valuations in a sustainable fashion. There are many examples over the years where central banks might as well have been talking to a brick wall; the RBA is not alone on this front.

So what’s it going to take to break out of its recent tight trading range?

One thing is for certain: eventually the Aussie dollar will loosen its stranglehold between 93 and 95 cents and break free.

There have been a few false dawns in recent weeks with Yellen’s testimony, Stevens' comments, and inflation figures (both here and in the US) all of which have had little influence on the exchange rate. This week, once again, promises plenty with key events out of the US such as GDP, FOMC meeting and of course the employment report. Will any of these be the catalyst for change on the currency front?

Given there is no scheduled press conference this time around, it is unlikely the US Federal Reserve will make any drastic change to its policy or rhetoric. There may be some acknowledgement of an improving labour market but otherwise there is probably nothing to see here.

The other two key economic indicators the Fed will be interested in -- GDP and employment -- could however provide the spark that’s needed for some action on the greenback. Strong numbers are expected on both fronts, though failure to meet expectations here could see some weakness emerge once again.

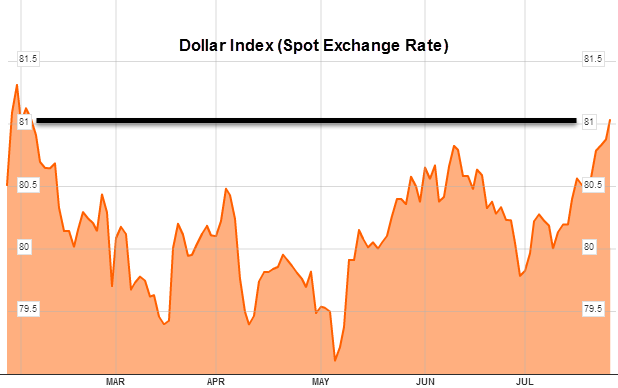

I note that the US dollar looks stretched with the dollar index trading at its highest level since February. The majority of the strength in the USD has come from euro weakness and, while EUR/USD may remain heavy, there could be some short-term respite should this week’s US economic data fail to deliver.

So once again the Aussie dollar's fortunes rely on the fate of the greenback, with the risk favouring a return towards last week’s high of 0.9470.

Jim Vrondas is Chief Currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".