Is the lower dollar doing Australia any good?

The Australian dollar has dropped by around 25 per cent since its 2011 peaks -- some 30 cents or so -- an event widely celebrated among policy circles and some in industry.

Indeed, official attempts at lowering the dollar have been extremely frequent. The government (both sides of politics), the RBA, Treasury and a number of economists have all called for weaker currency and actively pursed that outcome. The hope was that a lower dollar would help rebalance the economy and in particular, help lift the currency-sensitive industries -- manufacturing, tourism and education (via exports).

However, the costs associated with the exchange rate target have been significant. Monetary policy has been completely hijacked by the currency concerns, while, conversely, issues to do with financial stability and inflation have been given secondary consideration. In trying to achieve this outcome, policymakers have had a clear and unequivocally detrimental influence on business and consumer confidence, creating, whether deliberately or not, a sense of perpetual fear throughout the nation.

Unfortunately the evidence doesn't suggest a weaker currency has done much good in terms of lifting those currency-sensitive sectors. Indeed it's quite clear the program has been a complete and utter failure.

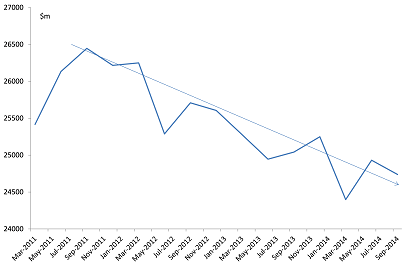

Take a look at chart 1. It actually shows manufacturing activity has been on the decline since late 2011. Two years of currency weakness hasn't changed that, even through 2014 as the exchange rate depreciation accelerated.

Chart 1: The weaker AUD doesn't appear to have helped manufacturers

That's not to say anyone should have expected a rebound due to the lower dollar. The fact is that manufacturing has been in structural decline for the better part of two decades. That policymakers did expect something is very concerning.

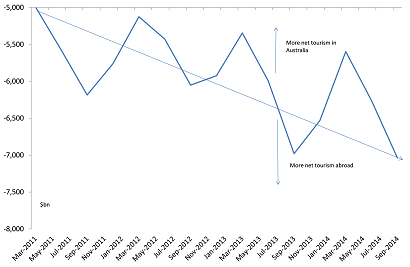

The tourism industry doesn't look to have received a boost from the weaker dollar either. Remember the concern here was that the stronger currency was scaring foreign tourists away. Furthermore, it was acting to encourage Australian citizens to holiday abroad when they could have been be holidaying domestically.

These concerns were held despite research from tourism bodies showing that the currency was less important than wealth effects and the growing availability of cheap flights, in influencing travel destinations.

Chart 2: The weaker AUD hasn't helped tourism

Chart 1 shows that even as the currency fell, net tourist dollar outflows were well and truly in the red. That is, on balance, Australians were and still are choosing to travel abroad, and the inflow of foreign tourists isn't sufficient to offset that.

Notice that the weaker currency hasn't really changed that balance and in fact it's become worse as the currency has become cheaper. That's not to say the weaker currency is causing fewer foreign tourists to come here or more Aussies to go overseas. It probably just proves the point that the Australian dollar isn't a major consideration. In fact the net inflow of tourists was stronger when the Australian dollar was well over parity!

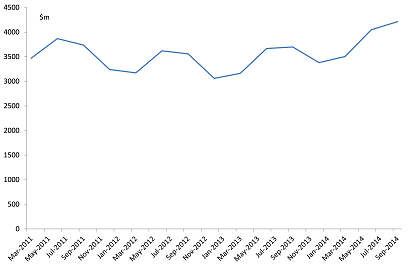

The one area where the currency may have had a positive impact is in education exports. Certainly the data above shows a marked recovery through 2014. It's hard to place this recovery at the feet of the currency, though.

Consider that the Australian dollar fell by 16 per cent in 2013, yet there was no discernible lift in education exports. Nor, it should be noted, was there any discernible decline in these exports as the currency surged from 2006 to 2008.

Chart 3: Education does appear to have lifted modestly - AUD driven?

Overall then, the currency depreciation, which is in its third year, has had little noticeable impact on either manufacturing, tourism or education. This raises the question: just what are policymakers hoping a lower Australian dollar will achieve?