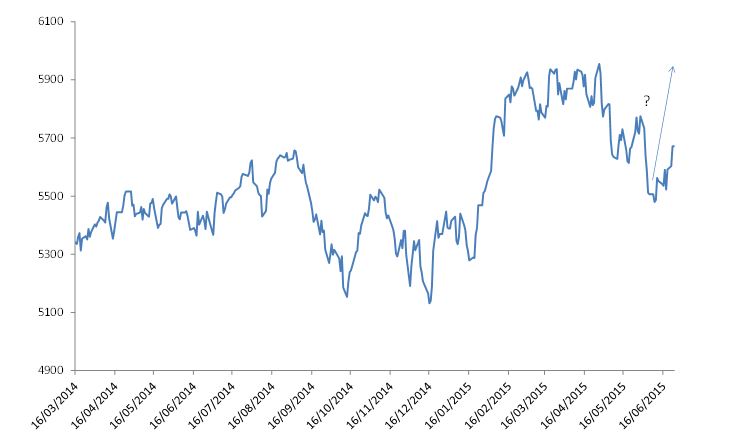

Is the ASX correction over?

Summary: Since the recent pull-back in shares due to the usual May seasonality, the talk of the town is that there is value back in the market. It's a good bet that we've seen the worst of the sell-off, subject to Greece, meaning the market could push higher from here. |

Key take-out: A lot of brokers are talking about ending the year around the 6000 mark and I think that's about right. |

Key beneficiaries: General investors. Category: Shares. |

As the financial year draws to a close it's time to see where we are at on the share market. Peak to trough the Aussie market fell 5.5 per cent from a closing high of 5954 on April 27 to a low of 5627 on May 11.

By definition that doesn't even qualify for a correction – we would have needed a 10 per cent fall for that to have happened.

Rather it was merely a pull-back and even then quite a modest one. In any case, since that point the market is up by nearly 4 per cent.

Chart 1: Is the correction done? (S&P/ASX200)

The first item to note about this pull-back is how it has changed the perception of value. Gone are the concerns that the market is expensive and due for a correction. The talk of the town now is that there is value back in the market. The thing is if 5.5 per cent is all that determines when the market is in value or not, then maybe the whole discussion was a little spurious to begin with.

As I believe it was in a world of ultra-low rates.

In any case, the correction or pull-back had nothing to do with perceptions of value – it was merely the usual May seasonality in operation.

What's interesting is that it occurred even though the US market doesn't appear to have been affected. In fact the S&P500 is hovering just below record highs, seemingly untouched by seasonality, bad weather, or the threat of a Fed rate hike. German stocks for their part are down about 12 per cent over the same period. Then again they've got the Greek crisis to contend with.

For the Australian market however, what we're seeing isn't unusual. We've seen it in pretty much every year since the GFC. Over a longer time period, say 20 years, we see it in operation just under 70 per cent of the time.

Since the GFC the average peak to trough fall has about 12 per cent. In 2014 the pull-back was much more modest – about 3 per cent and it was pretty much over by mid-June. Prior to that, every sell off had been at least 10 per cent.

So the question is, will 2015 be more like 2014, or the few years prior to that?

To answer that question we have to think about what drove the difference between 2014 and other years. More often than not it was Greece or some ‘event' such as a US double dip recession. In 2014 we didn't really have that which is why the May sell off was so modest.

In that sense 2015 is more like 2014.There's not really a lot on the horizon. Markets are less agitated by Greece, noting that the actual risk of a Grexit is the highest it's ever been. Yet the outcome is binary and at this point, it looks like a Greek deal will be made.

If a deal does not transpire then we know the sell-off will continue. Conversely, if a deal is announced, then there is ample scope for a rally.

That done and assuming no default, the stats suggests much of the May sell-off, if not all of it, tends to have occurred by June. Since the GFC, that's happened about 80 per cent of the time.

With all of that in mind, it's a good bet that we've seen the worst of the sell-off… subject to Greece.

If that's the case, then it's also a good bet that the market will push higher from here. That kind of price action, again, has occurred about 80 per cent of the time. With differences though: In 2010 and 2012, for instance, the market then went on to rally aggressively into the following year – in 2013 and 2014, the rally lasted only three to five months before a sizeable pre-Christmas sell-off ensued.

Last year that sell-off almost wiped the gains for the year. On a strict 12 month calendar basis the ASX gained 1.1 per cent in 2014 – but if you were to add in a dividends at 4.5 per cent (average dividend yield ) investors went home with around 5.6 per cent, which is not bad by any measure.

On balance, I'm thinking the outcomes favour a rally in between what we saw last year, and then in 2010 and 2012. In both of those years, rallies followed what was really a tumultuous market prior. In 2010 the market was still in a post-GFC recovery mode. In 2012, the market was recovering from the carnage of 2011 – the market was very cheap on any reasonable metric.

Last year things were different. At the time of the September sell off, the market had had a very strong run – up about 40 per cent in two years. Markets were nervous, with sentiment cautious, and so were susceptible to any bad news. That's why we saw such an aggressive sell off.

This year we're at neither of those points. Interestingly we're only just at the same level we were at before the September 2014 sell-off. That is, we are up only about 4 per cent over the last 12 months.

Note the difference between now and then though. Now, the talk in the market is that with a year of earnings growth, the market doesn't look so stretched. So there is less psychological concern that valuations are a problem. In fact the consensus appears to be that value has returned. That's a marked difference in market sentiment.

So we're at a point where the market isn't as cheap as it was in 2012, but is not perceived to be as expensive – even at the same level – as it was in September 2014.

Barring some ‘event', that suggests the usual rally should occur from about now, as it is, and continue for the remainder of the year. A lot of brokers are talking about ending the year around the 6000 mark and I think that's about right. That would see stocks up about 11 per cent for the year – not a bad effort.