Is repaying the mortgage still your best bet?

Summary: With very low interest rates, the traditional advice to pay off your mortgage first may be less convincing than in the past. Investors closer to age 60 may find salary sacrificing to superannuation very attractive. Investing in shares is another appealing option. |

Key take-out: Someone tossing up between the three strategies of extra mortgage repayments, building super or buying shares may choose to combine all three. |

Key beneficiaries: General investors. Category: Shares. |

In common with the bulk of conservative investors I've always taken it as an immutable law of investing that you should pay down mortgages whether it's an investment mortgage or a home mortgage. Suddenly, though – with interest rates at unbelievably low levels – I'm not so sure.

I am in the process of refinancing my home loan with a 5 year loan at 4.37% pa and no ongoing fees.

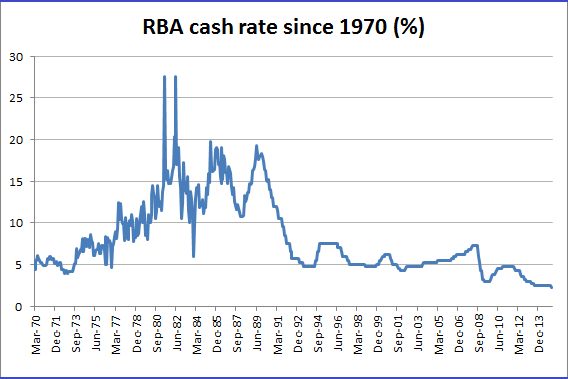

To put this current 4.37% interest rate into perspective (the same firm is offering a 4.18% pa 3 year fixed rate loan), it is worth looking at some historical averages for Australian mortgages. The Australian Bankers' Association compiled data on the standard variable home loan interest rates between 1990 and 2012, finding that the average rate over this 23 year period was 8.44% – double the 3 year fixed interest rate that you can get now.

The key reason that “pay your mortgage first” has been a cornerstone of a sensible financial approach is that it provides a reasonable risk free, tax free return. It also means that as a person's debt decreases, their financial situation becomes less risky. Over the 23 year period where the average interest rate was 8.44%, making extra mortgage repayments effectively “earned” you a tax free, interest free return of 8.44%, because every extra dollar repaid into your mortgage saved you this in interest.

8.44% pa risk free, tax free, is a great rate of return. However, looking at the current situation where you can get a fixed interest loan for 5 years of 4.37% pa, a 4.37% risk free, tax free return is less compelling – although ahead of the cash return at the moment.

To investigate this further, let's look at what other options are available, and calculate the possible returns. It is worth noting that one reason many people like making extra home loan repayments is that it makes their overall situation less risky – less debt means that they can cope better if they are without an income for a while or if interest rates rise. Indeed, I wonder how many recent homeowners would cope if interest rates went back to that 1990 – 2012 average of 8.44%? On that basis – reducing financial risk – extra mortgage repayments make sense regardless of the interest rate.

The case study

To put figures on the various strategies, let's assume we are talking about an income earner on $80,000 pa. They find that they have $10,000 per year of extra income, and want to decide the best use for that money. The “sacred cow” strategy, making extra mortgage repayments, returns 4.37% per annum of interest saved, with no tax to be paid. An extra $10,000 repayment will save $437 a year in interest charges. (The rate we have used here is a fixed interest rate, and there may be limits on making extra repayments – although I find many home loan providers are much more flexible than they were 15 years ago.)

Salary sacrifice to superannuation

Let's compare extra mortgage repayments to salary sacrificing to superannuation – another one of the “go to” personal finance strategies, and for good reason. Salary sacrificing to superannuation saves tax compared to taking the money as income, and the investments grow in the low tax rate environment of superannuation. To find a spare $10,000, the person in our case study has to earn $15,267 pre-tax. They then pay $5,267 to the ATO and keep $10,000 after tax. If they salary sacrifice the $15,267 to superannuation, rather than taking it as income, they have to pay 15% contributions tax, which leaves an after-tax contribution of $12,977.

The question, then, is what rate of earning should we use to calculate the return earned by the $12,977 in the superannuation fund? At June last year, for the 22 years that the superannuation guarantee had been in place, the average return from a balanced super fund was 7.2% per year (according to Superratings). I am not sure that it is reasonable to expect those sort of returns from a balanced fund given the current low interest rate environment, and suggest we use a return of 5% a year. This provides us with an ongoing return of $650 a year (a 5% return on the $12,977 after-tax superannuation contribution), keeping in mind that we also saved $2,997 in tax by salary sacrificing income to superannuation.

I think this is potentially a very attractive strategy for people who are closer to age 60, at which point in time they will be able to withdraw tax free any extra superannuation contributions – and potentially use them to pay off the mortgage at that time. Younger investors, who are some way from retirement, will find the long wait to access their superannuation makes this strategy less appealing.

Regular investments in shares

It won't make sense to invest the $10,000 in cash, as a cash return of around 3% at the moment will become 2% after tax (for someone earning $80,000) – meaning a potential (and fairly measly) return of $200 per year after tax. However, an asset class like Australian shares, where there is the possibility of a return above this rate, provides another option.

According to the 2014 Long Term Investing Report (from the ASX and Russell), the 20 year return for Australian shares to the end of December 2013 was 8.7% pa – I would suggest not too bad a return for a period that included the halving of share prices during the Global Financial Crisis.

The question is – what might the rate of return going forward be? The answer, of course, is that I have no idea. However, let's choose a rate of return of 7.5% pa, below the 10.0% per annum that Vanguard found Australian shares returned between 1 January 1970 and 31 January 2015 and most long run calculations (eg Credit Suisse and London Business School Global Investment Yearbook) that puts Australian share returns from 1900 to now at around 12% pa. The reason for this conservative figure of 7.5% is that with interest rates so low, share prices have been pushed higher as they look comparatively more attractive as an investment class, which might reduce future returns.

Now, that 7.5% return is before tax. Given that the franking credits will offset almost all the income tax payable on the dividends, and that if shares are not frequently sold then there will be limited capital gains tax to be paid, let's assume that tax paid reduces the rate of return to 6.5% per annum. An after tax return of 6.5% per year equates to $650 a year – the same as the superannuation fund return. Of course, the 6.5% return is a “risky” return – it might be 20% in some years, –20% in others. While not as effective in reducing financial risk as directly making additional mortgage repayments, I would argue that building a share portfolio does reduce your financial risk as it provides a source of liquid (easily turned into cash) assets and additional income in the form of dividends.

Conclusion

Historically low interest rates mean that making extra mortgage repayments are not the “only game in town” wealth creation strategy that they once were. Someone tossing up between the three strategies we have talked about here – extra mortgage repayments, salary sacrificing to superannuation or investing regularly in Australian shares – might think about one of the great realities of wealth creation: we have the flexibility to choose more than one direction. We can just as easily direct one third of our surplus income to investing in Australian shares, one third to making additional mortgage repayments and one third to salary sacrifice to superannuation – or whatever mix of strategies best suits our circumstances.

Scott Francis is a personal finance commentator, and previously worked as an independent financial adviser. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.