Is it possible to tame the Skew?

|

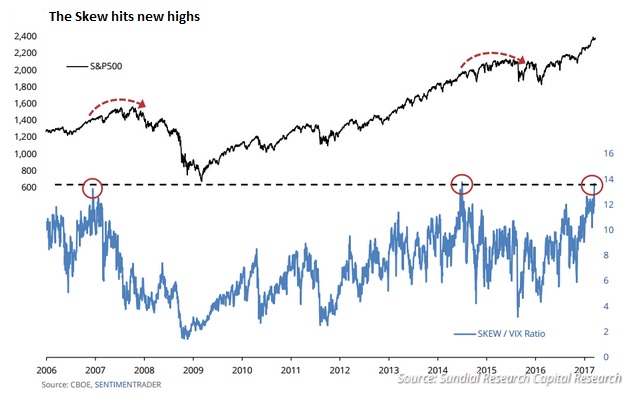

Summary: The standard index for measuring stock market volatility has been relatively flat for months. But investment specialists are using a more obscure index to track the probability of future market events, and that's trading near record highs. |

|

Key take-out: The market sounds are telling us that a big tail-risk event is close. What that event is no one knows, but there are a plethora of macro-economic and political events on the horizon to choose from. |

|

Key beneficiaries: General investors. Category: Investment Strategy. |

Investors with long-term horizons should ideally switch off from the daily market noise.

Unfortunately, that's not easy to do. Markets don't operate that way and nor do the professional stock and financial markets traders who thrive on volatility and uncertainty.

Take last week for example. Pent-up nervousness over the ability of US President Donald Trump to get his healthcare reforms passed and concerns over the pace of US interest rate hikes spilled over onto financial markets. Wall Street was on the receiving end, falling 1.5 per cent as panicked investors headed for the exits.

The Australian market followed suit the next day with a 2 per cent plunge that wiped $25 billion off local stock market values.

But should investors have been taken by surprise by the latest market dump? Well, the answer to that is both yes and no.

A common way of measuring the level of fear on the stock market is the Volatility Index. The VIX is a tradeable index and measures the implied volatility of the S&P 500 Index over the next 30 days, based on the current trading prices of index options.

The Australian S&P/ASX 200 VIX Index essentially does the same thing, as do VIX-like indices on other developed markets including Europe's so-called fear gauge, the Euro Stoxx 50 Volatility Index.

The thing is though, anyone following the US VIX or any other short-term volatility predictor over the last 30 days would have had little inkling anything untoward was on stock market radar screens.

The VIX has been virtually flat for months, tracking well below its historic average, with traders content in the fact that the US market has continued to break new records following Trump's election win.

Yet, those in the know are using a more obscure volatility indicator to measure the likelihood of a major market correction down the track. The CBOE Skew Index, which tracks options trading on the Chicago Board Options Exchange (CBOE), is used as a pointer to so-called ‘Black Swan' events – difficult to predict situations that have the potential to trigger a market crash.

The Skew measures the difference between the cost of buying a put option on the S&P 500 Index to protect against a sharp downturn, and the cost of buying a call option to leverage into a market rally. When there's much more buying of put options, that means the smart money is banking on a market correction. And that's exactly what's happening at the moment.

Think of the Skew as a sort of crash protection index and, unlike the relatively stable VIX, it is going through the roof. Its normal trading range is around 100, but earlier this month it hit a record level above 150. So far this year it's up more than 20 per cent.

“The Skew Index rises when people are using options to buy more protection against big tail risk events,” says Olivia Engel, deputy chief investment officer of State Street Global Advisor's active quantitative equities team.

“That implies that people are getting worried that a big event will occur. Nothing has occurred yet, but people are starting to buy insurance cover using options hedging strategies and those options obviously become more expensive when there's more demand.”

So what are the known events on the horizon that could create major problems for global share markets?

A good starting point is Obamacare. In an embarrassing setback, President Trump was forced to cancel a House of Representatives vote on his contentious healthcare bill on Saturday in recognition of the fact he does not have enough support from his own party to carry it through.

That also raises concerns he may not get enough support to push through his sweeping tax reforms and other proposed economic measures he has previously announced, and that will potentially panic the US stock market this week. How the US economy copes with a series of announced interest rate rises is also keeping some traders awake at night. Rate rises have clear flow-on effects for both businesses and consumers, and raising them too quickly could derail efforts to reboot the US economy.

Then there's Brexit, with the UK determined to split from Europe's economic clutches, and ongoing concerns around the break-up of the European Union, with Greece still at the forefront of anxieties. Add to this the series of national elections in Europe this year, including in Germany and France, where right-wing candidates in favour of an EU disintegration are polling very strongly.

Other fears revolve around China, Russia, North Korea, the war of attrition in Syria and unrest in other parts of the Middle East.

“If you look at the political landscape over the remainder of the year there are a number of big events on the horizon that could lead to major tail risk events,” says Engel.

“If the market starts to think about big tail risk events being more likely there will be more buying of protection, which is why the Skew index is rising.”

Sundial Capital Research, which tracks US market sentiment and what it terms the “mass psychology of financial markets”, suggests that when Skew climbs well above the VIX a market downturn has tended to follow in the next 30 to 60 days.

“Historically, when we have seen an extreme in the relationship between the Skew and VIX, the S&P moves in the opposite direction over the next 1-2 months,” firm President Jason Goepfert said last week.

Is the rise of the Skew something that should really concern us?

Jacob Weinig of Malachite Capital cautions that indexes such as the Skew have a big bias to the upside when absolute levels of implied market volatility are extremely low.

In other words, when there's no real apparent danger in the stock market, traders start worrying about the unknown and buy options to cover off their positions. In a way, it's like life insurance.

Fear of the unknown is a common human trait. The Skew is reflecting human behaviour, because it's evident more traders are getting nervous that a big market surprise is not too far away.

Market crash prophecies can become self-fulfilling, if enough people believe them. Taming the Skew at current levels won't be easy.