Is China's bull market for real?

Summary: Since I suggested investors gain some exposure to Chinese equities, the Shanghai Composite is up 90 per cent. Leading indicators suggest the Chinese economy may have stabilised. Weakness in the property market suggests Chinese investors have been rotating out of property and back into equities. |

Key take-out: I don't think we should be too concerned about the view that Chinese equities are no longer cheap. The outlook for Chinese stocks likely remains pretty good. |

Key beneficiaries: General investors. Category: International investing. |

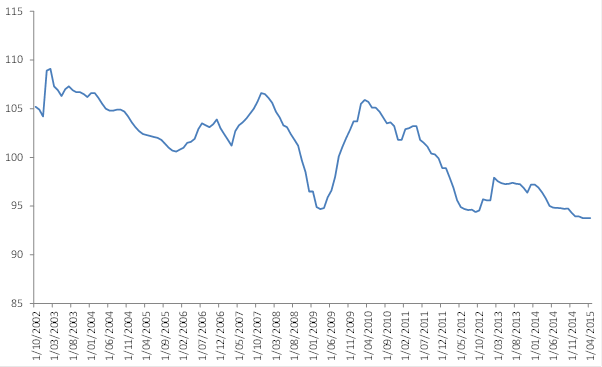

It's one of the great contradictions. If China is so weak, and many argue that it must be given the iron ore price has slumped below $US50, then why is its stock market so strong? Take a look at chart 1 below.

Chart 1: Shanghai Composite surging

Back in late 2012 and as part of my generalised call (well ahead of the consensus) for investors to look for opportunities overseas, I suggested that investors should gain some exposure to Chinese equities. And that's been a highly profitable investment as you can see from the chart. It's fair to say though that it took about 1 ½ years for that investment to come to fruition. But that is the key to successful investing – take a long-term view. Take note of the short-term noise and bouts of hysteria that hit the market and the press; but don't necessarily base your investment decisions on them. Anyway, since that time, the Shanghai Composite is up 90 per cent but I'll be honest in noting that that isn't quite the price action I had envisaged. It's a very hard run over a short space of time and naturally the question is, after such a large move, whether the market has done its dash. Whether investors should reduce their exposure.

The economic backdrop doesn't appear to be favourable according to common wisdom, and the consensus view is that the Chinese economy is slowing – a hard landing remains a reasonable probability. Suffice to say that I think the discussion on China is a little disingenuous. Seven per cent, even six per cent growth is strong growth for a $16-$17 trillion economy.

In any case and regardless of whether you can accept my view, the leading indicators suggest that – and at the very least – the Chinese economy may have stabilised. In other words, the worst is perhaps over.

Specifically the Chinese manufacturing PMI has been hovering around the 50 mark for the better part of two years. Most of the other indicators are also very consistent, showing an economy with slower, more manageable, but still strong growth. So industrial production is strong, money supply growth is around 12-13 per cent per annum, as are retail sales. Investors don't need to worry about China, or its growth prospects.

In any case, that 90 per cent surge occurred against the backdrop of heightened anxiety on China, so it doesn't appear, and it wouldn't be reasonable to assume, that ‘weak' growth would get in the way of further equity market gains anyway.

Instead, the key thing investors need to keep an eye on to determine whether further stock gains are likely is the property market. China differs from the western, and more specifically the Anglo, world in many ways. But, and just like in Australia or the US etc, Chinese investors need to put their money somewhere.

Chart 2 shows that property hasn't been the best place to invest over the last year, its weakness coinciding with the surge in the share market. And this ultimately is what I think we've seen. Chinese investors rotate out of property and back into equities.

Chart 2: The real estate climate index

Source: Bloomberg

Now at this point, property prices in the major cities are down between 4 and 6 per cent over the last year or so, according to Bloomberg figures. When you combine that with chart 2 above showing the real estate climate at its lowest on record, there doesn't appear to be any imminent threat of a resurgent property market.

Admittedly the Chinese government has taken a number of measures to boost support to the sector, including relaxing lending restrictions and those on residential property purchases. Furthermore, the People's Bank of China has cut lending rates, and eased reserve requirements on Chinese banks. That is, the amount banks must hold in reserve at the central bank for every dollar they lend – held to insure that banks have sufficient liquidity to meet cash demands.

Yet these seem aimed at cushioning the downturn rather than sparking a renewed upswing. Don't forget that the Chinese government wants more stable growth and that includes a slowing in leveraged property activity.

To the extent that they don't want the market to slump, though, it's likely that the authorities will take additional action to support the property market. Investors shouldn't misread these signals however. The government is neither panicking, nor trying to reignite the property boom – policy is still very much restrictive in that regard. It's more that the government doesn't think that policy needs to be as restrictive as it has been, given the slowdown.

In all likelihood this means that the property sector will remain subdued for a while yet, which of course, will continue to see equities bid.

Against that backdrop I don't think we should be too concerned about the view out there that Chinese equities are no longer cheap. The call is that at 2.4 times book value, the Chinese equity market is around its historical norms. I have to say though than any market still around its historical norms probably is still very cheap! That's especially the case for a country with nominal GDP growth of between 10 and 12 per cent and money supply growth of 12.5 per cent. That's a pretty solid earnings environment right there.

Overall then, the outlook for Chinese stocks most likely remains pretty good. Taking some profit now certainly wouldn't hurt after such a strong run, but there is every reason to retain exposure.