Is America getting ahead of itself?

Real GDP in the United States was stronger than expected in the September quarter but the devil is in the detail. However, more timely data indicate that the labour market continues to improve ahead of tonight’s release of the November payrolls data for the US.

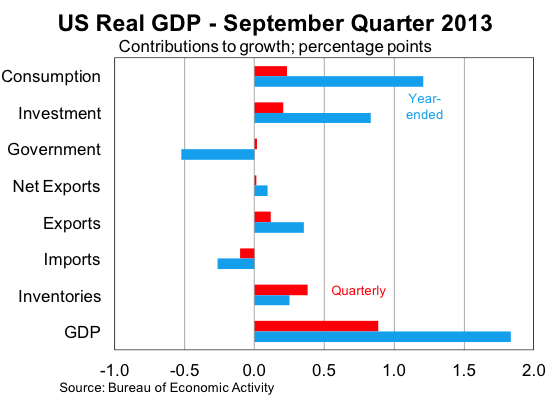

Real GDP in the US was revised up in the September quarter by 0.2 percentage points to 0.9 per cent. But the news is not completely positive – the upward revision almost entirely reflects inventory accumulation.

Typically a large rise in inventory accumulated occurs when sales disappoint. So the key takeaway from today’s revisions is that businesses, consistent with recent business surveys, were more optimistic in the September quarter than was justified given demand from households.

Household spending and exports were also revised down slightly, providing a partial justification for the inventory accumulation. Equipment investment was revised up by US$8.6 billion, while residential investment was revised down modestly but rose for the 12th consecutive quarter.

Real gross disposable income (GDI) – effectively an alternative measure of GDP using an income approach – rose by only 0.3 per cent in the September quarter. Between this data and the inventory accumulation, the US economy was weaker than suggested by the headline data.

Inventory accumulation may also have repercussions next quarter. Lower inventory accumulation, combined with the 16-day federal government shutdown, will be a drag on the US economy during the December quarter. At least to this point, the effect of the government shutdown has been isolated to government spending and has not weakened consumer spending or hiring.

More timely data though suggest that spending indicators and the labour market have improved. Jobless claims fell by 23,000 to 298,000 in the week ended 30 November – among the lowest results since the beginning of 2008. Although the data can be volatile around the holidays, it is another tick for the labour market ahead of tonight’s all-important November payrolls data.

If non-farm payrolls rose by more than 200,000 in November it will be the third time in the last four months that this has occurred and a key indicator that the recovery is becoming more sustainable. It could prompt the Federal Reserve to begin the taper of its US$85 billion per month asset purchasing program – though in my opinion March remains the more likely scenario.

Hopefully a strong payrolls result will prompt the Fed to be a bit more transparent at their 17-18 December meeting. Australian policy makers – as well as policy makers across the globe – could do with a little more certainty surrounding the Fed’s actions.

As I mentioned yesterday, not since the days of a fixed currency regime has Australian monetary policy been held hostage by the whims of another central bank. Never has a single policy decision had such importance for the global economy (RBA caution to cushion a Fed fallout, December 5). Right now US policy uncertainty has created uncertainty for countries across the globe.

The payrolls data tonight has important implications for the Australian economy. Our domestic outlook is dependent on a depreciation of the Australian dollar necessary to support our weaker non-mining sectors. Despite the efforts of the RBA to jawbone currency markets, the dollar needs to fall further to facilitate the type of growth necessary to rebalance our economy. A decision by the Fed to taper – even by a little bit – could do wonders for the domestic economy.