InvestSMART Performance Update: September 2025

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 6.2% and 14.6% to the end of September 2025. Over 10 years, the diversified portfolios have returned between 4.3% and 9.5% a year on average. Keep in mind, past performance is not an indication of future performance.

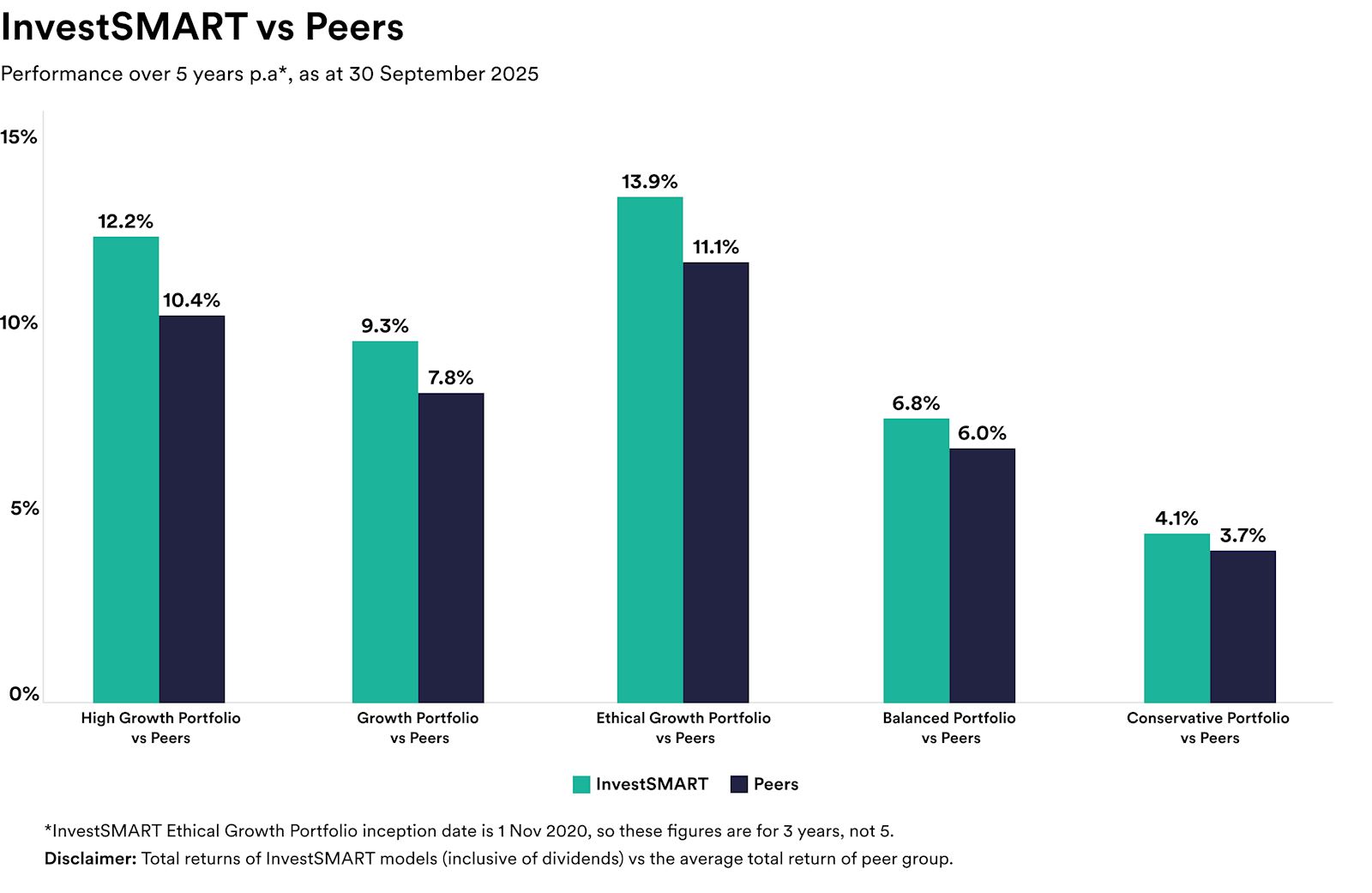

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years to 30 September 2025 (three years for the Ethical Growth Portfolio, which launched in November 2020).

As you can see, over five years, the diversified portfolios have delivered annual returns of between 4.1% and 12.2% on average, outperforming competitor funds by an average annualised return of between 0.4% and 1.8%.

The Ethical Growth Portfolio has returned 13.9% a year over three years, outperforming similar options by an average of 2.8% annually over that period.

InvestSMART's single-asset portfolios returned between 3.2% (Australian bonds) and 22.6% (international equities) in the 12 months to the end of September 2025, and between -1.0% p.a. (Australian bonds) and 15.6% p.a. (international equities) over five years.

September wrap-up

September brought a change of pace for investors. After five straight months of gains, the Australian share market dipped slightly, with the S&P/ASX 200 easing about 0.8%. Even so, it remains up roughly 11.5% year to date, highlighting how resilient markets have been in 2025.

Materials was the best-performing sector on the ASX, gaining 6.1%. The strong result was largely thanks to gold. The only other sector to end the month in positive territory was Utilities ( 0.7%). Energy (-9.8%), Consumer Staples (-4.4%) and Healthcare (-4.1%) were the worst performers.

Globally, markets held up well, with the MSCI World ex Australia up a little more than 3%. Japan's Nikkei 225 rose 5.2%, while in the US, the S&P 500 gained 3.7%. Chinese equities, however, weakened after earlier gains.

Back home, the Reserve Bank of Australia (RBA) kept the cash rate on hold at 3.60% at its September meeting, noting ongoing inflation pressures and renewed strength in the housing market. Whether we'll see another rate cut this year is hard to say.

Deloitte Access Economics expects another 25 basis point cut in December. Westpac thinks there's still enough data to come before the November meeting to justify a cut, even though currently available information would suggest a hold is more likely. The other three major banks anticipate that the RBA's next move won't come until 2026.

September served as a reminder that markets rarely move in a straight line. With the final quarter now underway, staying diversified and focused on long-term outcomes remains key.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 6.2% and 14.6% over the 12 months to 30 September 2025. Over five years they delivered average annual returns of between 4.1% and 12.2%, and over 10 years between 4.3% and 9.5% a year. Remember, past performance is not an indication of future performance.

The Ethical Growth Portfolio, which launched in November 2020, returned 13.9% a year over the three years to 30 September 2025. It outperformed similar options by an average of 2.8% per year over that period.

In the 12 months to the end of September 2025, single-asset portfolios returned between 3.2% (Australian bonds) and 22.6% (international equities). Over five years those returns ranged from -1.0% p.a. (Australian bonds) to 15.6% p.a. (international equities).

After five straight months of gains the S&P/ASX 200 eased about 0.8% in September 2025. Despite the monthly dip, the index was still up roughly 11.5% year to date at the end of September.

Materials was the best-performing ASX sector in September, rising 6.1% largely thanks to gold. Utilities was the only other sector in positive territory (+0.7%). The weakest sectors were Energy (-9.8%), Consumer Staples (-4.4%) and Healthcare (-4.1%).

Global markets held up well in September 2025: the MSCI World ex Australia was up a little more than 3%, Japan's Nikkei 225 rose 5.2%, and the US S&P 500 gained 3.7%. Chinese equities weakened after earlier gains.

The RBA kept the cash rate on hold at 3.60% at its September meeting, noting ongoing inflation pressures and renewed strength in the housing market. Forecasts varied: Deloitte Access Economics expected a 25 basis point cut in December, Westpac thought enough data might emerge before November to justify a cut (though current information suggests a hold is more likely), and three other major banks anticipated the next move wouldn't come until 2026.

September was a reminder markets rarely move in a straight line. For everyday investors the article recommends staying diversified and focused on long-term outcomes rather than reacting to short-term volatility. Use portfolio diversification and a long-term view to manage risk.