InvestSMART Performance Update: October 2025

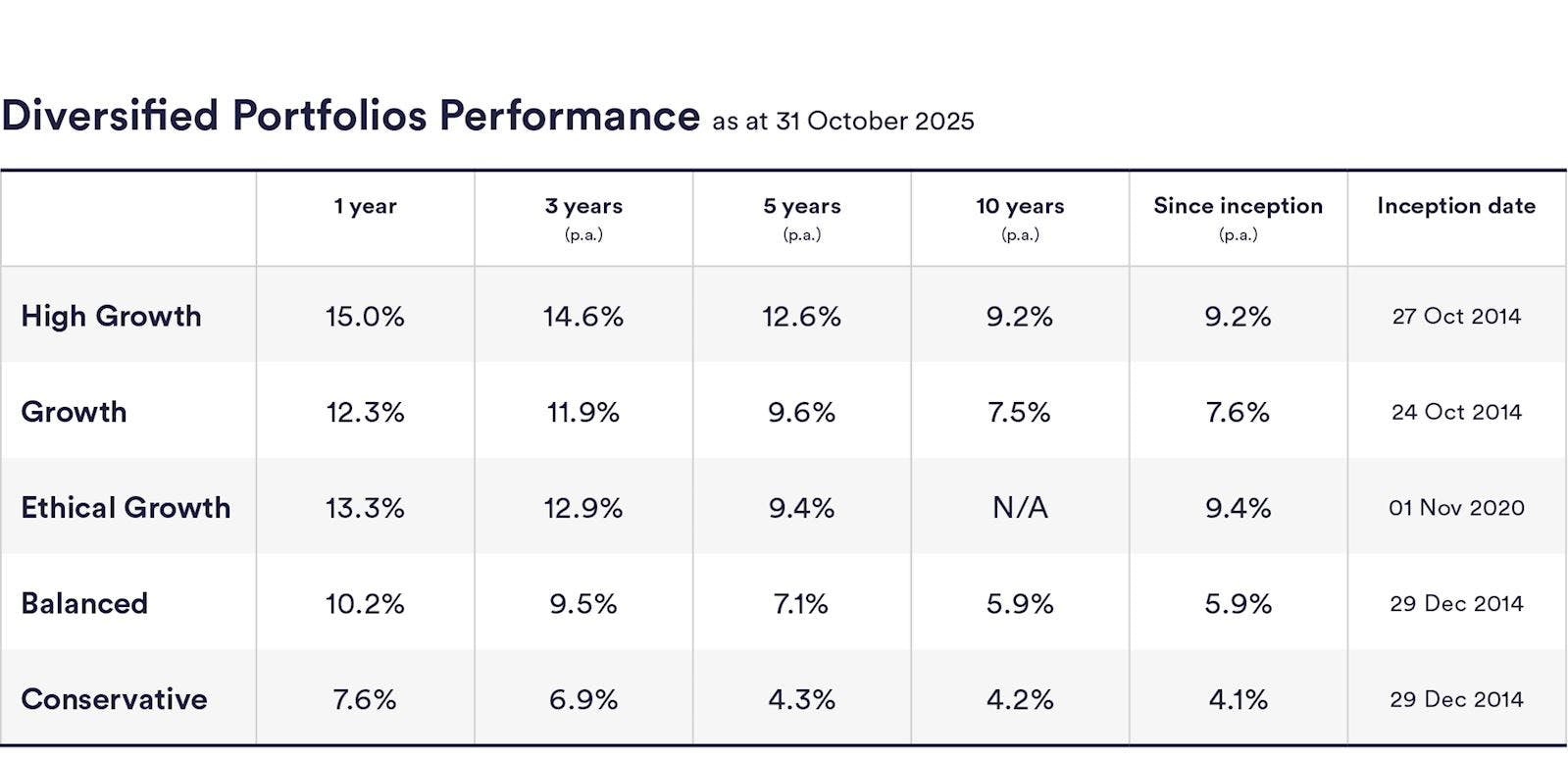

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 7.6% and 15.0% to the end of October 2025. Over 10 years, the diversified portfolios have returned between 4.2% and 9.2% a year on average. Keep in mind, past performance is not an indication of future performance.

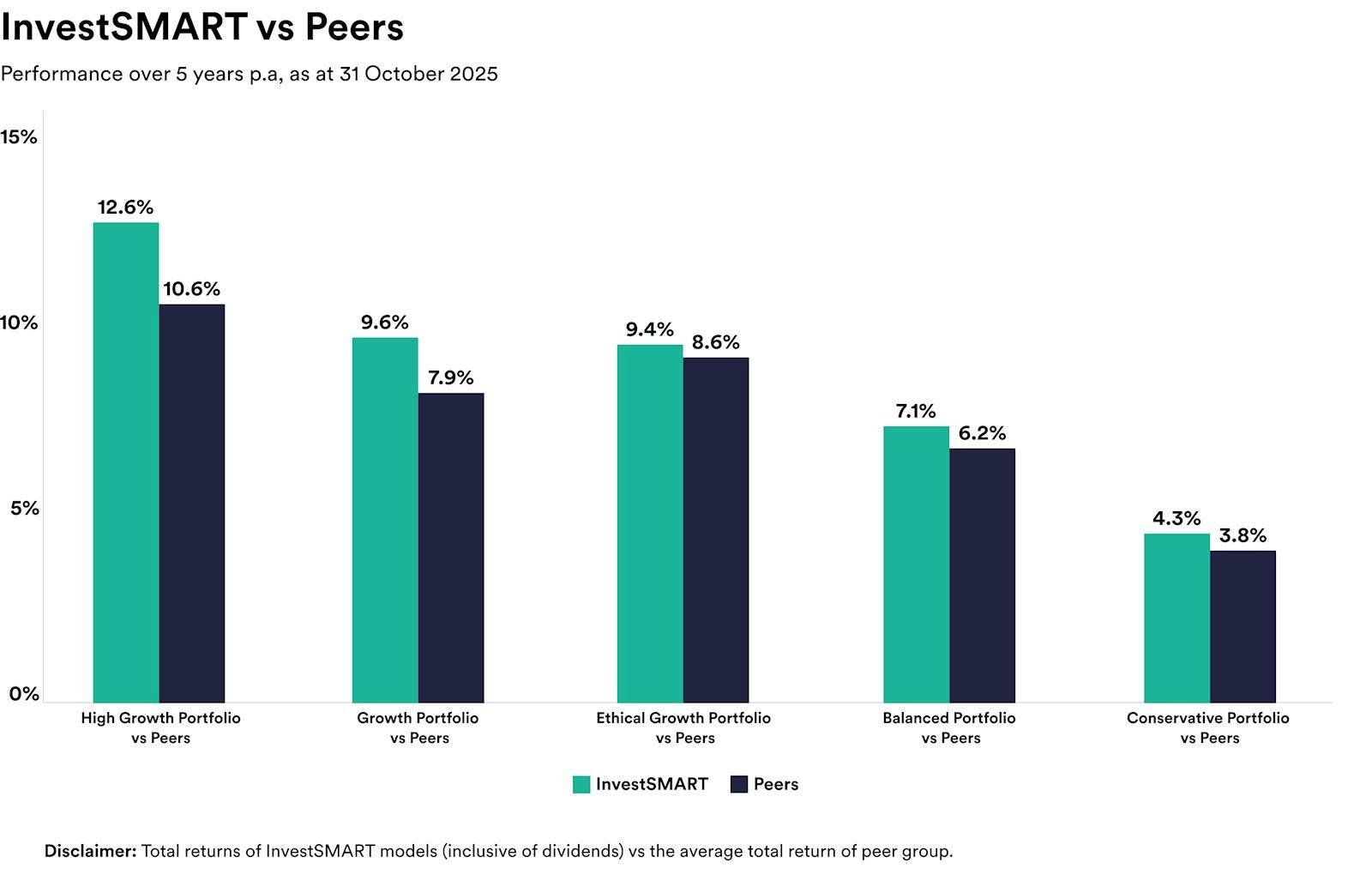

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years to 31 October 2025.

As you can see, over five years, the diversified portfolios have delivered annual returns of between 4.3% and 12.6% on average, outperforming competitor funds by an average annualised return of between 0.5% and 2.0%.

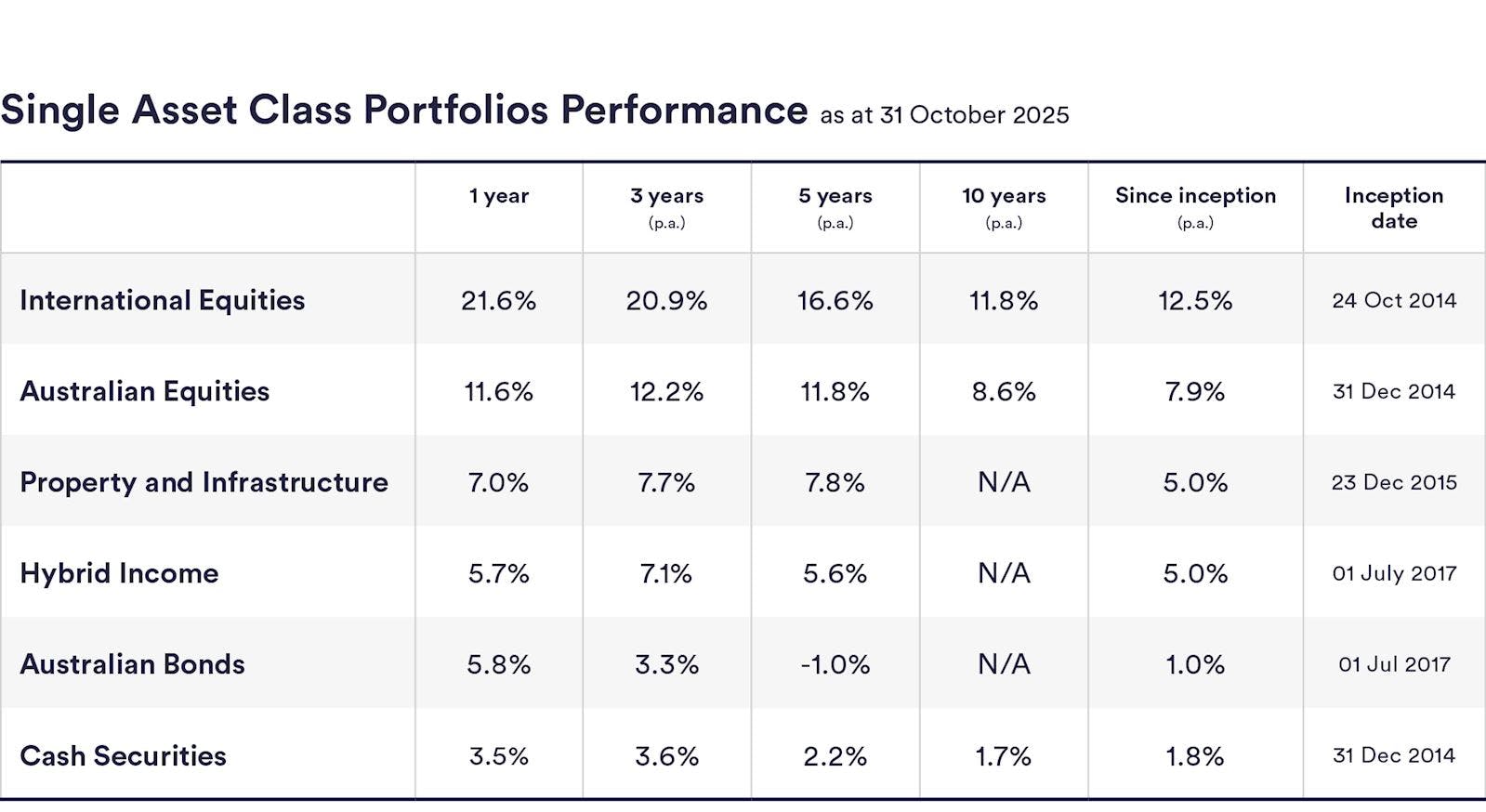

InvestSMART's single-asset portfolios returned between 3.5% (cash securities) and 21.6% (international equities) in the 12 months to the end of October 2025, and between -1.0% p.a. (Australian bonds) and 16.6% p.a. (international equities) over five years.

October wrap-up

October was a mixed bag for investors. Aussie shares regained September's losses, with the S&P/ASX 200 ending the month up 0.4% after a 0.8% dip the month before. It's now up 11.9% year to date, as at the end of October.

It was a good month for Materials (4.3%) and Energy (3.7%) sectors, but not so great for Information Technology (-8.4%), Consumer Discretionary (-6.8%) and Healthcare (-4.8%).

Despite the modest rebound, local shares still lagged most global markets. The MSCI World ex Australia Index rose 3.3% in Aussie dollar terms, while emerging markets climbed 4.2%. Even the S&P 500, up around 1.3% for Australian investors, outpaced the local market.

Back to Australia, and October brought two important pieces of data - inflation and unemployment - both of which dampened hopes of a rate cut in the near term. Inflation came in higher than expected, with headline CPI rising to 3.2% over the 12 months to the September quarter.

At the same time, the labour market strengthened. The unemployment rate dropped to 4.3% after rising to 4.5% in September and the number of employed people increased by more than 40,000.

Together, the numbers suggest the RBA is likely to keep rates on hold for now.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 7.6% and 15.0% over the 12 months to the end of October 2025. Over five years they delivered annualised returns of between 4.3% and 12.6%, and over 10 years between 4.2% and 9.2% per year. Remember, past performance is not an indication of future performance.

Over the five years to 31 October 2025, InvestSMART's diversified portfolios outperformed funds in the same risk category by an average annualised margin of about 0.5% to 2.0% per year.

InvestSMART's single-asset portfolios returned between 3.5% (cash securities) and 21.6% (international equities) in the 12 months to the end of October 2025. Over five years, single-asset returns ranged from -1.0% p.a. for Australian bonds to 16.6% p.a. for international equities.

The S&P/ASX 200 rose 0.4% in October 2025 (after a 0.8% fall in September) and was up 11.9% year to date as at the end of October 2025.

In October 2025, Materials (+4.3%) and Energy (+3.7%) were the best-performing sectors, while Information Technology (-8.4%), Consumer Discretionary (-6.8%) and Healthcare (-4.8%) were the weakest contributors to market returns.

Global markets outpaced the Australian market in October 2025: the MSCI World ex Australia Index rose about 3.3% in Australian-dollar terms, emerging markets climbed around 4.2%, and the S&P 500 returned roughly 1.3% for Australian investors — all stronger than the local market's monthly gain.

Headline CPI rose to 3.2% over the 12 months to the September quarter 2025, and the unemployment rate fell to 4.3% (from 4.5% in September) with employment increasing by more than 40,000. Together these data points dampened hopes of a near-term rate cut and suggest the RBA is likely to keep rates on hold for now.

InvestSMART's recent numbers show solid short- and long-term returns for both diversified ETF and single-asset portfolios, and some outperformance versus peers over five years. However, the article stresses that past performance does not guarantee future results. Use these figures as part of your research, consider your risk profile and time horizon, and remember market conditions (sectors, global performance, inflation and jobs data) can shift outcomes over time.