InvestSMART Performance Update: November 2025

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 5.1% and 10.0% to the end of November 2025. Over 10 years, the diversified portfolios have returned between 4.2% and 9.2% a year on average. Keep in mind that past performance is not an indication of future performance.

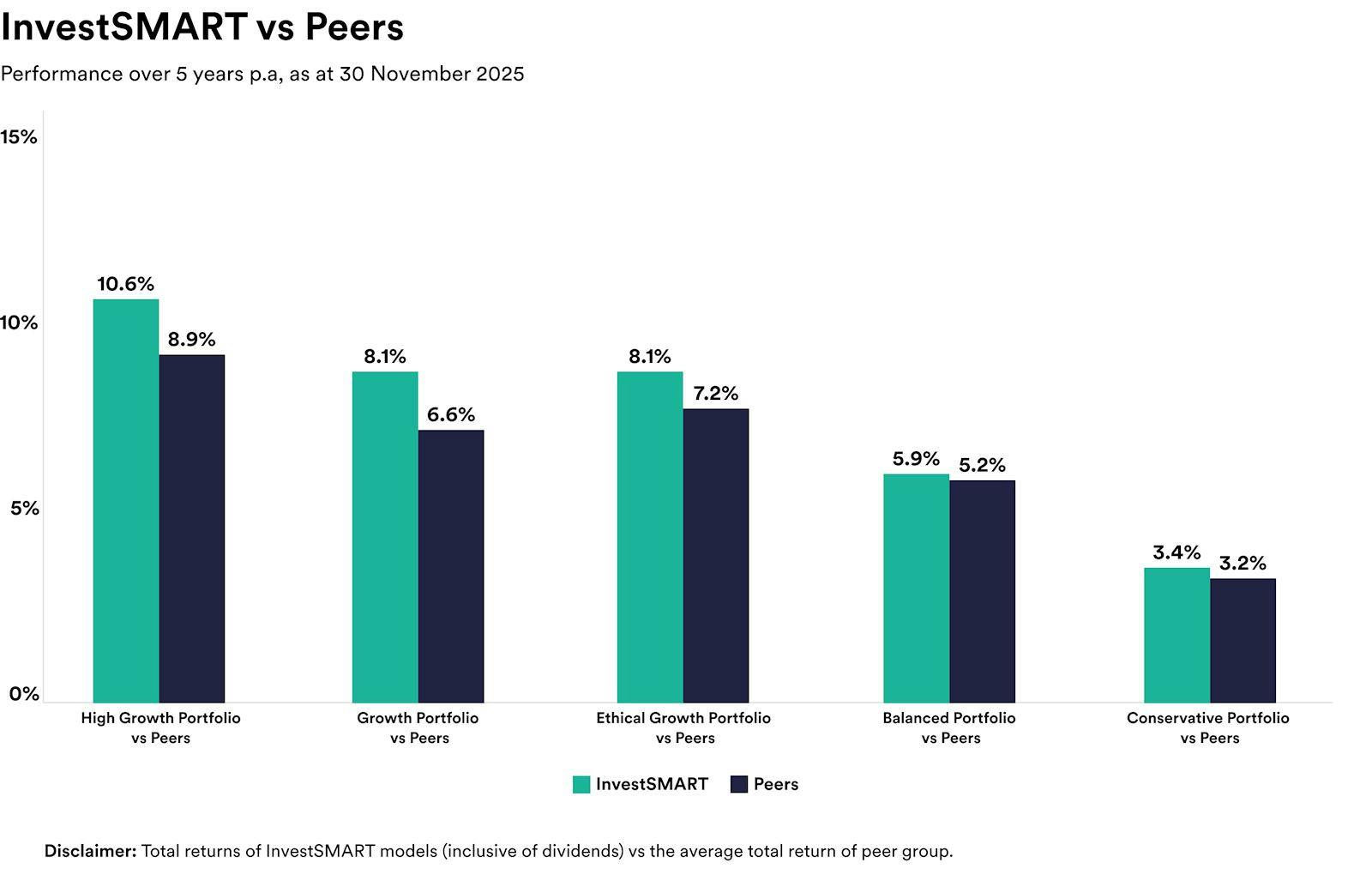

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years to 30 November 2025.

As you can see, over five years, the diversified portfolios have delivered annual returns of between 3.4% and 10.6% on average, outperforming competitor funds by an average annualised return of between 0.2% and 1.7%.

InvestSMART's single-asset portfolios returned between 3.4% (cash securities) and 17.5% (international equities) in the 12 months to the end of November 2025, and between -1.2% p.a. (Australian bonds) and 15.0% p.a. (international equities) over five years.

November wrap-up

With the year almost behind us, November felt like a moment for markets to take stock. Australian shares dipped, with the S&P/ASX 200 falling 2.7% over the month, but remain in positive territory, up 8.9% year to date to the end of November.

The three best-performing sectors for the month were Healthcare ( 2.0%), Consumer Staples ( 1.6%) and Materials ( 1.5%), while Information Technology (-11.6%) was the worst.

Global markets were steady in comparison. The MSCI World ex Australia Index gained 0.2% in November, while the S&P 500 was relatively flat, down 0.07%.

The Reserve Bank opted to sit tight in November and December, keeping the cash rate on hold as inflation continued to prove more stubborn than expected.

Looking back on 2025, it hasn't been a straight line for markets, but it has reinforced some key lessons - diversification matters, discipline pays off and sticking with a plan beats chasing short-term moves.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 5.1% and 10.0% over the 12 months to the end of November 2025. Over five years they delivered between 3.4% and 10.6% a year on average, and over 10 years between 4.2% and 9.2% a year. Remember that past performance is not an indication of future performance.

Over five years to 30 November 2025, InvestSMART's diversified portfolios outperformed funds in the same risk categories by an average annualised margin of between 0.2% and 1.7%.

In the 12 months to the end of November 2025, InvestSMART's single-asset portfolios returned between 3.4% (cash securities) and 17.5% (international equities). Over five years the range was between -1.2% p.a. (Australian bonds) and 15.0% p.a. (international equities).

The S&P/ASX 200 fell 2.7% in November 2025 but remained positive year to date, up 8.9% to the end of November 2025.

The best-performing ASX sectors in November 2025 were Healthcare (+2.0%), Consumer Staples (+1.6%) and Materials (+1.5%). Information Technology was the weakest sector, down 11.6% for the month.

Global markets were relatively steady in November 2025: the MSCI World ex Australia Index rose 0.2% while the S&P 500 was roughly flat, down 0.07% for the month.

No — the Reserve Bank opted to sit tight in November and December 2025, keeping the cash rate on hold as inflation proved more stubborn than expected.

The November 2025 update reinforces straightforward investing lessons: diversification matters, discipline pays off, and sticking with a plan generally beats chasing short-term market moves.