InvestSMART Performance Update: November 2024

It's been another great month of returns for InvestSMART with our diversified ETF portfolios returning between 10.5% and 23.4% in the 12 months to 30 November 2024. Our low fees and use of broad-based passive ETFs have allowed us to outperform the majority of our competitors over the long term. Of course, past performance is not an indication of future performance.

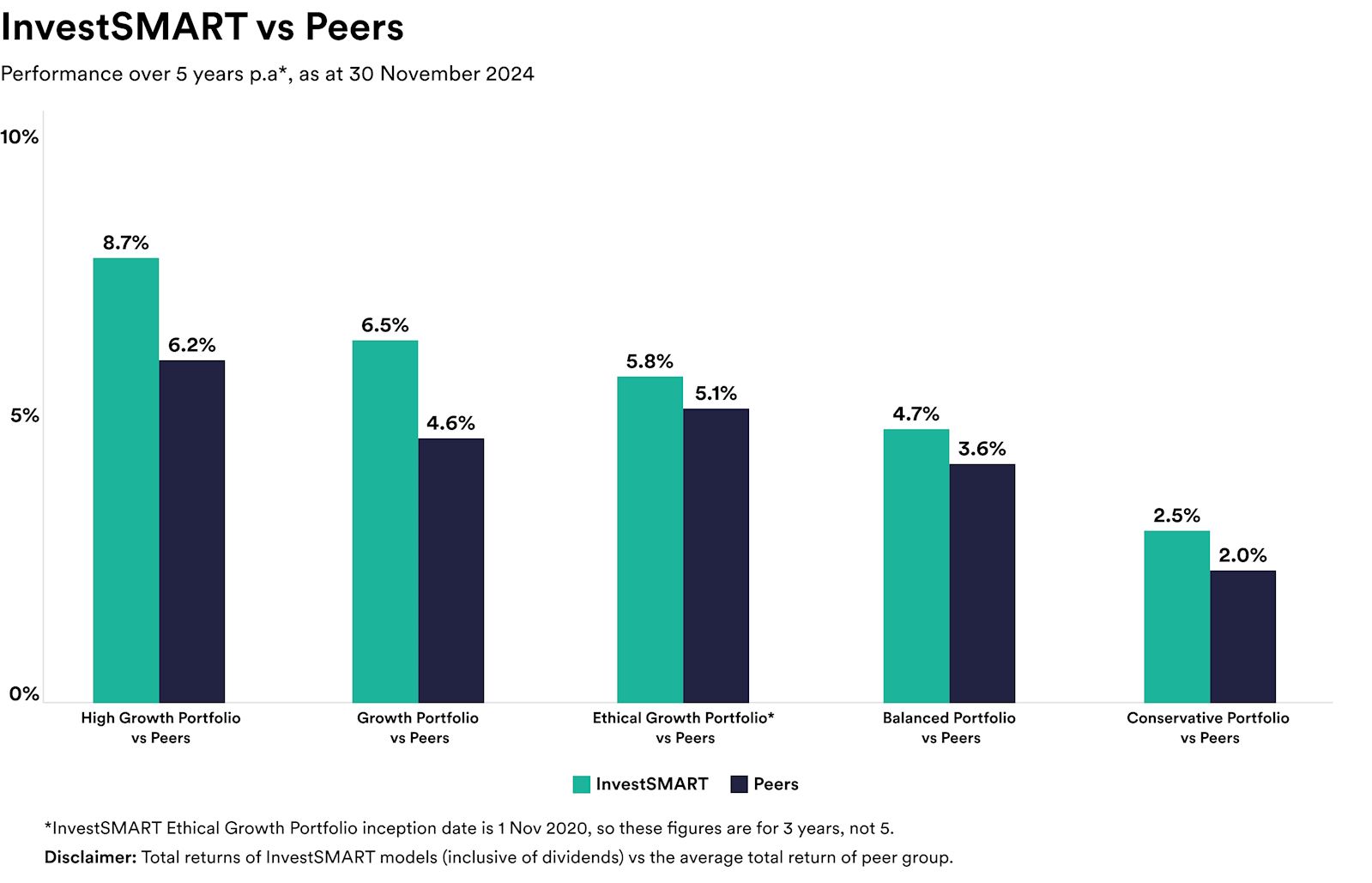

Over five years the diversified portfolios have delivered annual returns of between 2.5% and 8.7% on average. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over five years. As you can see, our High Growth portfolio has returned 8.7% a year over five years, outperforming similar options by an average of 2.5% over that period.

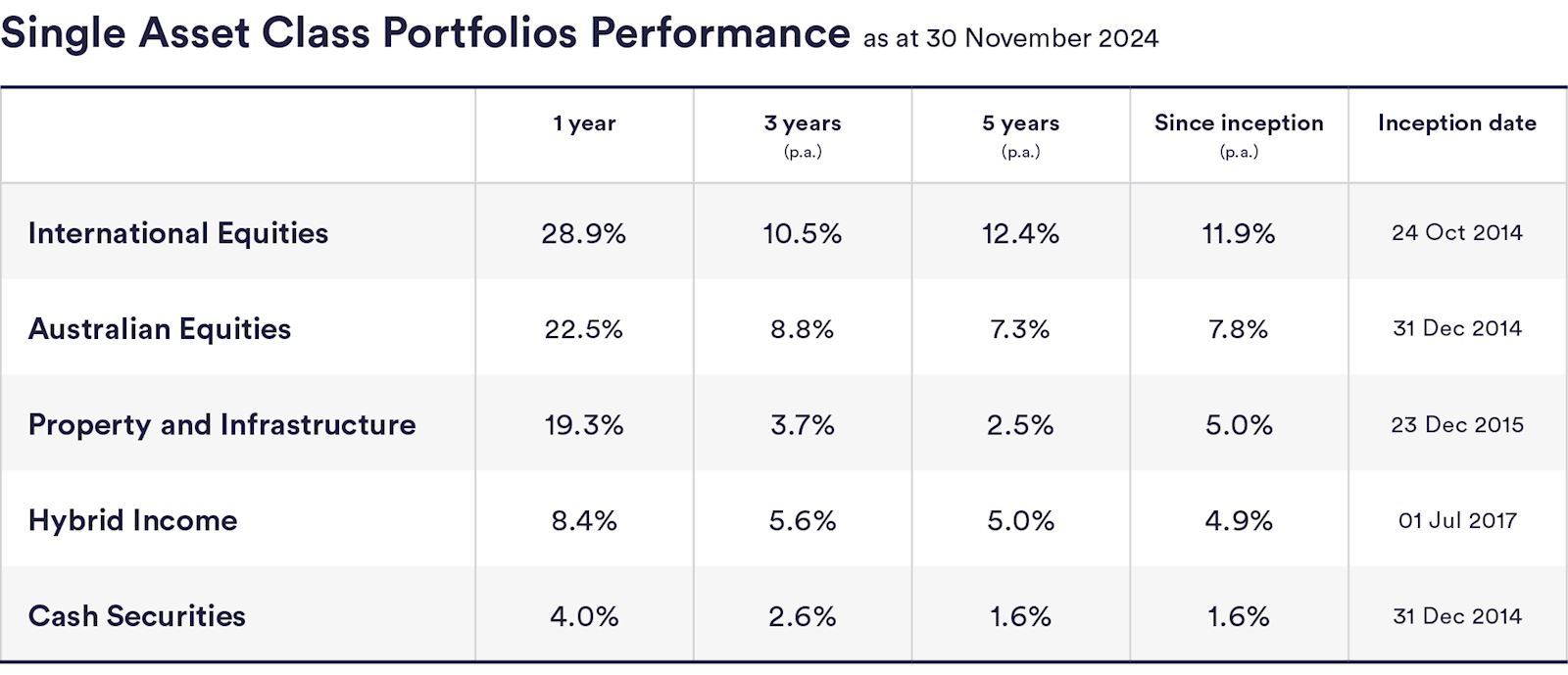

InvestSMART's single-asset portfolios also performed well, returning between 4.0% (cash securities) and 28.9% (international equities) in the 12 months to 30 November 2024, and between 1.6%p.a. and 12.4%p.a. over five years.

November wrap up

Share markets bounced back in November after most went backward in October. US stocks performed the best with the S&P 500 rising by 5.9%, thanks largely to the re-election of Donald Trump. Global equities and Aussie shares also had a great month. The MSCI World ex-Australia index rose by 4.5% while the S&P/ASX 200 was up 3.8%.

Emerging markets, however, felt the impact of the strong US dollar and the threat of US tariffs and fell by 1.9%.

Bonds rallied towards the end of the month benefiting from easing bond yields and ended the month up 1.19%.

Most global markets, including the US, Eurozone, Japan and China, have gotten off to a strong start in December but Aussie shares have fallen by about 0.5% in the month to date.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered impressive returns, ranging from 10.5% to 23.4% in the 12 months leading up to November 2024. This performance highlights the effectiveness of our low-fee, broad-based passive ETF strategy.

Over the past five years, InvestSMART's diversified portfolios have achieved annual returns between 2.5% and 8.7%. Notably, our High Growth portfolio has consistently outperformed similar options by an average of 2.5% annually during this period.

In the 12 months to November 2024, InvestSMART's single-asset portfolios saw returns ranging from 4.0% for cash securities to 28.9% for international equities. Over five years, these portfolios have delivered annual returns between 1.6% and 12.4%.

Global share markets rebounded in November 2024, with US stocks leading the way. The S&P 500 rose by 5.9%, while the MSCI World ex-Australia index increased by 4.5%. The S&P/ASX 200 also saw a rise of 3.8%.

Emerging markets faced challenges in November 2024, declining by 1.9% due to the strong US dollar and concerns over US tariffs.

Bond markets rallied towards the end of November 2024, benefiting from easing bond yields and ending the month with a gain of 1.19%.

Most global markets, including those in the US, Eurozone, Japan, and China, have started December 2024 strongly. However, Australian shares have experienced a slight decline of about 0.5% so far this month.

The re-election of Donald Trump played a significant role in boosting US stocks, with the S&P 500 rising by 5.9% in November 2024.