InvestSMART Performance Update: May 2025

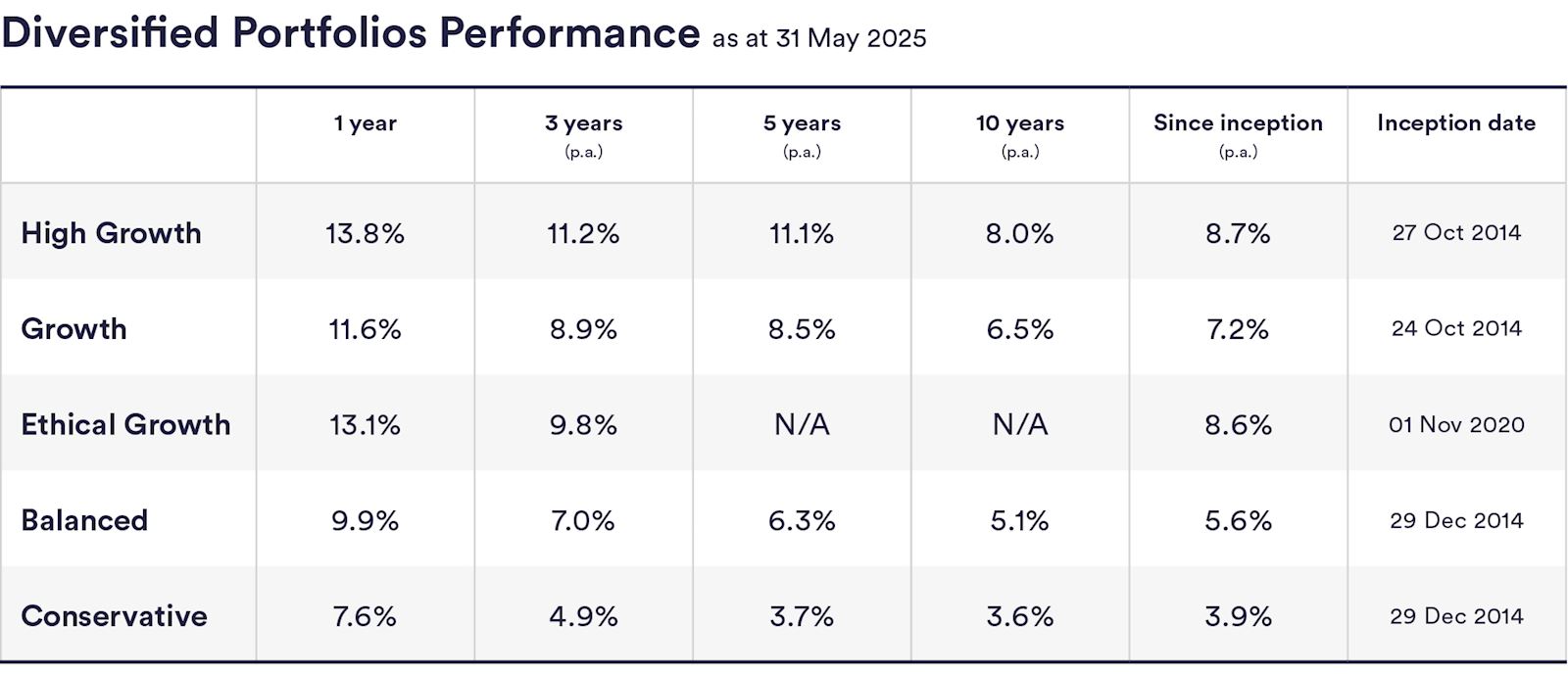

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 7.6% and 13.8% to the end of May 2025. Over 10 years, the diversified portfolios have returned between 3.6% and 8.0% on average. Keep in mind, past performance is not an indication of future performance.

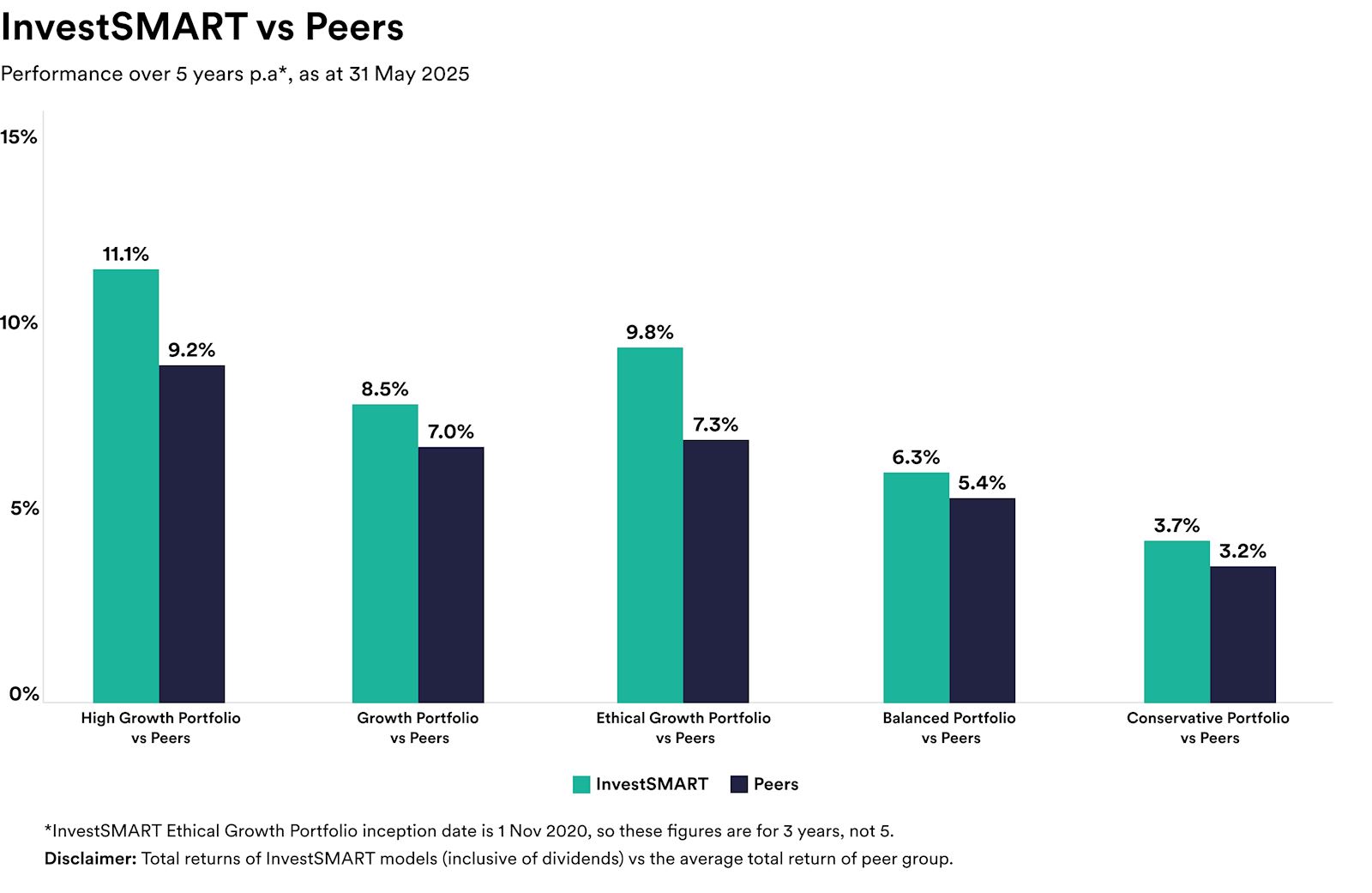

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years (three years for the Ethical Growth Portfolio, which launched in November 2020).

As you can see, over five years, the diversified portfolios have delivered annual returns of between 3.7% and 11.1% on average, outperforming competitor funds by an average annualised return of between 0.5% and 1.9%.

The Ethical Growth Portfolio has returned 9.8% a year over three years, outperforming similar options by an average of 2.5% annually over that period.

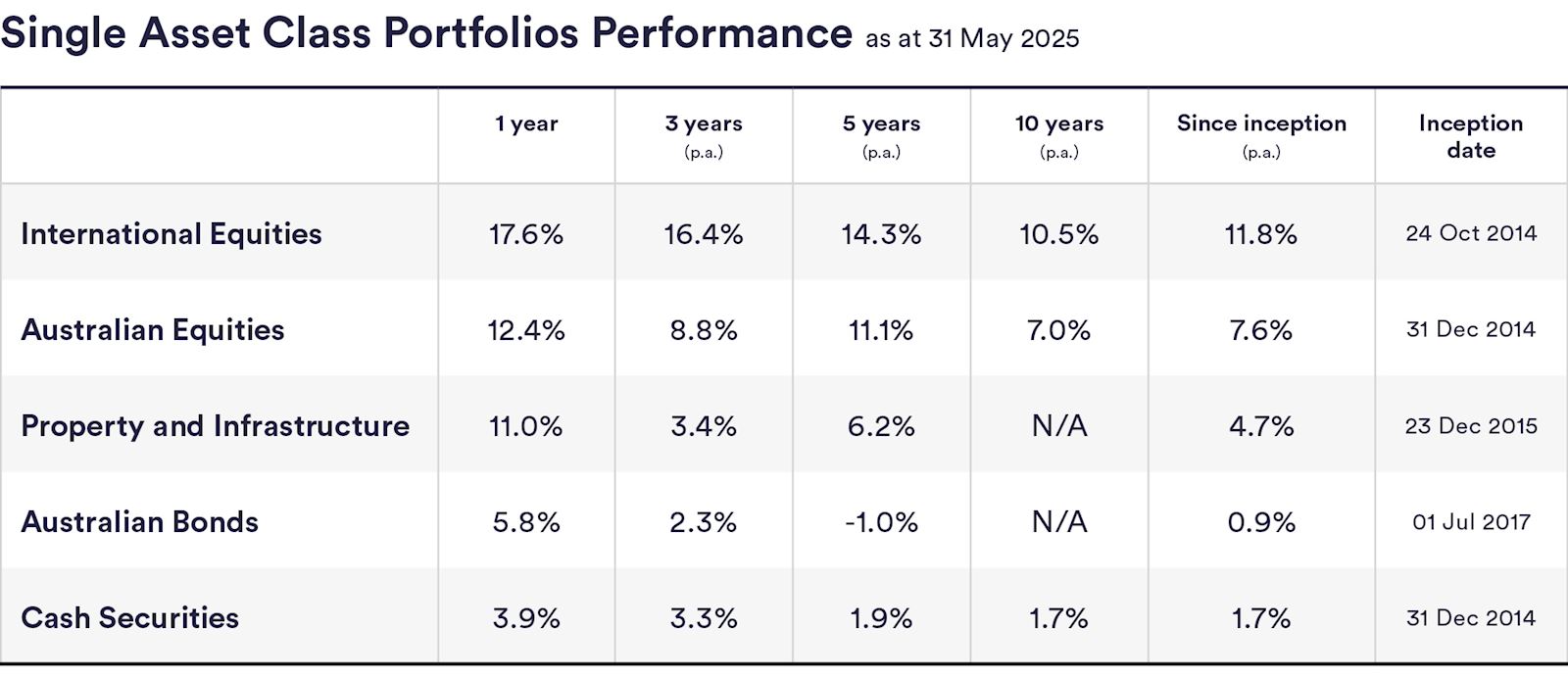

InvestSMART's single-asset portfolios returned between 3.9% (cash securities) and 17.6% (international equities) in the 12 months to the end of May 2025, and between -1.0%p.a. (Australian bonds) and 14.3%p.a. (international equities) over five years.

May wrap-up

If 2025 has taught us anything, it's to stay on our toes. After a shaky first quarter and a jittery April, May finally delivered some welcome relief for investors.

The Aussie sharemarket had a good month, with the S&P/ASX 200 gaining 4.2%. All sectors ended the month in positive territory. Information Technology was the best-performing sector in May delivering a double-digit return of 19.2%. At the other end of the spectrum was Utilities which rose by just 0.3%.

US shares also bounced back, with the S&P 500 climbing 6.2% in May - enough to nudge it back into positive territory for the year.

There may still be pockets of volatility, especially with ongoing geopolitical tensions (including the situation in Iran), but markets feel a bit more balanced at this stage.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, with returns ranging from 7.6% to 13.8% as of May 2025. Over a 10-year period, these portfolios have averaged returns between 3.6% and 8.0%.

The Ethical Growth Portfolio has performed well, returning 9.8% annually over the past three years since its launch in November 2020. It has outperformed similar options by an average of 2.5% annually during this period.

Over the past five years, InvestSMART's diversified portfolios have outperformed competitor funds by an average annualised return of between 0.5% and 1.9%.

In the 12 months leading up to May 2025, InvestSMART's single-asset portfolios returned between 3.9% for cash securities and 17.6% for international equities.

The Australian share market had a strong performance in May 2025, with the S&P/ASX 200 gaining 4.2%. All sectors ended the month positively, with Information Technology leading with a 19.2% return.

US shares rebounded in May 2025, with the S&P 500 climbing 6.2%, which helped it return to positive territory for the year.

While markets have shown some balance, there are still potential risks due to ongoing geopolitical tensions, such as the situation in Iran, which could lead to pockets of volatility.

Past performance is not an indication of future performance because market conditions can change due to various factors, including economic shifts, geopolitical events, and changes in investor sentiment, which can all impact future returns.