InvestSMART Performance Update: June 2025

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 7.7% and 13.6% to the end of June 2025. Over 10 years, the diversified portfolios have returned between 4.0% and 8.6% a year on average. Keep in mind, past performance is not an indication of future performance.

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years (three years for the Ethical Growth Portfolio, which launched in November 2020).

As you can see, over five years, the diversified portfolios have delivered annual returns of between 4.0% and 11.6% on average, outperforming competitor funds by an average annualised return of 0.7% and 2.3%.

The Ethical Growth Portfolio has returned 12.3% a year over three years, outperforming similar options by an average of 3% annually over that period.

.jpg)

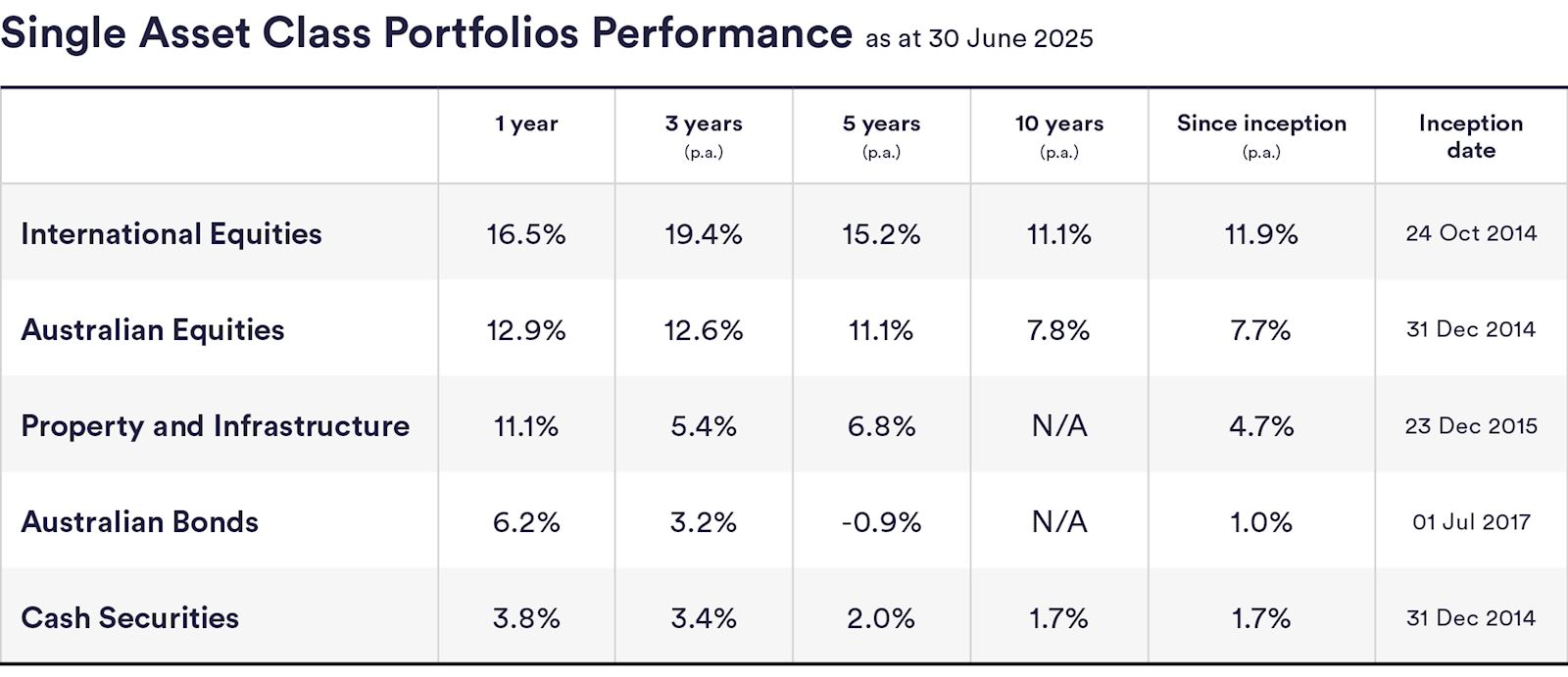

InvestSMART's single-asset portfolios returned between 3.8% (cash securities) and 16.5% (international equities) in the 12 months to the end of June 2025, and between -0.9%p.a. (Australian bonds) and 15.2%p.a. (international equities) over five years.

June wrap-up

June felt like a bit of a breather after the market volatility earlier in the year. The Aussie share market posted modest gains, with the S&P/ASX 200 rising 1.4% for the month. Energy (up 9.0%), financials (up 4.3%), and real estate (up 1.7%) were the best-performing sectors in June, while materials lagged, falling 3.3%.

Over in the US, the market kept its momentum going - even if the pace eased a little - with the S&P 500 rising 5.1% in June after increasing 6.2% in May.

As we head further into 2025, it feels like investors are finding a bit more calm after a shaky start to the year. That said, there could still be some bumps along the way as global events keep things interesting.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered solid results over the past 12 months, with returns ranging from 7.7% to 13.6% by the end of June 2025.

Over the past 10 years, InvestSMART's diversified portfolios have achieved average annual returns between 4.0% and 8.6%.

InvestSMART's diversified portfolios have outperformed competitor funds by an average annualised return of 0.7% to 2.3% over the past five years.

Since its launch in November 2020, the Ethical Growth Portfolio has returned 12.3% annually over three years, outperforming similar options by an average of 3% each year.

In the 12 months to the end of June 2025, InvestSMART's single-asset portfolios returned between 3.8% for cash securities and 16.5% for international equities.

In June 2025, the best-performing sectors in the Australian share market were energy (up 9.0%), financials (up 4.3%), and real estate (up 1.7%).

The US stock market continued its momentum with the S&P 500 rising 5.1% in June 2025, following a 6.2% increase in May.

As we progress into 2025, investors might experience more stability after a volatile start to the year, though global events could still cause some fluctuations.