InvestSMART Performance Update: July 2025

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 6.6% and 13.4% to the end of July 2025. Over 10 years, the diversified portfolios have returned between 3.8% and 8.5% a year on average. Keep in mind, past performance is not an indication of future performance.

.jpg)

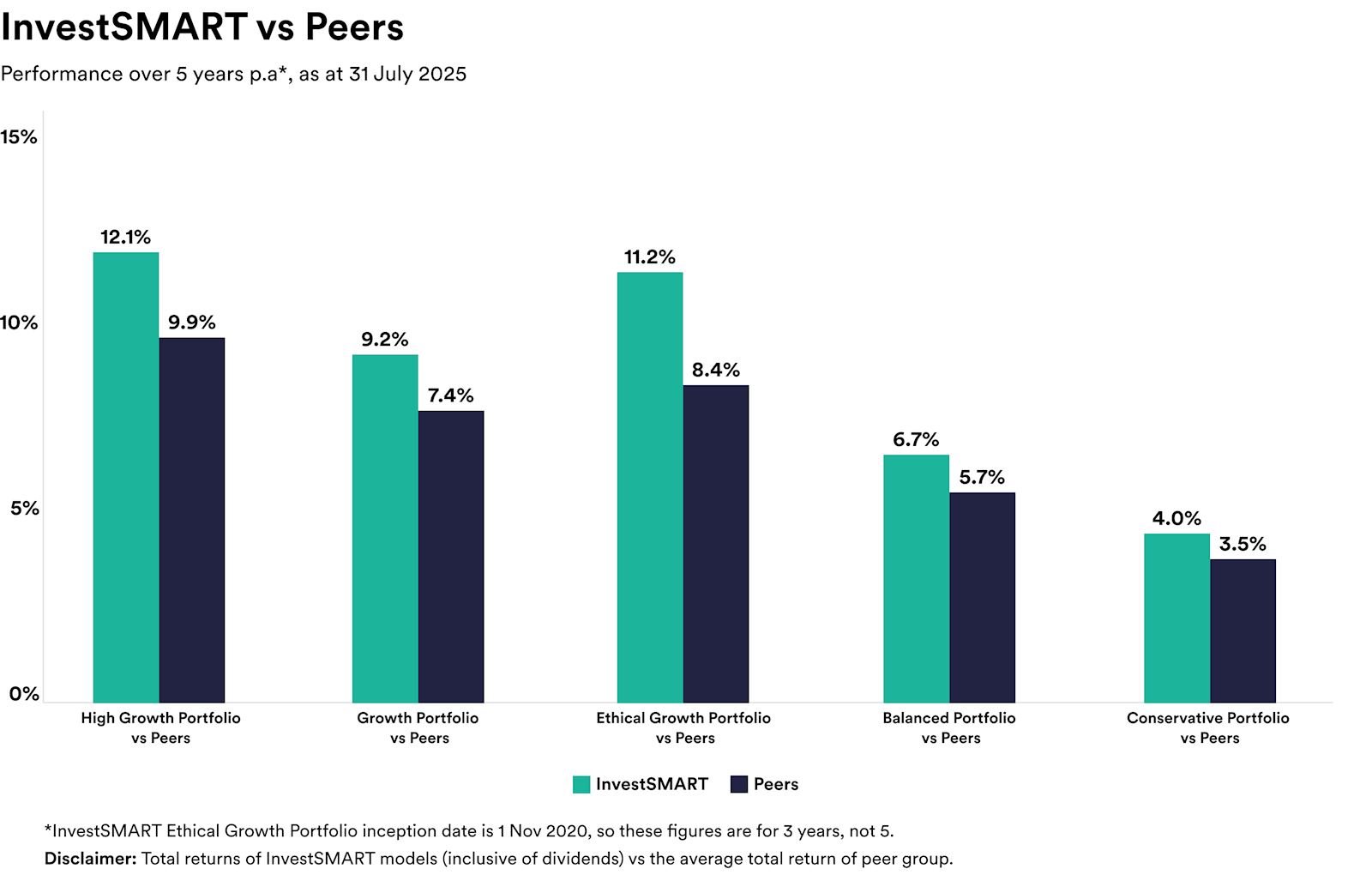

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years (three years for the Ethical Growth Portfolio, which launched in November 2020).

As you can see, over five years, the diversified portfolios have delivered annual returns of between 4.0% and 12.1% on average, outperforming competitor funds by an average annualised return of 0.5% and 2.2%.

The Ethical Growth Portfolio has returned 11.2% a year over three years, outperforming similar options by an average of 2.8% annually over that period.

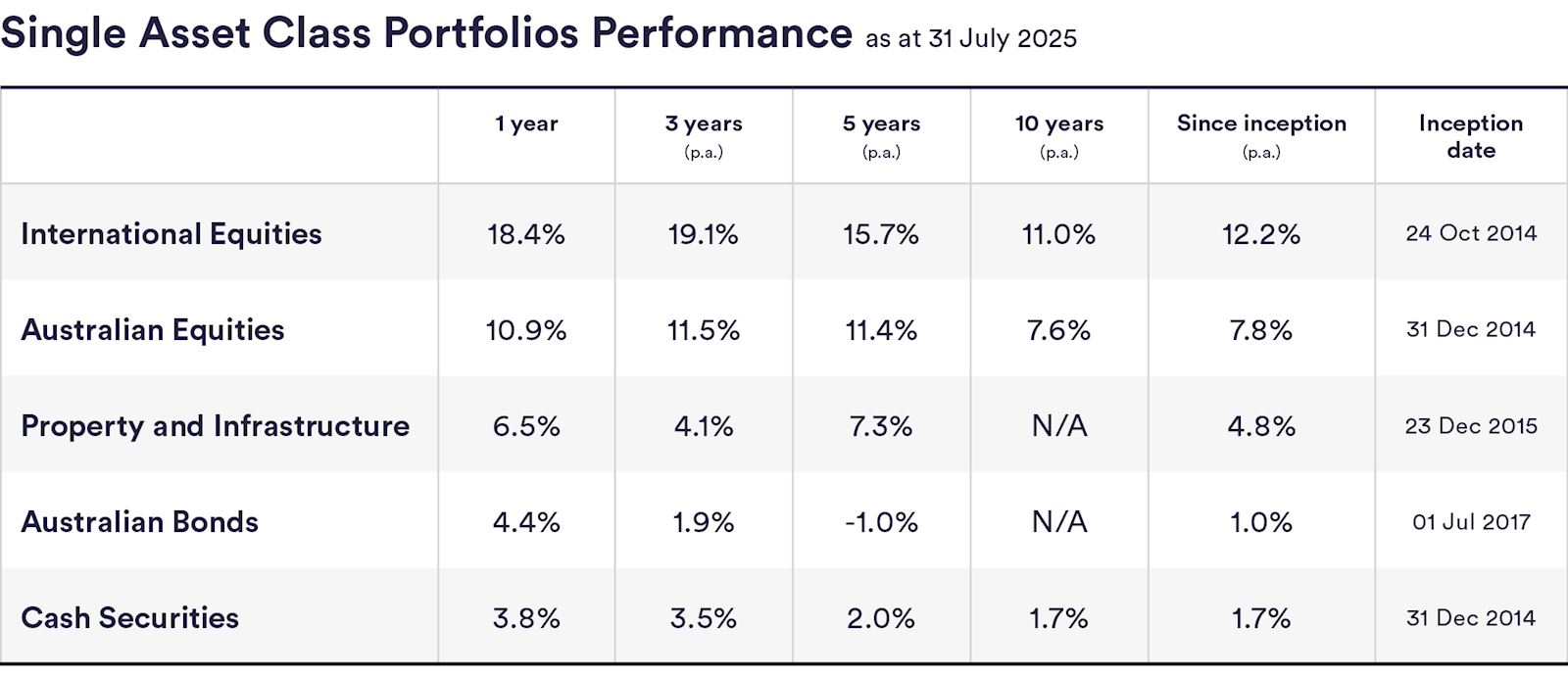

InvestSMART's single-asset portfolios returned between 3.8% (cash securities) and 18.4% (international equities) in the 12 months to the end of July 2025, and between -1.0%p.a. (Australian bonds) and 15.7%p.a. (international equities) over five years.

July wrap-up

July delivered another smooth ride for investors. The Aussie market kept its upward momentum, with the S&P/ASX 200 climbing 2.4%. The best-performing sectors in July were health care (9.1%), energy (5.7%) and utilities (5.1%). Financials (-1.0%) was the only sector to finish the month in the red.

In the US, the S&P 500 rose 2.2% - its third monthly gain in a row - and the Nasdaq surged 3.7%, stretching its rally to four months. Global equity markets also ended July in positive territory.

Cooling inflation and easing trade tensions helped lift confidence across global markets, while big tech once again led the charge in the US.

Following the RBA's August cut, the spotlight is now on how households and markets will respond to a lower-rate environment.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios have shown solid performance over the past 12 months, with returns ranging from 6.6% to 13.4% as of the end of July 2025. Over a 10-year period, these portfolios have averaged annual returns between 3.8% and 8.5%.

The Ethical Growth Portfolio has delivered an impressive annual return of 11.2% over the past three years, outperforming similar options by an average of 2.8% annually.

Over the past five years, InvestSMART's diversified portfolios have outperformed competitor funds by an average annualised return of 0.5% to 2.2%.

In July 2025, the best-performing sectors in the Australian market were health care, which rose by 9.1%, energy with a 5.7% increase, and utilities, which climbed 5.1%.

Global equity markets ended July 2025 in positive territory, with the S&P 500 rising 2.2% and the Nasdaq surging 3.7%, marking its fourth consecutive monthly gain.

Cooling inflation and easing trade tensions helped boost confidence across global markets, with big tech leading the charge in the US.

InvestSMART's single-asset portfolios returned between 3.8% (cash securities) and 18.4% (international equities) in the 12 months to the end of July 2025.

Following the RBA's August rate cut, attention is focused on how households and markets will respond to the lower-rate environment.