InvestSMART Performance Update: December 2025

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 5.3% and 10.2% in the 12 months to the end of December 2025. Over 10 years, the diversified portfolios have returned between 4.1% and 9.3% a year on average. Keep in mind that past performance is not an indication of future performance.

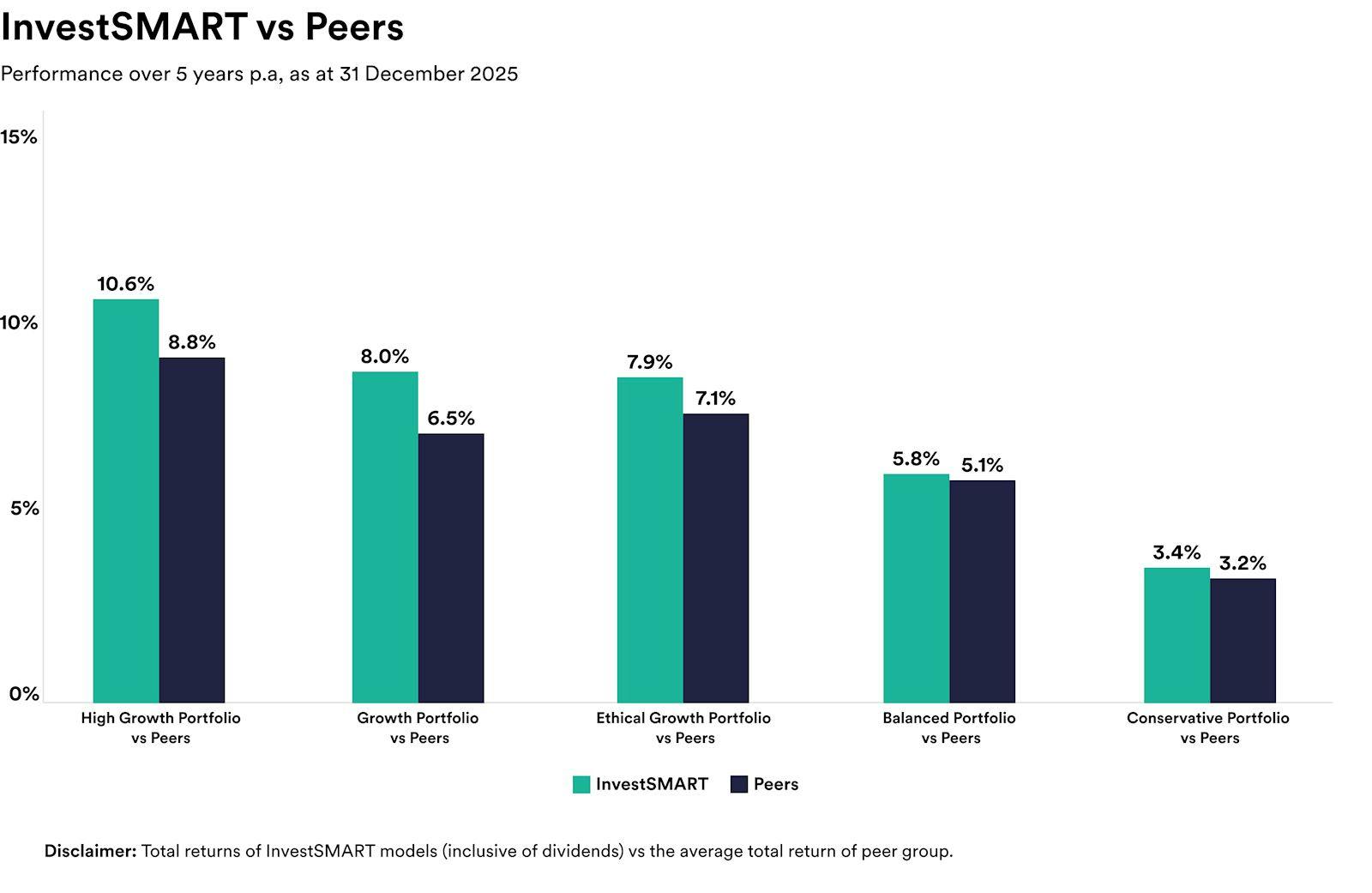

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years to 30 December 2025.

As you can see, over five years, the diversified portfolios have delivered annual returns of between 3.4% and 10.6% on average, outperforming competitor funds by an average annualised return of between 0.3% and 1.8%.

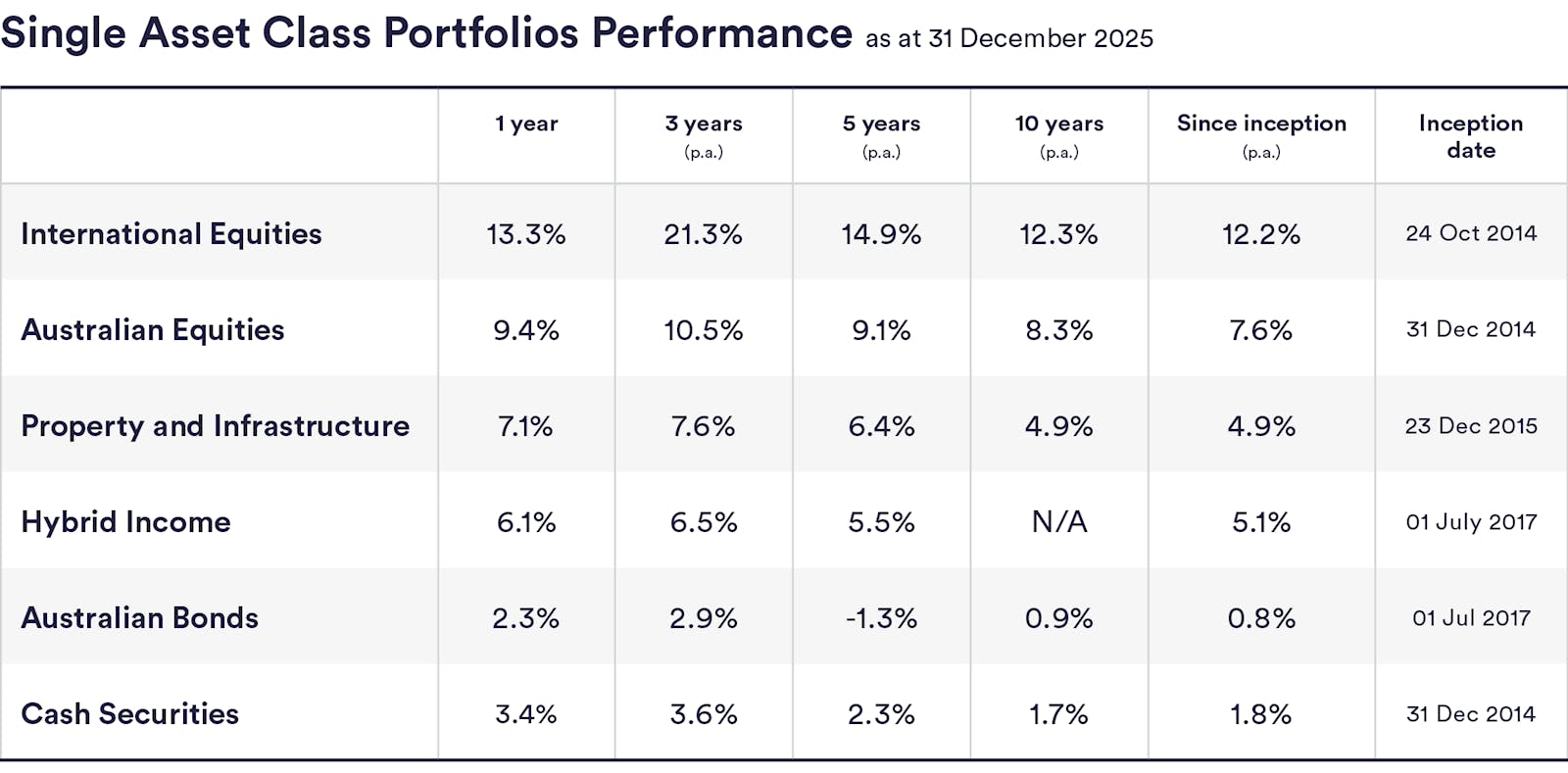

InvestSMART's single-asset portfolios returned between 2.3% (Australian bonds) and 13.3% (International equities) in the 12 months to the end of December 2025, and between -1.3% p.a. (Australian bonds) and 14.9% p.a. (International equities) over five years.

December wrap-up

December brought a calm end to an interesting year for markets. While 2025 delivered its share of surprises, investors who stayed focused on the long term were rewarded as markets worked through US tariffs, inflation and interest-rate uncertainty.

Despite some late-year volatility, Australian shares closed the year higher, with the S&P/ASX 200 returning around 10.3% over the calendar year.

Global markets also proved their value in diversified portfolios - the S&P 500 delivered roughly 18% in 2025, while the MSCI World ex Australia Index returned just over 21%.

The Reserve Bank finished the year with rates on hold, but opinions are mixed on when we'll see the next move, and even whether it will be up or down.

With the outlook still evolving, having a strategy that doesn't rely on perfect timing remains as important as ever. Now that the year is underway, it's a good time to give your portfolio a once over and make sure your strategy is set for 2026 and beyond.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 5.3% and 10.2% in the 12 months to the end of December 2025, according to the December 2025 performance update.

Over 10 years, InvestSMART's diversified portfolios delivered average annual returns between 4.1% and 9.3% per year. The update also notes that past performance is not an indication of future performance.

Over five years to 30 December 2025, InvestSMART's diversified portfolios returned between 3.4% and 10.6% per year on average, outperforming funds in the same risk category by about 0.3% to 1.8% annualised.

In the 12 months to the end of December 2025, InvestSMART's single‑asset portfolios returned between 2.3% (Australian bonds) and 13.3% (International equities). Over five years, returns ranged from -1.3% p.a. (Australian bonds) to 14.9% p.a. (International equities).

Despite some late‑year volatility, Australian shares (S&P/ASX 200) returned around 10.3% for the 2025 calendar year. Global markets also performed well: the S&P 500 delivered roughly 18%, while the MSCI World ex Australia Index returned just over 21%.

The update notes the Reserve Bank finished the year with rates on hold, but says opinions are mixed about when the next move will be and whether it will be up or down, highlighting continued interest‑rate uncertainty.

The December wrap‑up described a calm end to an eventful year, with markets working through US tariffs, inflation and interest‑rate uncertainty. The update emphasises that long‑term focus and diversification helped investors navigate those challenges.

Yes — the update recommends giving your portfolio a once‑over to ensure your strategy is set for 2026 and beyond, and stresses having a plan that doesn't rely on perfect market timing.