InvestSMART Performance Update: August 2025

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 6.9% and 15.9% to the end of August 2025. Over 10 years, the diversified portfolios have returned between 4.2% and 9.2% a year on average. Keep in mind, past performance is not an indication of future performance.

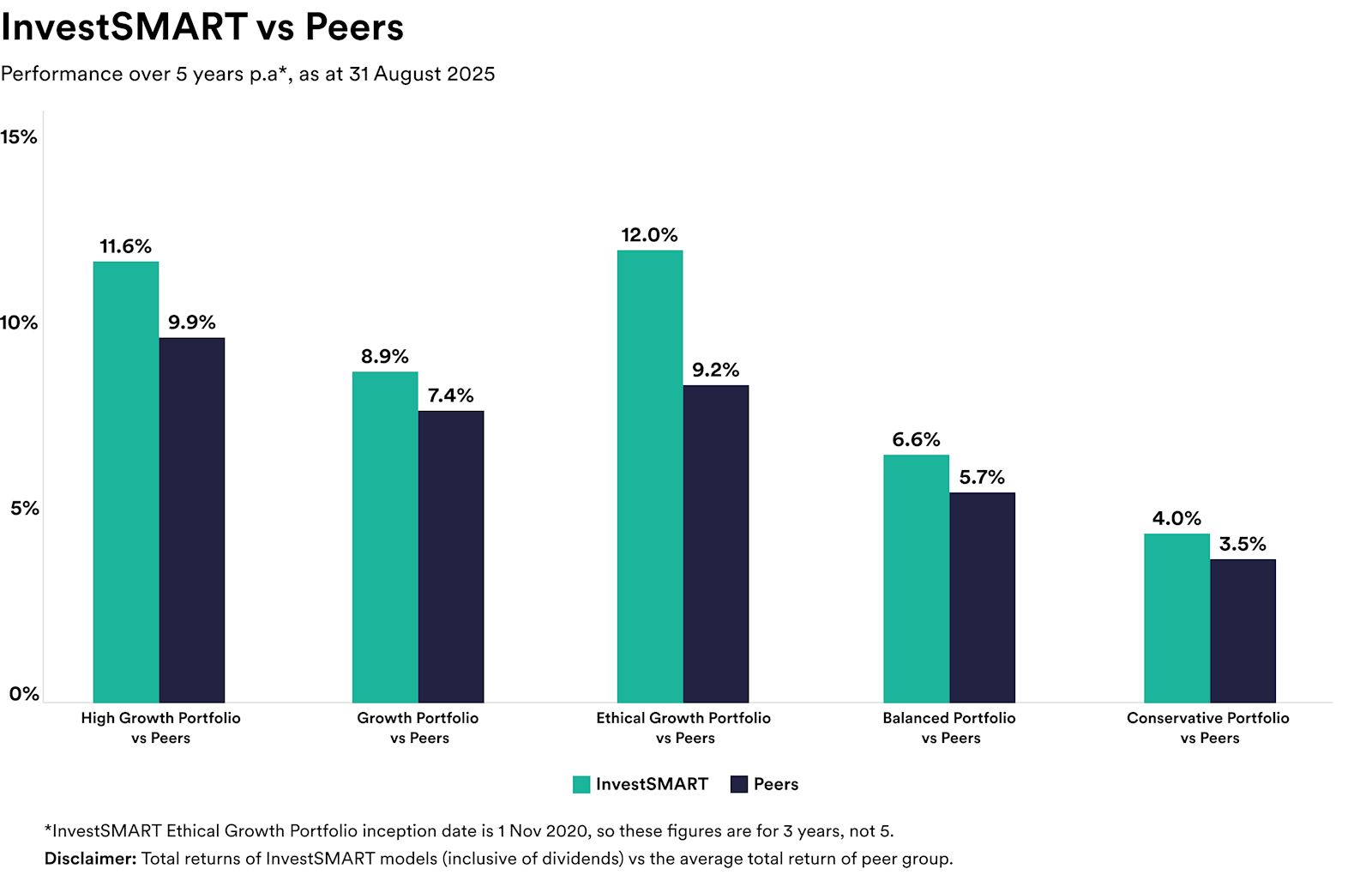

The chart below illustrates how InvestSMART's diversified portfolios have performed compared to funds in the same risk category over five years (three years for the Ethical Growth Portfolio, which launched in November 2020).

As you can see, over five years, the diversified portfolios have delivered annual returns of between 4.0% and 11.6% on average, outperforming competitor funds by an average annualised return of 0.5% and 1.7%.

The Ethical Growth Portfolio has returned 12.0% a year over three years, outperforming similar options by an average of 2.8% annually over that period.

InvestSMART's single-asset portfolios returned between 3.5% (Australian bonds) and 21.3% (international equities) in the 12 months to the end of August 2025, and between -0.8%p.a. (Australian bonds) and 14.8%p.a. (international equities) over five years.

August wrap-up

August was a solid month for investors. The Aussie market did well, gaining a little over 3% over the month, helped along by a strong reporting season. The S&P/ASX 200 was up 12.3% in the year to date at the end of August.

Materials ( 9.2%), Consumer Discretionary ( 7.6%) and Utilities ( 5.3%) were the standout sectors on the ASX in August, while Health Care was the worst performer, falling 13.2%.

Many international markets also edged higher. China's Shanghai Composite Index was the big winner for the month, gaining 8%. Japan also did well, with the Nikkei 225 ending the month roughly 4% higher. In the US, the S&P 500 rose about 2%.

The Reserve Bank's third rate cut for the year was a key talking point in August. The move puts even more focus on how households and businesses respond to a lower-rate environment.

For now, August's gains add to an already solid year for markets, but attention is shifting to whether lower rates and slowing growth can keep the rally intact.

Frequently Asked Questions about this Article…

InvestSMART’s diversified ETF portfolios returned between 6.9% and 15.9% over the 12 months to the end of August 2025. Over five years the portfolios delivered annual returns of between 4.0% and 11.6% on average, and over 10 years they returned between 4.2% and 9.2% per year. The article also notes past performance is not an indication of future performance.

The Ethical Growth Portfolio, which launched in November 2020, returned 12.0% per year over the three years to the end of August 2025. According to the article, it outperformed similar options by an average of 2.8% annually over that period.

In the 12 months to the end of August 2025, InvestSMART’s single-asset portfolios returned between 3.5% (Australian bonds) and 21.3% (international equities). Over five years those single-asset returns ranged from -0.8% p.a. (Australian bonds) to 14.8% p.a. (international equities).

August was a solid month: the Australian market gained a little over 3% during the month, helped by a strong reporting season. The S&P/ASX 200 was up 12.3% year-to-date at the end of August 2025.

In August 2025 the best-performing ASX sectors were Materials (+9.2%), Consumer Discretionary (+7.6%) and Utilities (+5.3%). Health Care was the weakest sector, falling 13.2% for the month.

Many international markets edged higher in August 2025. China’s Shanghai Composite rose about 8% for the month, Japan’s Nikkei 225 finished roughly 4% higher, and the US S&P 500 gained about 2%.

The Reserve Bank’s third rate cut for the year was a key talking point in August 2025. The article highlights that the move increases focus on how households and businesses respond to a lower-rate environment and raises questions about whether lower rates and slowing growth can sustain the market rally.

While InvestSMART’s portfolios have delivered solid historical returns, the article explicitly reminds readers that past performance is not an indication of future performance. Everyday investors should consider past returns alongside risk tolerance, time horizon and broader market conditions when making investment decisions.