InvestSMART Performance Update: August 2024

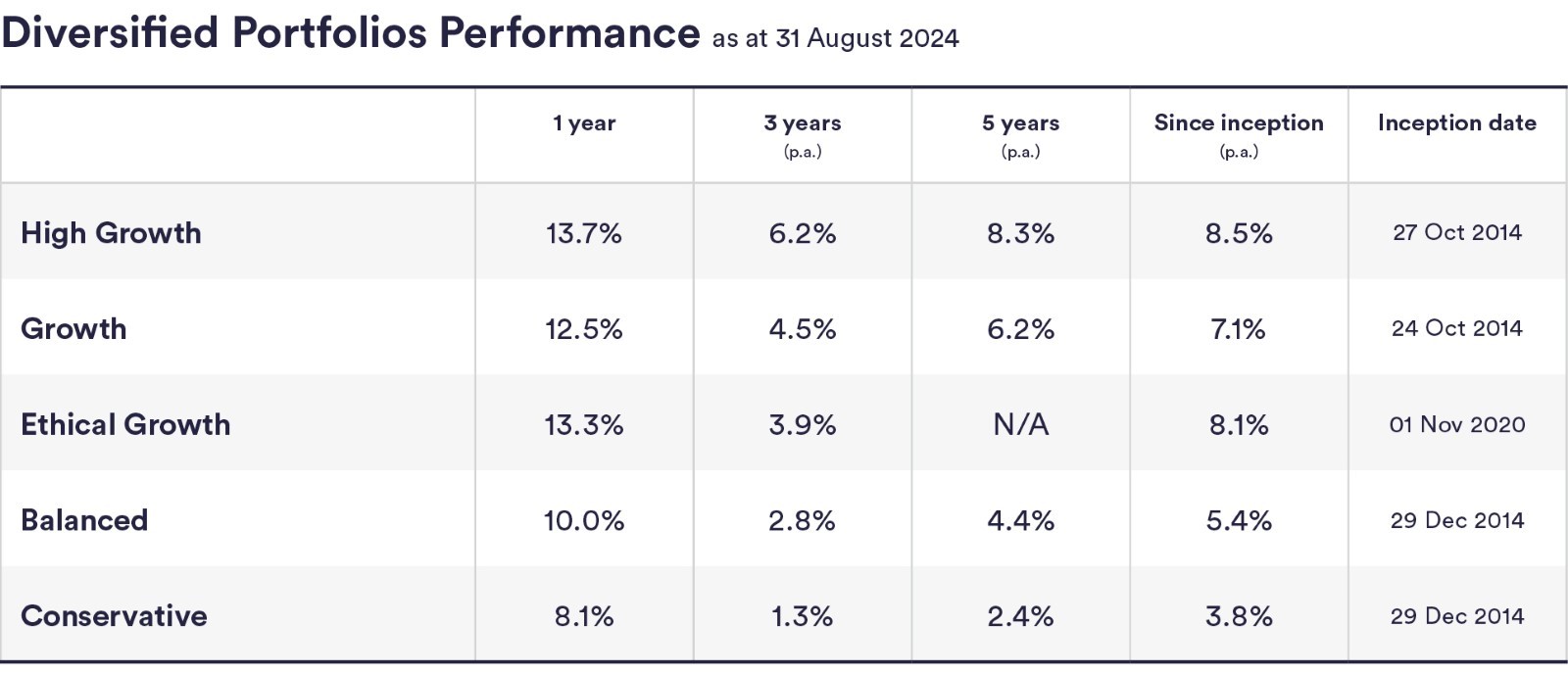

InvestSMART's diversified ETF portfolios continue to deliver strong results, showcasing the benefits of strategic diversification and disciplined management. The portfolios achieved returns between 8.1% and 13.7% for the 12 months to 31 August 2024.

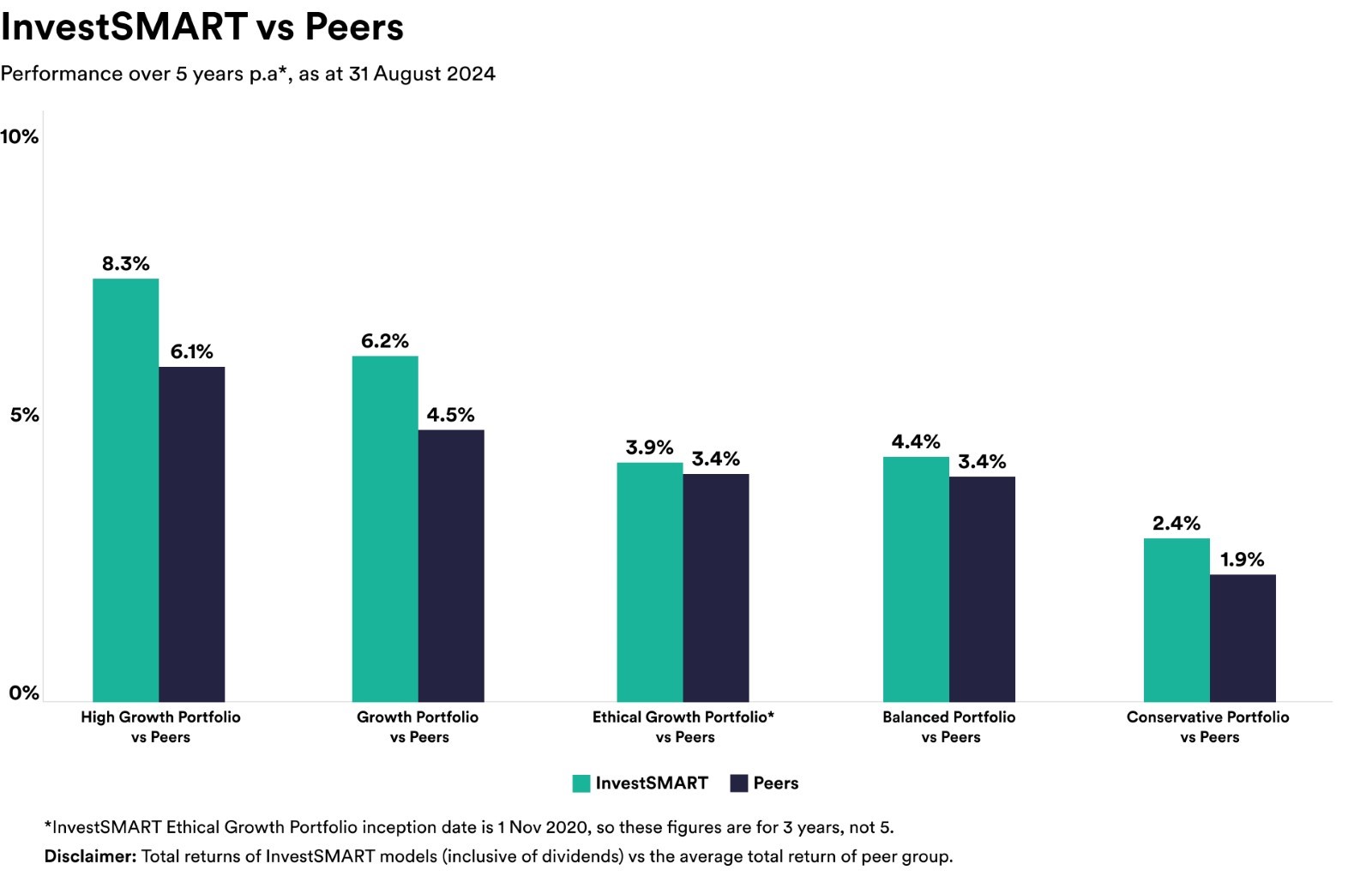

Over five years the portfolios have returned on average 2.4% to 8.3% p.a, consistently outperforming competitor funds by an average annualised return of 0.5% to 2.2%. This performance highlights the resilience of our investment strategy and reinforces our commitment to long-term value creation for our clients.

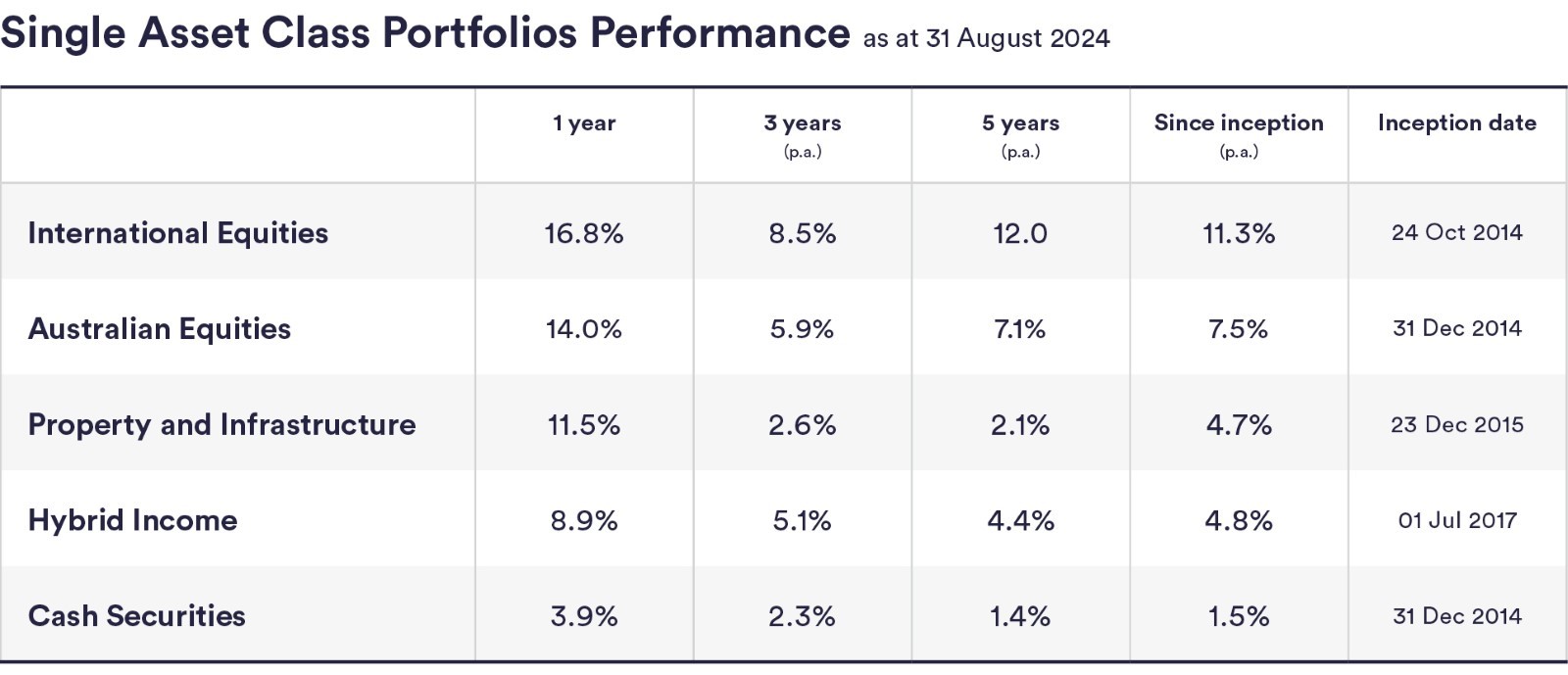

InvestSMART's single asset portfolios also performed well, returning between 3.9% (cash securities) and 16.8% (international equities) in the 12 months to 31 August 2024, and between 1.4% and 12.0% over five years.

August round up

After a volatile start to August, both Australian and international share markets ended the month relatively flat, recovering much of the earlier losses. The ASX200 Accumulation Index finished the month up 0.47%, while the MSCI World ex-Australia fell 1.2%.

August was also the end-of-year reporting season for the ASX, which saw mixed results. Gains were made in finance and resources shares, making up for declines in other major sectors. As we noted after February's earnings season, these results provide short-term insights but are ultimately just background noise for long-term investors. If you're focused on the future, your main task is to set clear financial goals and ensure your portfolio is properly diversified to match your risk tolerance.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered strong results, achieving returns between 8.1% and 13.7% for the 12 months to 31 August 2024. This performance showcases the benefits of strategic diversification and disciplined management.

Over five years, InvestSMART's portfolios have returned on average between 2.4% and 8.3% per annum, consistently outperforming competitor funds by an average annualised return of 0.5% to 2.2%.

InvestSMART's single asset portfolios also performed well, with returns ranging from 3.9% for cash securities to 16.8% for international equities in the 12 months to 31 August 2024. Over five years, these portfolios returned between 1.4% and 12.0%.

After a volatile start to August, both Australian and international share markets ended the month relatively flat, recovering much of the earlier losses. The ASX200 Accumulation Index finished the month up 0.47%, while the MSCI World ex-Australia fell 1.2%.

During the end-of-year reporting season in August 2024, the ASX saw mixed results. Gains were made in finance and resources shares, which helped offset declines in other major sectors.

InvestSMART suggests that long-term investors should focus on setting clear financial goals and ensuring their portfolio is properly diversified to match their risk tolerance, rather than getting distracted by short-term market fluctuations.

Diversification is important because it helps spread risk across different asset classes, which can lead to more stable returns. InvestSMART's strong portfolio performance highlights the benefits of strategic diversification.

InvestSMART's recent performance indicates the resilience of their investment strategy and reinforces their commitment to long-term value creation for clients, as evidenced by their consistent outperformance of competitor funds.