Investors test the RBA's homing instinct

Although house prices are booming and housing credit is on the rise, the Reserve Bank of Australia does not believe that housing poses a near-term risk to financial stability. In its opinion, households continue to act in a prudent manner, displaying a cautiousness that was not present a decade ago.

In the Financial Stability Review, the RBA paints a pretty rosy picture for the household sector over the past six months, characterised by rising net wealth, high savings and stable debt ratios.

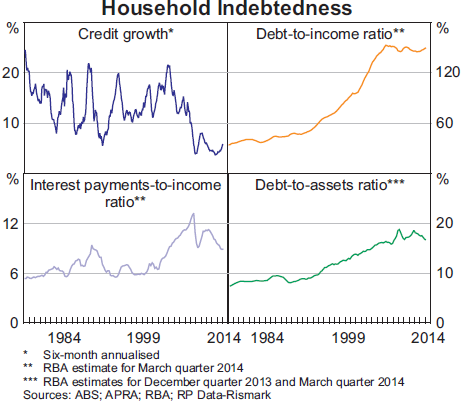

But the RBA is at pains to remind us that “with household gearing and indebtedness still around historical highs and unemployment trending upwards, continued prudent borrowing and saving behaviour is needed”.

We are beginning to see some tentative signs of greater risk appetite among households. The savings ratio slipped in the December quarter compared with its average level over the past few years and housing credit for both owner-occupiers and investors is on the way up.

But greater risk appetite for some households is still being partially offset by cautiousness from other households. Many are using low mortgage rates to pay down their mortgages faster than they are required to. Consequently, housing credit growth has actually been slower than is normally the case when mortgage lending activity has been so high.

The aggregate mortgage buffer -- a measure of balances in mortgage offset and redraw facilities -- has risen to almost 15 per cent of outstanding loan balances, which is the equivalent to around 24 months of total scheduled repayments at current interest rates.

This suggests that households will still be able to meet their debt obligations even if the unemployment rate continues to trend upwards.

However, it is also important to recognise that these balances are likely to be held by households who have been paying down their mortgages for a lengthy period of time. There is limited offset and redraw facilities for households that have taken on considerable debt recently; that group remains vulnerable to loss of income.

A positive for households is that their net wealth continues to climb, though admitted it still remains 2 per cent below its 2007 peak.

Both housing and financial wealth has climbed in recent years. However, much of the recent growth in house prices has been driven by speculative investment rather than growth in income. There remains considerable downside risk for housing and net wealth when the exuberance of investors fades.

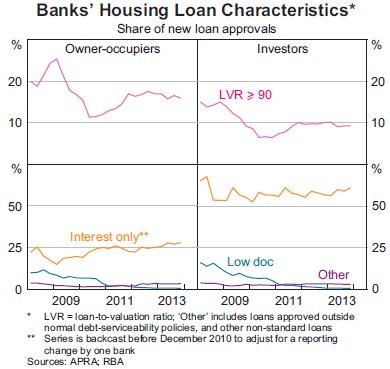

The rapid rise in investor lending does pose some issues for financial stability. Investor behaviour differs significantly from that of owner-occupiers.

On a positive note, investors tend to have larger deposits when they purchase an investment property, with a lower share having high loan-to-valuation ratios. But they also are much more likely to take out interest only loans since negative gearing provides fewer incentives for borrowers to pay back their loan quickly.

As a result, negative equity can be a concern for investors particularly those who do lend with high LVRs. They may also get into more trouble if they suffer a loss of income – though, since investors tend to be wealthier, on average they are also likely to have more money to fall back on during times of unemployment. Regardless, the rise in investor activity needs to be monitored closely.

The RBA believes that, on balance, “the pick-up in investor activity in the housing market does not appear to pose near-term risks to financial stability”, but it acknowledges that it will continue to monitor the market closely for signs of excessive speculation and riskier lending practices.

It doesn’t surprise me that it has discussed macroprudential policies, but it is clear that it remains a step too far for the RBA at the present time.

But I’m concerned about what will happen when the demand from investors is exhausted. Low interest rates cannot encourage investors to bring forward their investment decisions indefinitely. We saw this firsthand for first home buyers after state and federal governments unwound the first home owner boosts following the global financial crisis.

Investors have been driving Sydney and Melbourne housing markets, but what will happen to prices when owner-occupier and first home buyers are required to fill the void? The answer is surely a significant decline in prices. This may not cause a crisis but will surely cause significant pain for households with high LVRs and low offset balances.

For now, the household sector is in pretty good shape and and that is being reflected in rising spending and lending activity.

Importantly, many households have taken a responsible approach to low lending rates by taking the opportunity to refinance or unwind their existing loan balances. But the RBA should be more concerned about housing investment, particularly with regard to what will happen to house prices and net wealth when investor demand becomes exhausted.