Investor Signposts

A look ahead to the key economic and financial events next week.

Reserve Bank dominates the agenda

- It is a quiet week for economic data in the US and Australia. The Reserve Bank dominates the key local events.

- The week kicks off in Australia on Monday when ANZ releases the October data on job advertisements. The job ads series measures newspaper and online advertisements. But available jobs are also advertised on corporate websites and social media. So the job ads series can be considered a good, but not great, forward-looking gauge on employment. In September, job ads fell by less than 0.1 per cent after six straight months of gains.

- Also on Monday the Australian Bureau of Statistics (ABS) releases the new weighting pattern for Australia's premier inflation measure – the Consumer Price Index. And the ABS releases the annual data showing the number of people studying in Australia. The data can provide fresh insights on available workers and the overall state of the job market.

- On Tuesday, ANZ and Roy Morgan release the weekly survey of consumer sentiment. Consumers can't be described as overly optimistic at present but neither can they be described as overly pessimistic.

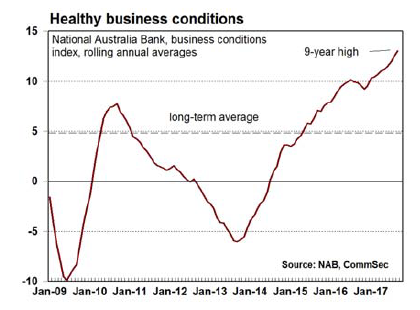

- The National Australia Bank business conditions index is released on Tuesday and it is one of the best economic indicators that exists in Australia. In smoothed terms, business conditions are the best in nine years.

- Also on Tuesday the Reserve Bank Board meets for the second last time this year. And just like the previous nine meetings in 2017, official interest rates will be left on hold. The main development over the month has been the inflation data – not just consumer prices but producer and international trade prices. And it is clear that inflation is well contained and is likely to remain contained into the early months of 2018.

- It is still more likely that rates will rise at some point in 2018, but more likely later in the year rather than earlier. Our view is that the first rate hike will occur in the December quarter of the year.

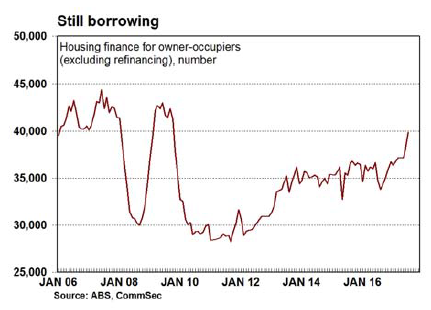

- On Thursday, the Australian Bureau of Statistics (ABS) releases data on home lending. More precisely, the ABS measures the commitments made by lenders to advance funds to budding home purchasers. Of course these commitments may not get taken up if the budding purchaser doesn't find the dream home. And lenders may also seek to withdraw the offer if certain conditions aren't met.

- In August the number of loans rose by 1 per cent – the fourth straight months of gains – with the value of loans up by 2.1 per cent.

- On Friday, the Reserve Bank releases its quarterly Statement on Monetary Policy. As well as being a comprehensive assessment of the state of the economy, the RBA also provides updated forecasts. Few changes are expected.

Overseas: Quiet week in the US;

Chinese trade and inflation data

- The US economic data release schedule for the coming week is probably the smallest for the entire year. There are few highlights. Chinese data could prove of greater interest.

- The week kicks off on Tuesday with the release of the JOLTS survey – job openings and labour turnover series. The data is produced by the Bureau of Labor Statistics and includes “employment, job openings, hires, quits, layoffs and discharges, and other separations.” The BLS also note “The number of unfilled jobs—used to calculate the job openings rate—is an important measure of the unmet demand for labor.”

- Also on Tuesday in the US the September data on consumer credit is released (effectively lending to consumers) together with the usual weekly figures on chain store sales – a measure of consumer spending.

- On Wednesday in the US the usual weekly data on mortgage applications is released – both applications to buy homes as well as refinancing transactions.

- On Thursday, the usual weekly gauge on the job market – new claims for unemployment insurance (or jobless claims) – will be issued. The job market is strong with jobless claims hovering around levels last seen in the early 1970s. Data on wholesale inventories is also set down for release on Thursday.

- On Friday, the University of Michigan provides the first look at consumer sentiment in November – in other words the preliminary measure. In contrast to Australia, consumers are “feeling the love” of the economy. The sentiment index is at the highest levels since early 2004.

- In China, key economic data is released later in the week. On Tuesday the October data on foreign exchange reserves is released. Reserves have lifted for the past eight months and stand at US$3.109 trillion.

- On Wednesday in China the October trade data is issued. Over the year to September, exports were up by 18.6 per cent with exports up 8.1 per cent.

- On Thursday in China the October inflation data is scheduled. In the year to September, producer prices were up by 6.9 per cent with consumer prices up 1.6 per cent. At face value inflation is contained, but food prices are down 1.4 per cent on the year with non-food prices up 2.4 per cent. So there is no room for complacency.

Financial markets

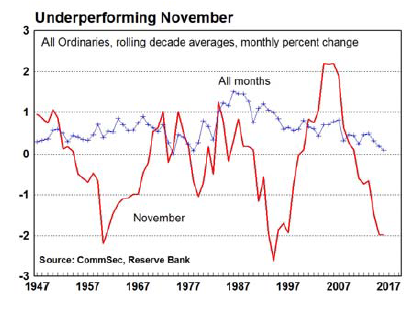

- A new month has begun – so how does November stack up for investors? The answer is not encouraging. In fact the sharemarket has only lifted twice in November in the past decade, falling on average 2 per cent a month.

- Still, in the previous decade (1997-2006) November was the stand-out performer – lifting on all but one occasion, averaging gains of 2.2 per cent.

- But over the last 70 years, November was the third worst performer.

Craig James is the Chief Economist at CommSec.

Share this article and show your support