Investor Signposts: March 19, 2018

Australia: Will the record jobs growth continue?

Australia: Will the record jobs growth continue?

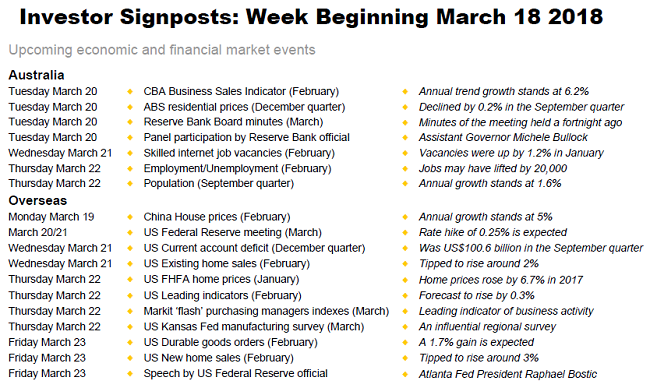

- This week is all about Thursday's employment report in Australia. Will the record breaking run of 16 consecutive months of job gains continue? The Bureau of Statistics also

releases its somewhat dated update on residential property prices. And the Reserve Bank releases the minutes of its March meeting.

releases its somewhat dated update on residential property prices. And the Reserve Bank releases the minutes of its March meeting. - The week kicks off on Tuesday when the Commonwealth Bank Business Sales Indicator (BSI), a measure of economy-wide spending, is released. Spending grew at the strongest annual pace of growth in four years in January.

- Also on Tuesday the Australian Bureau of Statistics (ABS) releasing the December quarter Residential Property Price indexes. While the data on home prices is not as current as the CoreLogic data, other figures are provided including those on the number of homes, permitting estimates on the number of people per home.

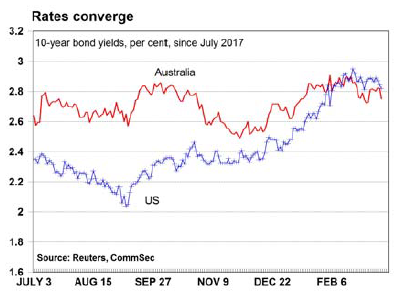

- On Tuesday the Reserve Bank releases the minutes of its March Board meeting. Commentary on wages growth, share market volatility and trade protection (i.e. tariffs) could be of particular interest to market participants. We don't expect any significant change in the Bank's view on the inflation and economic growth outlook for Australia. Interest rates are firmly on hold.

- Also on Tuesday, Reserve Bank Assistant Governor (Financial System) Michele Bullock participates in a panel discussion at the ASIC Annual Forum in Sydney.

- Roy Morgan and ANZ also release the weekly consumer sentiment data on Tuesday. The number of optimistic respondents to the survey still outnumber the pessimists. Consumer confidence has rebounded from its August lows as strong job gains and record low interest rates have improved sentiment. Household consumption, however, still remains an “uncertainty” for the Reserve Bank due to modest wages growth and spending caution.

- On Wednesday, the Department of Jobs and Small Business releases its internet vacancy index. The index has now risen for 16 consecutive months – the longest period of growth since March 2011. The index has increased by 10.6 per cent over the year to 5½-year highs in January.

- On Thursday the ABS releases the all-important February employment report. Jobs rose for a record-breaking 16th straight month in January. The unemployment rate has hovered around 4-year lows of 5.5 per cent in recent months due to an increase in the participation rate to near 7-year highs. The strengthening job market has encouraged people back into the workforce or to look for a job. Female participation is at record high levels. Economists tip an increase in total jobs of around 20,000 in February.

- Also on Thursday, the ABS releases the latest population figures for the September quarter. Population is growing at a 1.6 per cent annual rate.

Overseas: The US Federal Reserve is expected to lift interest rates

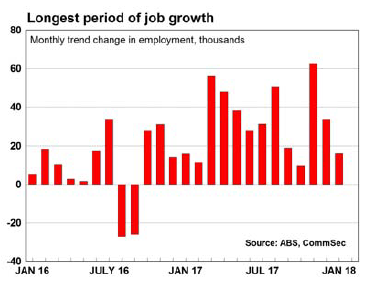

- The US central bank monetary policy meeting takes centre stage this week. Markets are almost certain that the Federal Open Market Committee (FOMC) will lift interest rates for the first time this year, having lifted the federal funds rate three times last year.

- The week kicks off on Monday when the National Bureau of Statistics issues China's 70-city housing price data for February. House price growth decelerated to 5.0 per cent in January, continuing the decline from a peak of 12.6 per cent in November 2016. Policymakers have announced stricter property-buying controls in an effort to cool prices. In tier-1 cities, housing prices fell on an annual basis in January for the first time since May 2015.

- New US Federal Reserve Chair Jerome Powell is expected to increase interest rates by 0.25 per cent to a federal funds target range of 1.50-1.75 per cent at the conclusion of the FOMC policy meeting on Wednesday. Inflationary pressures are building in the US but not enough to warrant a more aggressive tightening in monetary policy than previously guided. Wages growth fell back from 8-year highs in February. We expect three rate hikes this year, including the expected increase in the coming week.

- On Wednesday the US current account balance is released for the December quarter. The current account deficit narrowed from US$124.4 billion in the June quarter to US$100.6 billion in the September quarter. Trade of goods and services, together with net income from foreign investments, are an important part of the overall current account. The US trade deficit surged to 9-year highs of US$56.6 billion in January. US President Trump's tariff policies are aimed at closing trade gaps with countries such as China.

- Also on Wednesday US existing home sales data is issued. Existing home sales unexpectedly fell for a second consecutive month in January due to persistent supply

constraints. Sales fell by 4.8 per cent over the year to January, the largest decline in the annual growth rate since August 2014.

constraints. Sales fell by 4.8 per cent over the year to January, the largest decline in the annual growth rate since August 2014. - On Thursday the Federal Housing Finance Agency (FHFA) releases its January house price index. The index is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. US home prices increased by 1.6 per cent in the December quarter to up by 6.7 per cent on the year.

- Also on Thursday the Conference Board's Leading Economic index is issued for February. The index increased by 1.0 per cent in January. The index is tipped to rise by 0.3 per cent in February.

- Markit also releases its ‘flash' purchasing managers' indexes (PMIs) for March on Thursday. PMIs are released across the US, Eurozone and Japan. The influential Kansas Federal Reserve manufacturing survey is also released in the US on Thursday.

- On Friday new orders for US durable goods – ranging from aircraft to toasters – are issued for the month of February. A 1.7 per cent gain is expected after falling by 3.6 per cent in January.

- Also on Friday US new home sales are released. New home sales fell by 7.8 per cent in January to an annualised pace of 593,000 units – the largest monthly decline since July last year.

- Federal Reserve Bank of Atlanta President Raphael Bostic speaks at the Knoxville Economic Forum on Friday.

Share this article and show your support