Investor Signposts: February 23, 2018

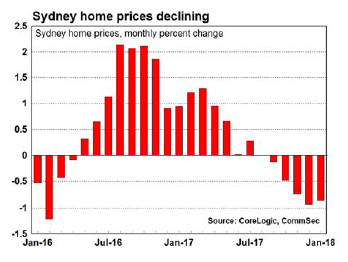

Locally, home prices and business investment will be the indicators of most interest.

Business investment and home prices in focus

- A relative quiet week beckons in terms of new economic data. Home prices and business investment are the indicators of most interest.

- The week kicks off on Tuesday when Roy Morgan and ANZ release the weekly consumer sentiment results.

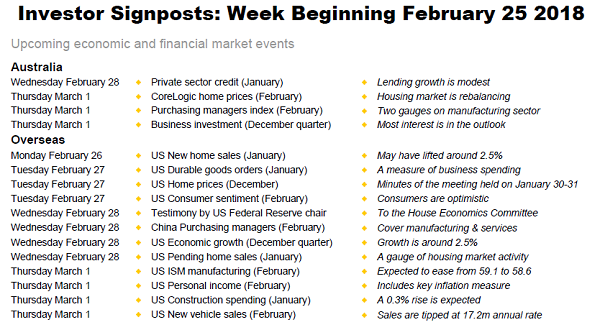

- On Wednesday the Reserve Bank releases the monthly Financial Aggregates publication that includes the private sector credit measure (effectively ‘loans outstanding').

- In December, private sector credit rose by 0.3 per cent, after a 0.4 per cent rise in November. Annual credit growth fell from 5.2 per cent to a 3½-year low of 4.8 per cent. The annual decline in personal credit was just off the biggest decline recorded in 5½ years.

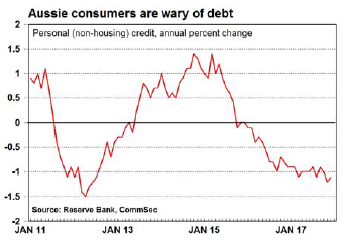

- On Thursday the Australian Bureau of Statistics (ABS) releases the Private Capital Expenditure publication (essentially business investment figures).

- In the September quarter, business investment rose by 1.0 per cent. But more importantly, investment expectations for 2017/18 continued to be revised up. The upgrade in investment between the first and fourth estimates was 34.1 per cent – the biggest upgrade in 12 years.

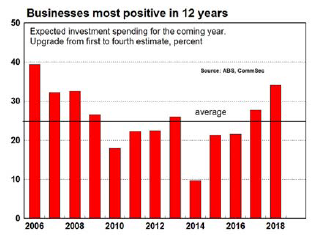

- Also on Thursday CoreLogic releases home price data for February. And based on the daily observations, home

prices in all the five mainland state capitals were either flat or lower in February. So far in February, Sydney home prices were down by 0.6 per cent to stand 3.8 per cent lower than the record high set in September 2017.

prices in all the five mainland state capitals were either flat or lower in February. So far in February, Sydney home prices were down by 0.6 per cent to stand 3.8 per cent lower than the record high set in September 2017. - And both AiGroup and Commonwealth Bank release surveys of manufacturing purchasing managers also on Thursday.

Overseas: Spotlight on the US Federal Reserve Chair

- The focus this week will be first testimony to be delivered on the economy by the new US Federal Reserve chair.

- The week kicks off in the US on Monday with January data on new home sales slated for release. After falling by 9.3 per cent in December – the biggest drop in 16 months – analysts tip a 2.4 per cent lift in January sales. St Louis Federal Reserve President James Bullard is also due to speak on the economy on Monday.

- On Tuesday, two gauges of home prices are released in the US – the Federal Housing Finance Agency (FHFA) measure and the CaseShiller survey. Home prices are growing at a healthy annual rate near 6.5 per cent.

- Also due on Tuesday in the US is data on durable goods orders (a measure of business spending), a survey of consumer confidence, the Richmond Federal Reserve survey and the usual weekly figures on US chain store sales – a measure of consumer spending.

- On Wednesday the US Federal Reserve chair, Jerome Powell, delivers semi-annual monetary policy testimony before the House Financial Services Committee. This will the first real chance for investors to assess the policy leaning of the new number one at the Fed.

- Also on Wednesday the second (preliminary) estimate of US economic growth for the December quarter is issued. The initial estimate suggested that the economy grew at a 2.6 per cent annual rate. And only a modest downgrade in growth to 2.5 per cent is tipped. Investors will also closely watch a key inflation measure – the core private consumption expenditure deflator (core PCE). The pending home sales data for January is also slated for release on Wednesday together with weekly figures on housing finance and the Chicago purchasing managers index.

- In China on Wednesday the National Bureau of Statistics will release the February purchasing manager surveys for manufacturing and services sectors. In January the manufacturing gauge was 51.3 with the equivalent services sector reading at 55.3. Any reading above 50 suggests expansion. The Chinese private sector Caixin purchasing manager's index for manufacturing is set down for release on Thursday.

- On Thursday in the US the January figures for personal income and spending are expected. Incomes may have lifted 0.3 per cent with spending up 0.2 per cent. But most interest will be in the inflation measure (the core PCE, as defined above). The annual rate is not expected to change from 1.5 per cent.

- Also on Thursday in the US, data on construction spending is released with new vehicle sales figures and the ISM manufacturing index. The usual weekly data on claims for unemployment insurance (jobless claims) is also down on the Thursday data docket.

- On Friday in the US the final reading on consumer sentiment for February is released.

Financial markets

- The Australian corporate reporting season moves into the home straight in the coming week.

- Amongst companies to report on Monday are Billabong; Japara Healthcare; Reliance Worldwide; Select Harvests; QBE Insurance; Spark Infrastructure Group; Amaysim Australia; Ardent Leisure; Bluescope Steel and Monash IVF.

- On Tuesday results include AWE; Boart Longyear; Caltex Australia; Iluka Resources; PMP; Resolute Mining; Bubs Australia and Costa Group.

- Results to be issued on Wednesday may include Harvey Norman; Medusa Mining; Orocobre; REVA Medical; Noni B, Emeco Holdings Auscann Group, Macquarie Atlas Roads, Vita Group and Ramsay Health Care.

Craig James is Chief Economist at CommSec

Share this article and show your support