Investor Signposts: February 2, 2018

Market watchers will be eagerly awaiting the first RBA meeting of 2018.

Australia: The Reserve Bank Board meets

- The Reserve Bank Board's first meeting of 2018 takes place, together with the release of its quarterly Statement on Monetary Policy. Retail and international trade are the key data releases along with the NAB's quarterly business survey.

- The week kicks-off on Monday with separate surveys by CommBank and the AiGroup on activity in the services sector.

- Also released on Monday is data on job advertisements from ANZ. And the Federal Chamber of Automotive Industries releases January new vehicle sales data.

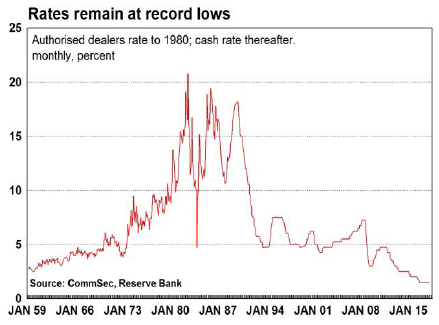

- The Reserve Bank Board meets on Tuesday for the first time this year. No change in monetary policy settings are expected. Interest rates are firmly on hold until at least the end of 2018 due to low inflation. Commentary on the strengthening Aussie dollar and wages growth will be keenly observed.

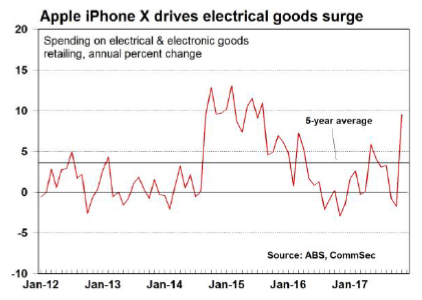

- Also on Tuesday the monthly retail sales report for December is released. Consumers' spending plans appeared lacklustre in the lead-up to Christmas. Department stores Myer and David Jones both reported weak trading in the first half of the month. However, a solid lift in consumer sentiment through October-December suggest actual spending may have been better.

- Australia recorded surprise back-to-back trade deficits in October-November on the back of strengthening imports. We expect a trade surplus of around $300 million for December to be released on Tuesday.

- On Wednesday, AiGroup releases its construction industry survey. The index has expanded for 11 consecutive months.

- On Thursday Reserve Bank Governor Philip Lowe speaks at the A50 Australian Economic Forum dinner in Sydney. Earlier, the NAB December quarter business survey is released.

- On Friday the December data on home loans is released. Based on data from the Bankers Association, total home lending is expected to have fallen by 1.9 per cent during the month. Investor lending is tipped to decline by 1.0 per cent as restrictions from bank regulator, Australian Prudential Regulation Authority, continue to bite.

- Also on Friday, the Reserve Bank releases its quarterly Statement on Monetary Policy. As well as being a comprehensive assessment of the state of the economy, the RBA also provides updated forecasts.

Overseas: China trade and inflation in focus

- A busy week lies ahead on the Chinese economic calendar. The private sector services purchasing manager's index, inflation and trade data are all issued. US trade, services survey and job openings data are released.

- The week kicks off in the US on Monday with the release of the ISM non-manufacturing (services) index for January. A reading of 56.3 points is forecast, a further moderation from the series record reading of 60.1 points in October. The Employment Trends report for January is also issued on Monday.

- In China on Monday the Caixin services purchasing managers gauge is released. The survey is compiled from questionnaires sent to over 400 private services sector executives. The index rose to 3-year highs in December.

- On Tuesday the US trade deficit is expected to have widened to $US51.7 billion in December, up from $US50.5 billion in November. Imports continue to outpace exports. The Department of Labor's job openings and labour turnover survey is also released for December. Job openings unexpectedly fell in November to a six-month low. The usual weekly figures on chain store sales – a measure of consumer spending – rounds out the data releases.

- On Wednesday US consumer credit data is issued for December. The November reading of $US27.9 billion was the largest monthly expansion in lending to consumers since November 2001.

- The weekly US data on new claims for unemployment insurance are set down for release on Thursday.

- Attention then turns to China on Thursday. Annual exports growth slowed to 10.9 per cent in December, down from 11.5 per cent in November. And imports growth decelerated notably to 4.5 per cent from 17.6 per cent. Supply-side policy restraints impacted iron ore imports which declined by 9.9 per cent in December.

- US wholesale inventories and sales are due for release on Friday. The key takeaway from the November report was that the sales outpaced inventories by a sizeable margin, as wholesalers attempted to regain pricing power.

- Also on Friday Chinese inflation data takes centre stage. Consumer prices are likely be higher in January due to higher food prices, reflecting both a very low base and the impact of harsh winter weather in some regions. The annual growth of producer prices decelerated to 4.9 per cent in December from 5.8 per cent in November. Easing factory prices and contained consumer prices should reduce pressure on China's central bank to tighten policy rates in the near-term.

Financial markets

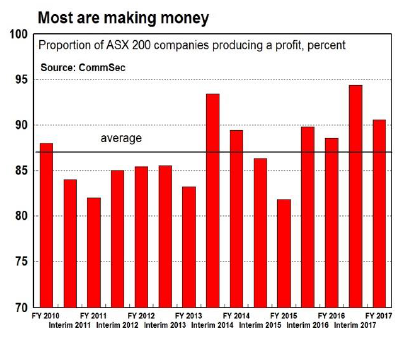

- The Australian corporate reporting season continues in the coming week. Consensus forecasts are for 7 per cent earnings per share growth in 2017-18, after 12 per cent growth in 2016-17 – the highest in six years.

- Key companies to report this week include: Magellan (Tuesday); CommBank and Rio Tinto (Wednesday); AGL Energy, AMP, Mirvac, carsales.com and Tabcorp (Thursday).

Craig James is the Chief Economist at CommSec

Share this article and show your support