Investment scammers: Spotting the red flags

Summary: Even sophisticated investors are falling victim to well-presented investment scams that specifically target the successful and play on areas of current interest. |

Key take-out: There are key warning signs to help you spot scammers, or at least prompt you to proceed with extreme caution. |

Key beneficiaries: General investors, SMSF trustees. Category: Strategy. |

It's the investment opportunity we all dream of, to earn money seven days a week, even while we sleep, using an online financial platform that automatically trades securities known as binary options that are linked to different asset classes.

In an investment environment where record low interest rates and volatile markets are a fact of life, it's little wonder that even sophisticated investors are being enticed into products offering huge percentage returns.

Within minutes of entering your phone and email details, a salesman will be in contact to get you started on the pathway to riches.

But these schemes are scams, and the Australian Competition and Consumer Commission estimates that so far this year Australians have lost $3 million to the binary options scammers.

"Although they may be a legitimate financial product with many licensed firms trading in them, binary options are speculative, high risk products that are almost impossible to predict, even for professionals. There are groups of scammers who use binary options to steal your money," says the ACCC on its Scamwatch website.

Spotting the red flags can be difficult in the moment however, particularly when the balance of the scenario is quite convincing and plays upon an investor's desires.

Scamwatch reports that in 2015 there was just under $24 million reported as lost in connection with investment related scams, with 2016 on track for similar results. Those figures are almost twice that 2014.

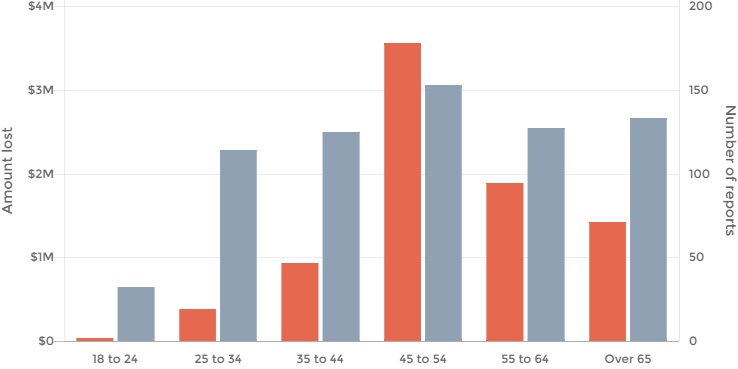

And it's the 45-54 age category that is hit the hardest. Interestingly, and despite the global proliferation of the internet and ability for scam artists to more easily cast a broader net, in Australia telephone remains the dominant method of delivery when it comes to funds reported as lost. This, in addition to promises of higher rates of return in a low interest rate environment, likely goes some way to explaining the also high portion of reports among Australians of retirement age overall.

Chart 1: Age group of victims (amount lost in grey, number of reports in orange).

Source: Scamwatch.gov.au

The big property spruik

Another area which has its fair share of spruikers is property, with Australia's ongoing love affair with bricks and mortar making investors particularly vulnerable. Questionable arrangements sometimes delivered through slick investment seminars have proven to come in various shapes and sizes.

Self-managed super funds' ability to gear into property has opened the door to a host of operators in recent years looking to capitalise on the interest. As such the area continues to draw the Australian Securities and Investment Commission's attention, with one-stop shops doing it all from establishing the SMSF to arranging the property investment and then the loan.

Although it can be an appropriate investment in some circumstances, investors should be wary to ensure that any investment in property – particularly inside superannuation – is in their best interests, aligns with their overall strategy and suits their circumstances.

Furthermore, the complexities that surround SMSFs and property investment mean that some may not only enter into mispriced or inappropriate investments for their circumstances but potentially unknowingly breach SMSF rules.

It is therefore important to ask questions, be aware of any conflicts and deal with a licensed advisor who is legally obliged to act in their clients' best interest and who is not remunerated in any way other than by you.

Spotting the fakes

Out of the blue phone calls offering something which sounds too good to be true more than likely will be just that. ASIC's MoneySmart cites fake companies with ‘not to be missed' investment offers and claims of high returns and low risk as often characteristic.

They may relate to anything from share investments, foreign currency or options trading, betting software, domestic or international real estate, credit – and the list goes on. However, these might not always be easy to spot as it may seem as crafty scammers, often from overseas, continually evolve their methods.

Here are some of the key warning signs that should prompt you to proceed with extreme caution:

Any cold or unsolicited phone calls – treat with high suspicion.

Claims that you can earn additional income with very little effort or expertise.

Claims that the offer is ‘limited', provides discounts for early birds or that there is a sense of urgency that a decision needs to be made quickly, if not on the spot.

Upfront incentives.

Claims of little to no risk.

The absence of an Australian Financial Services Licence. Any Australian provider must carry a licence, so it's important to ask questions here. A company based outside of Australia will deliberately be outside the Australian regulator's jurisdiction.

While consumer awareness is on the rise, it is important to recognise that anyone can fall victim to a questionable scheme as many are exceptionally well presented, specifically target the successful and play on areas of current interest.

Deception or misrepresentation can be highly unsettling, with or without financial loss. Recognising that our very nature makes us vulnerable, exercising caution can make all the difference in a successful retirement outcome from a disaster.

If in doubt over an offer's legitimacy or appropriateness for your circumstances, it is critical to undertake research and ensure you have the opportunity to step back and seek independent advice.

Carol Tawfik is a Certified Financial Planner and adviser with Affinity Private.