Investing in China just got easier

Summary: Today marks the first day of trading for the Shanghai-Hong Kong stock connect – a program that allows retail investors abroad direct access to Chinese stocks. The reasons to buy Chinese shares are numerous, given the country's leading position in several industries, its burgeoning global economic output, and its property market falling out of favour. But there are reasons to be cautious too. |

Key take-out: At this point investors should watch the program with interest or perhaps allocate only a very small portion of their portfolio to Chinese shares. It is uncertain whether the market is set to go higher and, at least for now, there are issues with liquidity and capital gains tax. |

Key beneficiaries: General investors. Category: International Investing. |

The Chinese government announced in April that it was going to set up a program called Shanghai-Hong Kong stock connect. The aim of the program was to allow institutional and retail investors abroad direct access to Chinese stocks (A-Shares).

Previously, only institutional investors could by A-shares and retail investors were otherwise limited to Chinese shares that traded in Hong-Kong – known as H shares. Today marks the first day of trading for the so called Shanghai-Hong Kong stock connect. The question is, should we invest?

Reasons to buy

The reasons to buy Chinese stocks are numerous. China is a world power in its own right. It is the world's largest and fastest growing major economy. These two facts alone provide great opportunities for investors to make money.

Remember that about one-third of global economic output comes from China. Moreover, in terms of industry, China is a global behemoth in commodities, agriculture and manufacturing.

Just to give you a taste, China is the largest producer of steel and iron ore and the second largest producer of copper. In manufacturing it makes the most cars and ships. And, of course, China is the world's largest agricultural producer. To facilitate all of this, China also has the largest bank in the world, with four in the top ten (by assets).

These are all great structural reasons to buy. Not only is China growing, but it's also a relatively stable country that is on clear path to further financial market liberalisation. In fact, there isn't too much to worry about the stability of its growth at this point. Much is made of the Chinese pretty crash and the credit bubble.

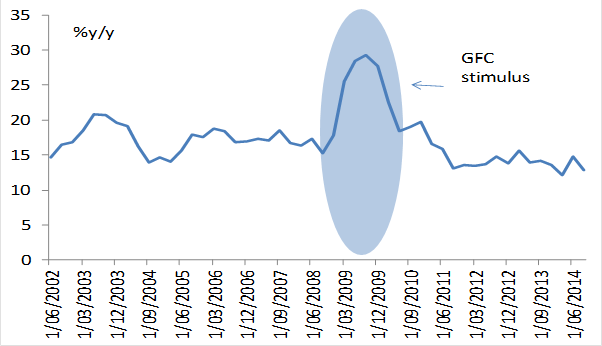

Chart 1: Chinese money demand is strong

Unfortunately most of the commentary on this is misleading. Chinese property prices are slowing, this is certainly true. But it's also by design. Also remember that property investors are a comparatively small segment of China's 1.35 billion population.

Of China's population, only 53% are urban. In the US it's around 80% and in Australia it's higher at 90%. This means when property prices fall only a small segment of the population are affected, and the fact is they're not even affected too badly. This is probably the main reason why we haven't seen the demand for money throughout China slow too much (chart 1), despite concerns over property and a supposed credit crunch. If there was a credit crunch or any sign of a broader fall-out from the property slowdown, you'd see it here.

Indeed, it makes sense that if property has fallen out favour, then a lot of the money that would have flowed into Chinese property is now going to find a home in equities.

Reasons for caution

Having noted all the very good reasons to invest in China above, there are however, some notes of caution.

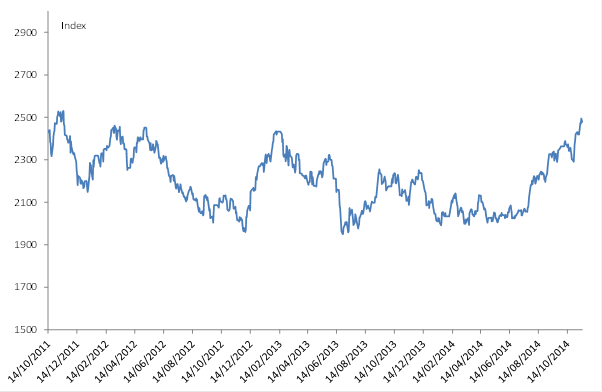

Firstly, the Chinese stock market hasn't done much over recent years (Chart 2). While there are very good macro grounds to invest, it seems that this isn't being reflected by the market.

Chart 2: Chinese stocks haven't done a lot!

Chinese stock may be up 18% over the year – and that's a great performance – but it really only brings the market back to where it was in early 2013. Technically, Chinese stock are range trading and that may be because the market is obsessed with China slowing.

The drop off in the property market will continue to support stocks. Yet given the performance to date, you'd want to see some evidence of that – there is no point in being a hero in this market. If the current line of resistance is broken, that'd be a very good signal that the market was set to go higher.

Further, the capital gains tax (CGT) implications aren't clear. For instance, China charges CGT on A-share trading, Hong Kong doesn't charge it on any shares, however. More clarity has been promised on this issue soon, but until then, it's worth waiting.

Furthermore, investors need to be aware that liquidity could be an issue – at least in the early days. That's because the program will initially operate under a quota system of 13 billion yuan per day initially ($A2.42 billion).

At this point then, I would watch with interest, or perhaps only start with a very small allocation. China presents some great opportunities and this new program – Shanghai-Hong Kong connect – helps open the Chinese market to retail investors. In the meantime, if you want to know more about international equities, I will be appearing at the 2014 international investment summit alongside speakers including Alan Kohler, Robert Gottliebsen and Kerr Neilson.

There are a few points which need to be settled before investors should take the plunge into buying individual Chinese shares directly as a sizeable proportion of their international portfolio. I would certainly keep watching for developments.