Intelligent Investor - Diversified Portfolios - 29 February 2016

COMMENTARY

PORTFOLIO COMMENTARY

After the sharp moves in December and January, with markets pushed around wildly by global macroeconomic and political factors, February saw the focus return closer to home, with the interim reporting season. Broadly speaking, this went better than expected, with the banks the main culprit for dragging the All Ordinaries into a 1.5%loss for the month, as global concerns continued to fester. The big four banks each lost 5–10% in February, although they made it all back in the first week of March.

The Growth Portfolio has no exposure to the big banks, so in that context its 1.0% loss over the month – while slightly better than the benchmark – was a little disappointing. The falls brought the banks close to the prices are which we might considering investing, but we’re happy to hold out for more compelling valuations.

We did, however, take advantage of the weakness to buy a 3% stake in Macquarie Group. The company has been making great strides in building up its ‘annuity-style’ businesses, but the market had still knocked it down 30% since last year’s highs. Since our purchase – at $60.28 – Macquarie’s share price has recovered 7%. We also started a position in Ansell after a 9% reduction in full-year guidance saw its shares fall around 20%. As things turned out, the interim result a few days later wasn’t as bad as many had feared and the stock returned 11% for the month. Making way for these two purchases were Washington H Soul Pattinson and Servcorp, which have done well for the portfolio (particularly the latter), but which we were happy to sell with their prices now closer to reflecting their underlying values.

The portfolio’s biggest gainer of the month was South32 which rose 28% due to a recovery in commodity prices and an interim result which, despite a 94% net profit fall, showed the miner is making great strides on the matters within its control.

Other notable performances came from the online classifieds companies, Trade Me and Seek, which rose 11% and 7% over the month after delivering results that demonstrated how recent investments have made their already strong businesses stronger. Monash IVF was another standout, gaining 12% after its interim result showed the assisted reproductive services provider increasing market share from 21%to 23%.

Of the portfolio’s holdings, the most disappointing result came from Computershare, which scored a loss for the month of about 13%. Even though the share registry operator confirmed its full-year guidance (for a fall of around 7.5% in US dollar earnings per share), the endorsement appeared somewhat half-hearted alongside management’s warning of a ‘softening in the operating environment’. The market is also worried about the potential for ‘block chain’ technology to disrupt Computershare’s registry business. We acknowledge these concerns and will watch developments closely, but any implementation looks a long way off and it’s important not to jump at shadows.

Fleetwood was another disappointment, falling 13% for the month and reporting another result that showed its profitable manufacturing accommodation business being overwhelmed by losses from its recreational vehicle operation.

The portfolio’s worst performer in February, though, was OxForex, which tumbled 39% after warning on full-year profits and advising the market that Western Union had failed to come up with a full takeover offer after a couple of months of due diligence. After rising on news of the bid, the stock had got up to a portfolio weighting of almost 6%, so its subsequent fall took 2% off February’s performance on its own.

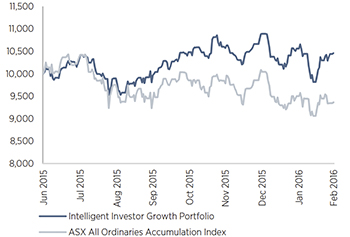

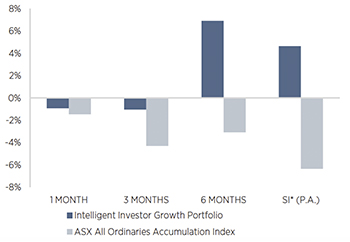

All up, though, the portfolio continues to perform satisfactorily, gaining 4.7% since it opened its doors to investment on 1 July 2015, compared to a loss of 6.4% for the All Ords, and 9.9% a year since inception back in 2001 compared to 6.9% for the All Ords.

INVESTMENT OBJECTIVE

The investment objective is to achieve a return of 1% above the All Ordinaries Accumulation Index per annum over three year rolling periods by investing in a diverse mix of Australian equities and cash.

GROWTH OF $10,000

Income Reinvested

PEFORMANCE SUMMARY TO 29 FEBRUARY 2016

Source: Praemium, RBA. Returns are before expenses and fees. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 1 July 2015.

| PERFORMANCE TO 29 FEBRUARY 2016 | 1 MONTH | 3 MONTH | 6 MONTH | SI* (P.A.) |

|---|---|---|---|---|

| Intelligent Investor Growth Portfolio | -0.93% | -1.05% | 6.90% | 4.64% |

| ASX All Ordinaries Accumulation Index | -1.47% | -4.31% | -3.09% | -6.36% |

| Excess to Benchmark | 0.54% | 3.26% | 9.99% | 11.00% |

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.

Frequently Asked Questions about this Article…

In February 2016, the Intelligent Investor Growth Portfolio experienced a 0.93% loss, which was slightly better than the ASX All Ordinaries Accumulation Index's 1.47% loss.

The big four banks each lost 5–10% in February 2016, contributing to a 1.5% loss for the All Ordinaries, although they recovered in the first week of March.

The portfolio invested in Macquarie Group due to its significant progress in building 'annuity-style' businesses, despite a 30% drop in its market value since last year's highs.

The portfolio invested in Ansell after a 9% reduction in full-year guidance led to a 20% drop in its share price, which later rebounded by 11% following a better-than-expected interim result.

South32 was the biggest gainer in the portfolio for February 2016, with a 28% rise due to a recovery in commodity prices and a positive interim result.

Trade Me and Seek, both online classifieds companies, performed notably well, rising 11% and 7% respectively, after demonstrating strengthened business results.

Computershare's stock fell by about 13% in February 2016 due to concerns over a 'softening operating environment' and potential disruption from 'block chain' technology.

The investment objective of the portfolio is to achieve a return of 1% above the All Ordinaries Accumulation Index per annum over three-year rolling periods by investing in a diverse mix of Australian equities and cash.