Insurance is best in super: ASFA

Summary: Super funds are moving with the times and tailoring their insurance policies to suit all types of members. Costs are typically quite low and comparative returns potentially very high, highlights a new study.

Key take-out: Including insurance in super is something some members should seriously consider. Insurance payouts are more common than one might expect and not just extended for degenerative disease, permanent disability and death. Premiums are lower for members in the middle of their lives, between the ages of 30 and 60.

Insurance payouts are more common than some are led to believe, with new research from the Association of Superannuation Funds of Australia showing it can pay dividends to consider your options.

Most death, disability and income protection insurance held by Australians is provided through superannuation, and without it, many people would have no protection at all.

And getting a payout is more common than some members may think. Payouts can help a member get back on track after an illness, support a mental health break, or service the mortgage and costs of living for a family where their breadwinner is struck by a long-term disease. Even providing financial support after a non-life threat injury that requires a member to stay home for a short time.

It should be added that members working casually or part-time are generally able to access life insurance cover as well.

With stakes so high, and risks so low on a cost basis, adding insurance seems a no-brainer.

The AFSA study puts the matter in perspective by shedding light on real-life member experiences like those above. According to the data, around 16,900 TPD benefits were paid in the 2015-16 financial year, more than 18,500 life insurance claims and nearly 37,000 income protection claims.

With an income protection policy, there's a 25 per cent chance of having a benefit paid due to temporary disability or a medical condition. Around 5 per cent of members will claim a total and permanent disability (TPD) benefit, and another 5 per cent will have a terminal condition payment made out to them or a death benefit paid to a beneficiary.

ASFA director of research, Ross Clare, explains the costs of keeping insurance in super may not be as high as first thought either.

“Life and disability insurance cover held in superannuation accounts typically has lower premiums than comparable policies held outside superannuation,” says Clare.

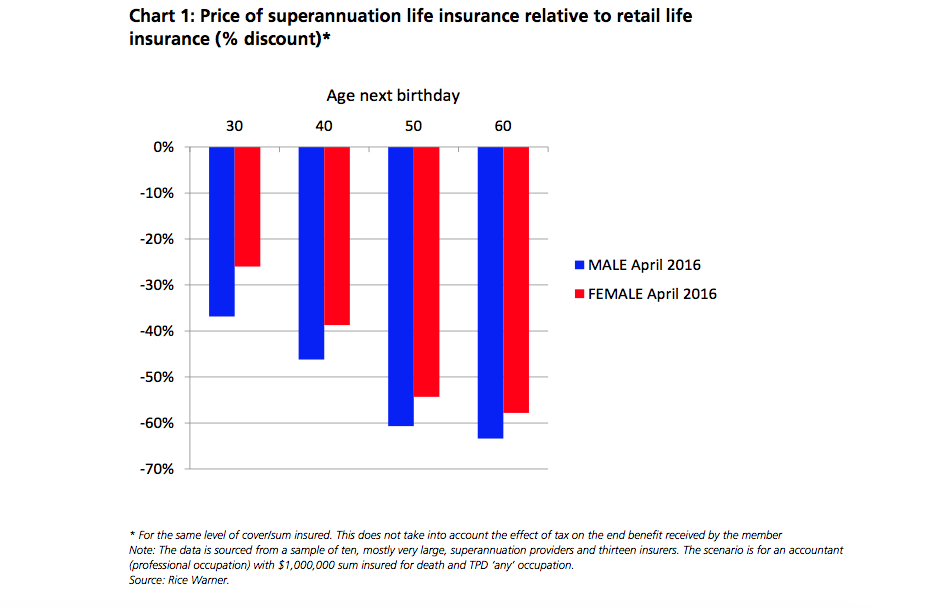

“Premiums for a given level of cover are lower across age categories between 30 to 60 years, for both genders.

“For women, the difference in premiums ranges from approximately 25 per cent to 55 per cent – increasing with age. Similarly for males, the difference ranges from approximately 35 per cent to over 60 per cent – also increasing with age.”

Risk protection is key to estate planning, reminded Eureka Report editor Tony Kaye in Making the call on life insurance.

Perhaps there's no greater need than for SMSFs, who should obtain life insurance quotes from several sources. After finding competitive quotes, the outcome could well be joining an external fund for life insurance at a reasonable cost and having some super contributions directed to this fund to keep it afloat.

ASFA's study noted the individual benefits of setting up life insurance through super include the relatively low cost due to bundling and personal cash flow not dictating premiums, the automatic acceptance of individuals without a health check, and the flexibility to tailor cover.

Age-based premiums are increasingly becoming the norm, but some funds are offering extra benefits such as letting those over 55 select death cover only, and cancelling salary continuance insurance (SCI) policies if super contributions haven't been paid for 120 days to ensure accounts aren't eroded.

The rewards seem to far outweigh the risks for individuals and their families when it comes to adding life insurance, not to mention the reduced pressure on the social security system. Currently underinsurance in relation to death, TPD and income protection costs the Government over $1 billion per annum in additional social security payments – which really just becomes another cost for the Australian taxpayer.