Inflation tells the tale of two regions

Inflation in the US and eurozone remains weaker than policymakers would prefer, but the outlook for the US is far brighter. Inflation should pick up in the US as the recovery continues, while in Europe slowing inflation continues to prolong the economic slump.

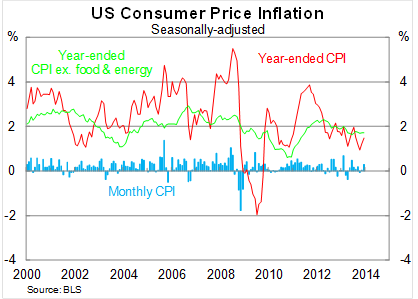

Consumer price inflation in the United States rose by 0.3 per cent in December, to be 1.5 per cent higher over the year. The uptick was largely due to energy prices, which climbed by 2.1 per cent in the month; food and beverage prices, by comparison, rose by just 0.1 per cent.

The core measure of inflation – which removes volatile components such as energy and food prices – rose by 0.1 per cent in December and continues to grow by around 1.7 per cent over the year.

Although core inflation is running only slightly below the upper target set by the Federal Reserve of 2 per cent annual inflation, other measures of inflation suggest that cost of living pressures remains well contained. The personal consumption expenditure deflator – the Fed’s preferred measure of inflation – is significantly weaker than the consumer price inflation data.

I expect inflation to remain fairly subdued over the next few months, but we will begin to see some cost pressures develop in wage markets in 2014. Although the labour market remains relatively loose, continued job growth will put some pressure on wages across a range of industries and that will boost inflation.

Pushing against rising inflation is the expected appreciation in the US dollar, which should rise as the Fed winds back its asset purchasing program. However, I think this will be a minor factor since the US is a relatively insular economy trade-wise; with many international markets priced in US dollars, foreign exchange exposure is limited.

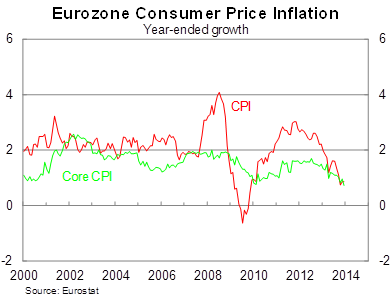

The same cannot be said for inflation in the eurozone. Inflation – or the lack of it – remains a big problem in the eurozone and has helped to prolong the economic pain and misery resulting from the financial crisis and the associated austerity measures.

Although many readers will view inflation as always a bad thing – who wants to pay more for goods? – it has proved one way in which countries in the eurozone can unwind the remarkable wage imbalances that developed after the euro came into commission.

Low inflation in countries where nominal wages are too high such as Spain (inflation 0.3 per cent higher over the year) and Greece (inflation down 1.8 per cent) is pushing relative wages down compared with countries with relatively low nominal wages such as Germany (inflation up 1.2 per cent).

This internal devaluation is doing the heavy lifting that is normally achieved through the exchange rate, but that obviously isn’t an option for countries in the eurozone. It is an incredibly slow process – much slower than currency depreciation – and one that is prolonged every time inflation across the eurozone declines.

In an ideal situation, you’d want inflation in the stronger economies to be much higher than they currently are, while the weaker countries would have annual inflation a little above 0 per cent. But that is awfully hard to achieve when demand is depressed across even the strongest economies in the region.

Inflation isn’t a big deal for the US at present. Despite extensive monetary stimulus, cost of living pressures remain well contained and are likely to remain that way for the foreseeable future. I anticipate that inflation will pick up a little in 2014 but remain around the 2 per cent upper target that the Fed uses.

It is a much bigger problem for the eurozone and a problem that will persist throughout 2014 and beyond. The labour market is so loose in the eurozone that there won’t be any wage pressures built up by capacity constraints for years. I don’t think deflation will occur – it is difficult to achieve – but we are looking a prolonged period where eurozone inflation hovers at or below 1 per cent annual growth.