India's solar surge; SunEdison's wind play

The sun was shining brightly for the solar industry last week, as India announced an ambitious energy goal and two big US developers revealed a surprising acquisition plan.

India last week said that it is seeking to generate five times more power from solar by 2022 than its previous target. Renewables need to be a "self-sustained industry and not dependent on government subsidies", coal and power minister Piyush Goyal said in an address at an event in New Delhi on November 17. The government is targeting 100GW of solar capacity in the next eight years, putting India's ambition for photovoltaics on par with China's, he said, according to a Bloomberg News story.

This week, the Indian government released its first comprehensive assessment of the country's solar resource potential. The assessment by the government estimates it at 749GW. This is almost three times the total current power generation capacity of 255GW from all sources. The data could be useful in planning for the goal of 100GW of solar capacity by 2022 announced by Goyal.

A Bloomberg New Energy Finance analyst reaction looks at the data and what it means for policymakers and investors.

The big potential for solar in India was reinforced last week by news that the US Exim Bank will give loans for as much as $1bn to clean energy projects in the South Asian country, a Bloomberg News story reported.

The loans will be given to Indian power producers that purchase equipment from the US and will have a repayment period of 18 years, the story said, quoting a statement from the ministry. The US Exim Bank and the Indian Renewable Energy Development Agency, a government body, signed an agreement on the credit facility.

India dropped its solar anti-dumping plan in September after the country contemplated imposing duties on PV panels from China, Taiwan, Malaysia and the US. The memorandum of understanding involving US Exim indicates that the trade tensions between the US and India are part of the past.

Meanwhile, there was big M&A news in the US last week. SunEdison, and its yieldco subsidiary TerraForm Power, agreed on November 17 to buy closely held US developer First Wind for $US2.4bn, with a view to expanding the types of renewable-energy projects it can develop. A Bloomberg New Energy Finance analyst reaction looks at the surprising deal and the value of the newly obtained operational and development assets.

Private equity-backed First Wind, which attempted an initial public offering in 2008 and pulled it in 2010, has stepped up its investment in PV, signing 400MW of solar power purchase agreements over the summer for utility-scale projects in Utah. Those projects supplemented First Wind's existing solar development efforts in Massachusetts.

From the buyer's perspective, SunEdison would gain 521MW of wind and solar operating assets for its yieldco, TerraForm Power, as well as 1.6GW of projects in the pipeline, of which we believe about 321MW are under construction. With the launch of six competing yieldcos in the last 18 months, the deal gives Terraform an important boost in the form of cash-producing assets.

In the UK, there was another heavy blow for wave power last week. Pelamis Wave Power, a Scottish maker of systems that harness the power of the ocean to generate electricity, said it has been unable to raise the money needed to continue development. As Bloomberg New Energy Finance pointed out in a recent research note, the last 18 months have seen a series of disappointments for wave technologies, including the bankruptcy of Oceanlinx and the cancellation of Ocean Power Technologies' project in Australia.

The failure to come up with the funds means Pelamis has entered administration, a rescue mechanism to enable insolvent companies to continue operating, the Edinburgh-based manufacturer said November 21 in an emailed statement. It is considering the options for “securing the future for the business and employees", it said.

Administration could perhaps provide a route to salvation for Pelamis, but the company has been looking for an industrial equity partner for a long time without success. Its venture capital investors are likely to be left with little or nothing. BNEF analysis shows that the company had accumulated balance sheet losses of $US114m by the end of 2013.

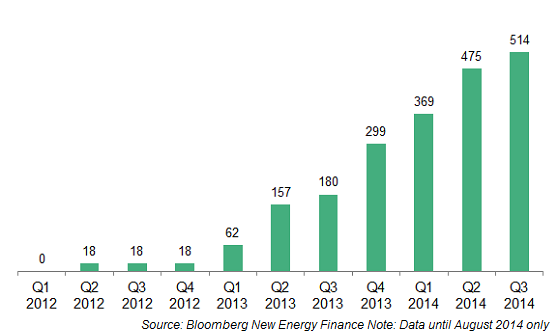

Graph of the week: Cumulative solar renewable energy certificate registered capacity growth surpassed 500MW in India.

Originally published by Bloomberg New Energy Finance. Reproduced with permission.