IEA: Grid can handle 45% solar wind at minimal cost

The International Energy Agency has released a study today declaring that it’s possible for power systems to manage as much as 45 per cent of annual power from solar and wind, while maintaining power reliability at “little additional long term cost over a system with no variable renewables at all”.

This study represents an excellent synopsis of what has been learned over the last decade as we’ve begun to see wind and solar make up quite substantial shares of power supplies in some power systems - such as in Spain and Portugal, Ireland, Germany, Texas and also South Australia.

It has been a well-worn myth of the debate around power supplies that power systems couldn’t manage to integrate much more than a small fraction of energy from wind or solar because their output varies so much due to changes in the weather. Usually the people pushing this view seemed to be completely ignorant of the fact that our demand for power is already subject to great amounts of variation.

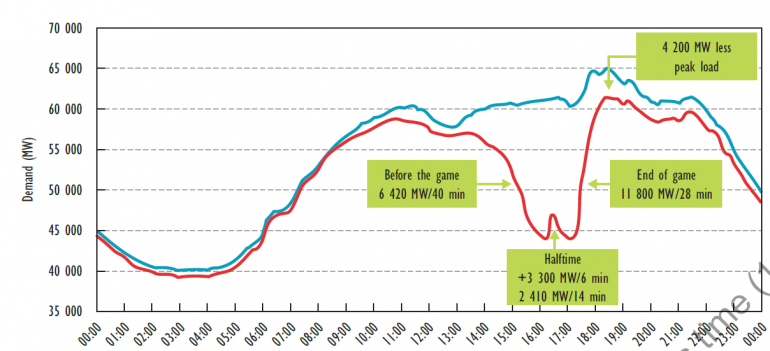

As the chart below of power demand in Brazil during a soccer World Cup game (red line) versus a typical day (blue line) so beautifully illustrates, power system operators have for some time needed to switch power stations up and down over short periods to cope with very large changes in power demand.

Power demand in Brazil during 28 June 2010 World Cup game versus typical day

Source: International Energy Agency (2014)

There is this urban myth that conventional fossil fuel power stations have two settings: on and off.

It is believed that if power stations don’t operate at full capacity they suffer from huge efficiency losses. This is simply not true.

However, some generators are more flexible than others and generally the newer the power station the more flexible it is.

So, according to Australian Energy Market Operator planning assumptions, the old clunker that is Hazelwood brown coal power station can only be ramped up or down by 7.5 per cent within an hour, but the more modern black coal Eraring can be ramped up or down by 20 per cent of its capacity while a brand new gas turbine can go from close to zero to full output within the hour.

This study by the IEA looked at experiences in integrating wind and solar into power systems across 15 countries - including 50 interviews with power system and market operators, regulators, academics as well as government and industry representatives.

What it has found is that integration of large amounts of wind and solar is easier than what many originally anticipated. That’s because power systems have adjusted market structures to make them better able to respond quickly to changes in demand and supply of power. It is not just a matter of having more flexible power stations.

In the end there’s more than one way to structure an electricity market and we can see that in the differences in approaches between the Australian east-coast National Electricity Market and the Western Australian south-west interconnected system.

The east-coast NEM is actually very well designed to be flexible to changes in demand and supply. That’s because the market operates on short-time intervals and generators are free to offer their capacity across a very wide price range so market prices can quickly respond to changes in wind and solar output. Also, a highly accurate wind forecasting system gives conventional generators plenty of notice to respond to wind power changes.

In addition there is an open competitive market for provision of capacity at short notice to cope with contingencies where there is an unforeseen imbalance between supply and demand (known as ancillary services). And in addition to that, generators that cause any imbalance in supply and demand are required to pay for the consequent ancillary services required, giving them an incentive to deliver the amount of power they bid-in.

The WA market historically has lacked such characteristics (although reforms are addressing this) making it more difficult for it to respond flexibly to changes. So as an example, it used to be the case that only the state-owned Verve Energy (now merged into Synergy) would provide the short-term balancing capacity for the market. But a lot of Verve’s capacity was actually old and inflexible coal-fired power stations, meaning it wasn’t in the best position to supply such a service. In addition, an accurate wind energy forecasting system is yet to be developed for managing the SWIS.

Hopefully, Shirley In’t Veld, who is involved in reviewing the Renewable Energy Target and the former chief executive of Verve, will realise that her experience is actually a case in how not to cost-effectively manage the integration of renewables.

According to the International Energy Agency, the key to cost effectively managing the variability of large shares of wind and solar is to adjust the power system as a whole, not simply just shoehorn the renewables in without adjusting other characteristics such as market structures and the mix of conventional power generators.

Ultimately, some of the older and less flexible baseload coal generators - such as Hazelwood - need to give way to peaking and intermediate plants which may have higher fuel costs but lower capital cost, and more output flexibility. Baseload is not the ideal in the future but rather flexibility. We should also be enhancing the ability and incentives for customers to adjust demand to respond to changes in available supply.

The IEA report finds that if you assume the existing shape of the system can’t be changed then the integration costs of something like 45 per cent wind and solar is very expensive at as much as $US33 per megawatt-hour. However, if you allow for adjustment of the rest of the generation mix over time and draw upon demand management, then the cost at 45 per cent market share is about $US11 per megawatt-hour and just $US6 at 30 per cent renewables.