How will markets react to a Fed hike?

If the US Federal Reserve opts to hike rates around the middle of next year -- as most analysts currently expect -- investors would be best served to sell out of stocks around April and buy back in during the final quarter of 2015.

At least that's what history tells us.

The benchmark S&P 500 index in the US has traditionally been jittery immediately prior to the first rate hike in a new cycle and fragile in the aftermath. However, history also shows that at the time of the first Fed move, there has usually been plenty of gas in any bull market run.

The most recent time the Fed shifted towards contractionary monetary policy was after the recovery from the dotcom bust, with the first move seen on June 30, 2004.

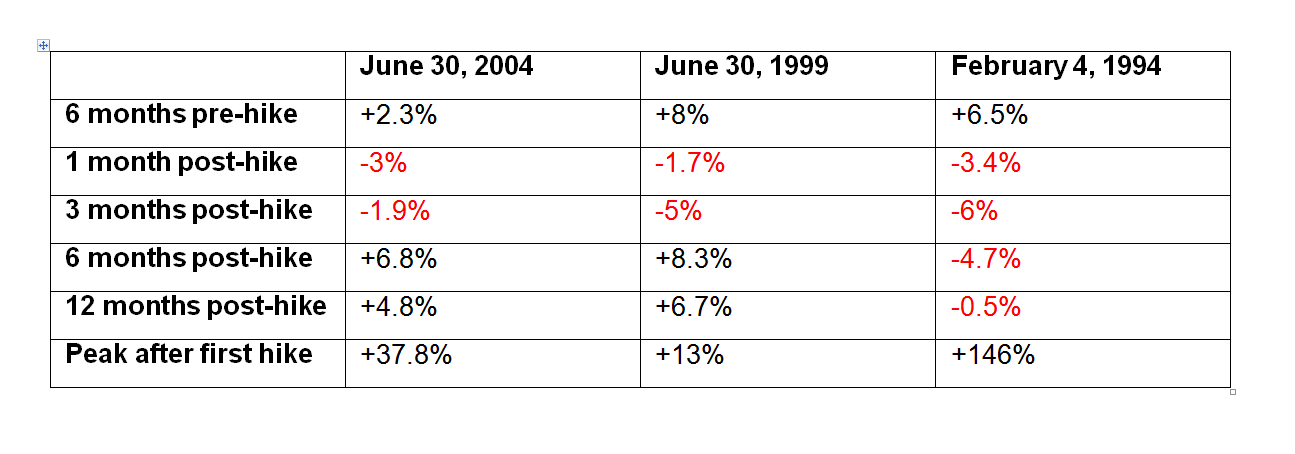

In the six months leading up to the Fed's initial rate lift, the S&P 500 climbed 2.3 per cent, despite a sharp (if brief) retreat of over 5 per cent about three months before the June call as investors showed a few signs of nerves.

Those jitters spread in the aftermath as US stocks gave up 3 per cent in the first month after the hike. It took three to four months before investors started bidding stocks higher, leading the benchmark US index to close the year 6.8 per cent higher than where it was on June 30 as the Fed made its first move.

While caution soon returned, the market still ended its first full year post-hike up 4.8 per cent. Crucially, the bull market remained untouched, with stocks eventually peaking in October 2007, three years and three months after the first change was implemented by the Fed and up a sharp 37.8 per cent during the period.

It's best not to think about what happened next.

Before the 2004 switch in Fed bias, the previous rate lift following a period of cuts came in the middle of 1999.

In the six months ahead of that rate lift, the S&P 500 gained 8 per cent but, just like 2004, this uptrend masked market volatility as stocks endured a brief 5 per cent-plus slump just a couple of months ahead of the move.

Stocks then retreated almost 2 per cent in the first month after the hike -- and about 5 per cent after three months -- before galloping higher for the next six months ahead of the crushing end of the dotcom boom.

The final example in the past 25 years came in 1994 as the Fed began to tighten monetary policy for the first time since the early 90s recession. In the six months preceding the Fed's change of direction, stocks rose 6.5 per cent. Momentum quickly stalled, however, as investors soured on the market's prospects in the wake of the first hike.

Such concerns led the S&P 500 to sink 3.4 per cent in the first month, 4.7 per cent over the first six months and 0.5 per cent over the first 12 months post-hike.

But just as in the previous examples, the bulls were far from exhausted, with the market eventually running a staggering 146 per cent higher before the next correction later in the decade.

Historical trends consequently suggest there is little for long-term investors to panic about -- at least not for a few years.

Still, given the depths of the global financial crisis, the slow, turbulent recovery and the unprecedented central bank stimulus, investor unease is logical and rising volatility is likely the greatest certainty for 2015.

Market impact of the first hike: