How will infrastructure fare in changing times?

Summary: Infrastructure investments have been seen as a safehaven in times of loose monetary policy but are now coming under pressure as interest rates are slated to tighten. |

Key take-out: Underinvestment in infrastructure in developed economies and hopes of a return to inflation and growth means infrastructure is likely still appealing for long-term investors. |

Key beneficiaries: General investors. Category: Investment strategy. |

How does infrastructure investing look in late 2016?

The question has been complicated over recent months as, first, global interest rates showed signs of finally lifting and, secondly, this process was bolstered by the surprise election of Donald Trump in the US.

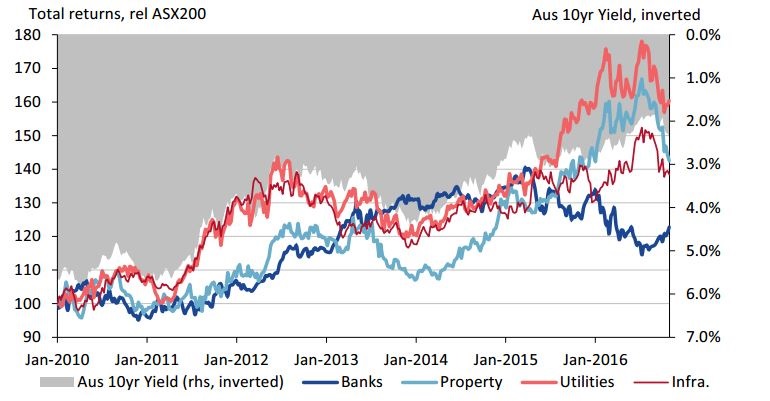

After steady growth for years, Australian infrastructure stocks have eased since mid-year, which was the moment many observers are now calling ‘the end of the 35-year bond rally', with analysts concerned these stocks had become yield or bond proxies amid the easy money environment.

Chart 1: The fall for ‘bond proxies' – property, utilities, infrastructure – in mid 2016 came after years of growth

Source: Morgan Stanley, Datastream

And while the election of Trump at the start of November mostly saw a bounce in the stocks – in line with broader markets – the big-spending plans of the president-elect are likely to exacerbate the tightening of monetary policy.

So is there a big correction on the cards for infrastructure stocks?

Russel Chesler, investment director at asset manager VanEck, which in May this year launched Australia's first infrastructure exchange-traded fund (ETF), says the retail-focused fund – which is 8.9 per cent domestic with the rest invested in developed markets overseas – was proving mostly immune to the global bond-yield uptick that had accelerated since the US presidential vote.

“From November 8 to current, we've lost only about 1 per cent whereas … the value of bonds has come down more than 5 per cent,” he says.

“What you see is that even though interest rates are going up to a certain extent it is offset by inflation expectations going up as well."

But Morgan Stanley this week said “further underperformance” for infrastructure names that had been serving as ‘bond proxies' was a possibility.

“With the US potentially joining the fiscal stimulus underway in China and Japan, we flag a scenario that could see further underperformance of bond proxies as markets pull back from what we believe is still a strong deflationary consensus among global and domestic investors that will take time to unwind,” the investment bank said in a note.

On a more nuanced level, Chesler says he expected the downside from higher long-term interest rates to weigh more on the debt-heavier stocks.

“For infrastructure companies that do carry debt, obviously rising interest rates would have a more negative effect than those that aren't."

The chart below shows this theory has not played out obviously since the mid-year falls, although there is patchy evidence for it. (For example, the less geared Aurizon so far appears to have been more resistant to the changing global interest-rate environment.)

Chart 2: Australian infrastructure stocks' performance since mid-year, (with their debt ratio in brackets)

Source: Bloomberg, FactSet, Eureka Report

A volatility barrier

Meanwhile, a lot of infrastructure is not publicly listed. On the unlisted front, economist Alex Joiner from IFM Investors – Australia's largest infrastructure investment group, which boasts a 10-year performance average of 12.1 per cent – says privately-owned infrastructure was set to benefit from the recent changes in global market dynamics.

“I think the increasing attractiveness of infrastructure as an investment class is going to be proven again going forward with the increase in volatility in markets,” he says.

“This is because, more broadly, infrastructure provides an asset class that usually has a low correlation to other asset classes, particularly equities, where there is probably going to be some volatility.

“Also infrastructure is well placed in our view in the unlisted space because assets are linked significantly to CPI and GDP growth, the growth and inflation thematic we are seeing in global markets.”

Nevertheless, further complicating the outlook for the asset class was a report this week from UK-based consultancy Arcadis saying Australia's infrastructure and built asset returns were lagging their peers.

But Joiner says the report needn't be a red flag for investors due to two mitigating factors:

- Some resources spend – largely in the still-expanding LNG space – was not yet producing, and;

- The performance figures were also likely weighed down by Australia's recent and notorious electricity "gold-plating" saga, where electricity-grid companies with regulated returns grossly overestimated (purposely or not) peak power-demand levels in Australia, the effects of which are coming towards an end.

“So in Australia there are reasons to be a little more positive on infrastructure in this context,” he says.

Indeed, VanEck forecasts Australia needs to spend about $53 billion to 2031 to address its infrastructure needs caused by just “city congestion and the like”, while the global economy could splurge as much as $41 trillion to 2030 – with established players in poll position.

“From our perspective, bond rates will have an effect, but over the long term we think that infrastructure is going to continue to grow as it has in the past,” VanEck's Chesler says.

Arcadis says it expects a “swing towards growth in the stock of transport infrastructure assets as key regions play catch up.”

“In New South Wales and Victoria in particular, major new transport schemes are underway to deal with historic underinvestment and growing populations.”

Indeed, despite its doubts over infrastructure stocks, Morgan Stanley this week said it envisioned an up to $60bn federal/state boost to "underlying" Australian infrastructure spending in 2017.

So the choice for investors seems not to be infrastructure or no infrastructure but, rather, how to weight your infrastructure holdings between the more volatile but also more liquid listed options – available through direct share investments as well as ETFs – and the less volatile unlisted space, which is generally accessed via managed funds and tilted towards long-term commitment.