How to make your super scam-proof

Summary: Losses from investment scams overtook romance scams in 2015, with DIY fund holders vulnerable. If you receive a cold call about an investment opportunity, check the credentials of the individuals and companies through ASIC and the ACCC. |

Key take out: Follow the checklist below to protect yourself – and remember that scams will look very similar to legitimate investments on face value. |

Key beneficiaries: General investors. Category: Investment strategy. |

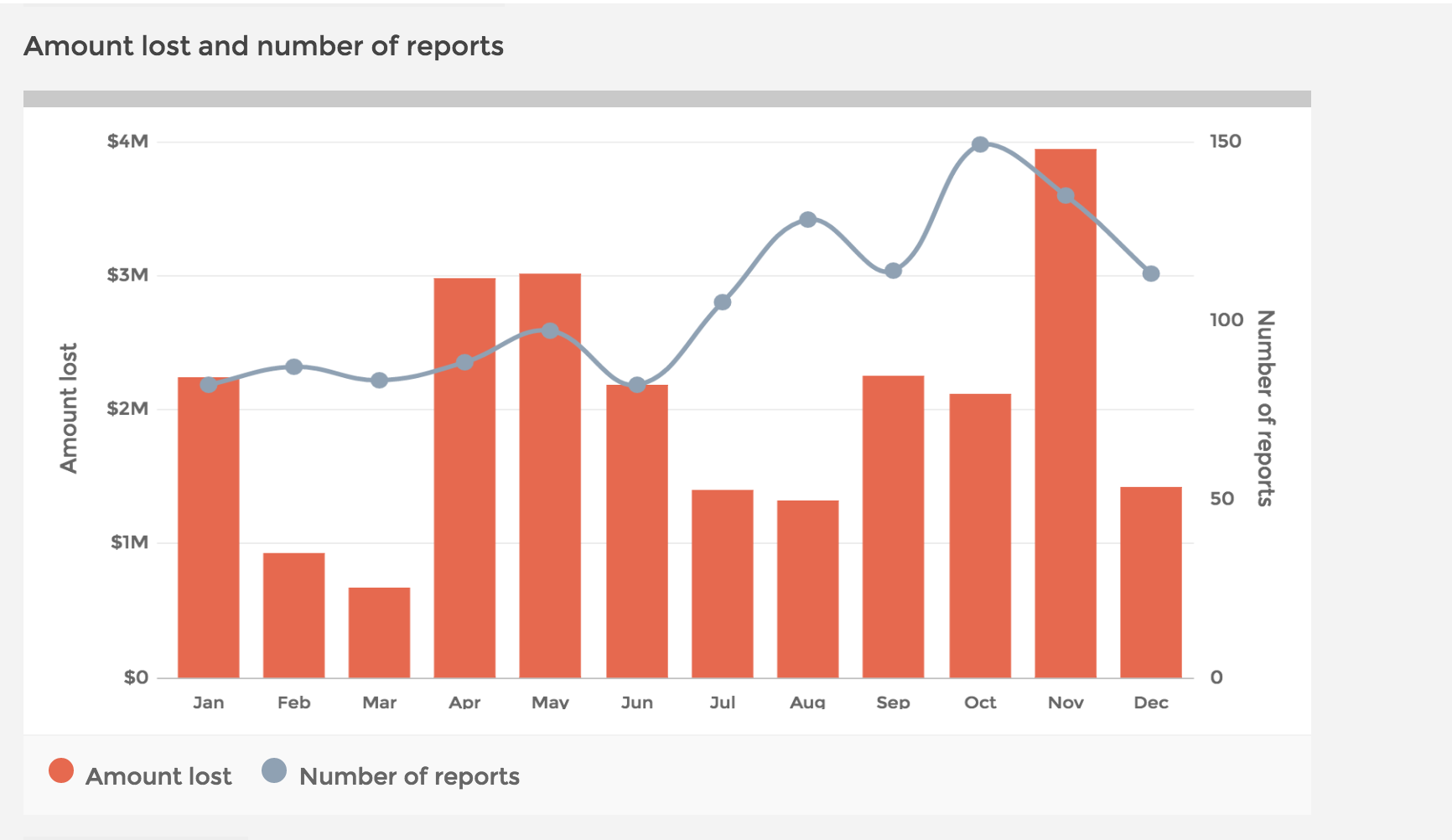

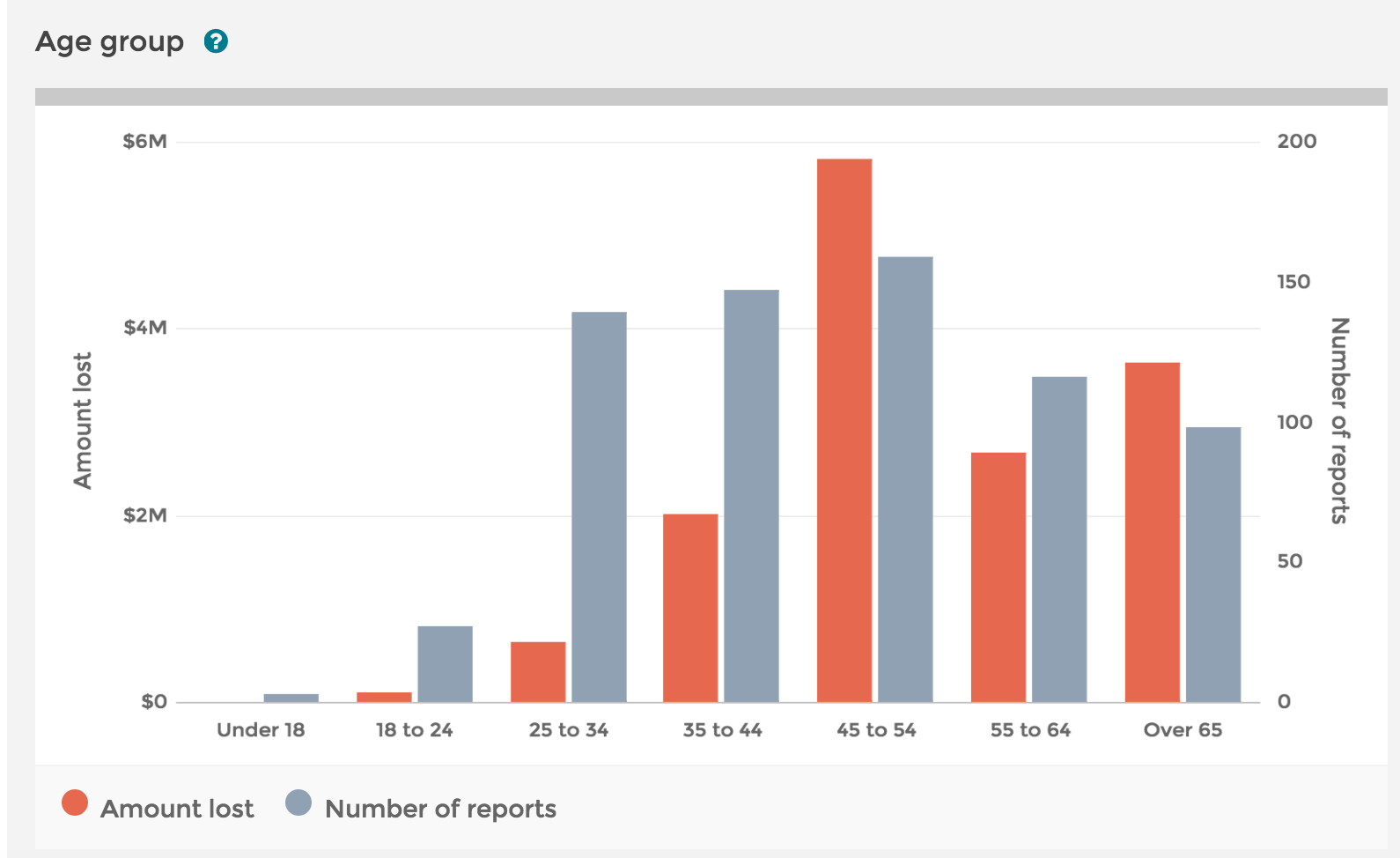

Investment scams cost Australians more than online romance scams in 2015 – over $24 million was lost last year, and more 45-54 year olds were affected than any other age group.

Worse still, the losses just keep on climbing – so far this year, investors have already been ripped off to the tune of $9 million.

The ACCC has warned that SMSF account holders are particularly vulnerable to property spruikers, investment clubs and other fraudulent investment schemes. It's easy to look at the numbers and think it won't happen to you – after all, as a Eureka Report subscriber you pay attention to the investment news cycle and understand how to pick a good deal, right?

Not quite. Research both here (see this QUT research) and overseas suggests that the more confident about the world of finance someone is, the more vulnerable they can be to shonky investments.

The theory goes that those with little or no experience with investing will be less likely to take the bait from potential scammers, while those familiar with the processes, and on the hunt for a good deal, are more likely to suffer from too much confidence. Throw in the fact that many scams look almost identical to legitimate investments and it becomes difficult to separate fact from fiction.

So what are typical scam scenarios?

Phone or email cold calling: someone will get in contact and claim they have your details through a brokerage platform or investor list and offer to discuss a new opportunity with you. After putting up the money, you'll find you can redeem some but not all of the investment.

Online spruiking: an online friend or participant in an investment forum you regularly visit might talk at length about the returns they got from an investment and encourage others to sign up to an identical scheme.

Investment clubs: you receive an invite to an exclusive “investors club”, timeshare or property opportunity out of the blue.

Wealth seminars and investor groups: opportunities offered up at the end of a wealth management course of information night that you have been invited to - with pressure to sign up or not come back to the group.

Source: ACCC

Scams will look real

Last month the ACCC handed down its 2015 report into losses through scams, and it was keen to drive home the message that looks can be deceiving: Australian investors' ability to separate real from fake opportunities appears to be weakening.

Dr Cassandra Cross is a senior lecturer in the faculty of law at Queensland University of Technology, and has looked studied the criminology of online fraud in detail - including the way investment scammers play with emotions. She says it's dangerous to assume that a “fake” investment will look amateurish: “These offenders are really good at what they do,” she says. “This includes high quality websites, platforms where you can track an investment's progress, and professional looking offices - these scams are designed to look and feel exactly like real investments.”

Given the entire point is for a scammer to look legitimate, prospectus information and websites may be tagged with ‘ASIC approval' or fake financial services licence numbers, or include the images and credentials of real fund managers or investors whose identities have been stolen and used in promotional materials. The only way you can check the bona fides of these claims is with ASIC itself - read more on this below.

Stick to your investment strategy

The ACCC's report highlighted the vulnerabilities of those close to retirement - many of whom are looking to maximise their super fund returns and might be nervous about the low interest rate environment. These anxieties can lead to a temptation to seek out unconventional investments.

Regularly reviewing an investment plan can be useful for preserving capital. With the big picture in mind (and an acceptance that this climate will not deliver spectacular returns), investors are less likely to take a chance on schemes that happen to cross their paths. “It's also worth noting that the returns on offer here are not always very big,” says Cross. “They might only offer something a bit higher than the standard returns for an asset, which can be difficult to spot.”

“Before parting with your money, do your own research on the investment company,” ACCC deputy chair Delia Rickard said on the launch of the ScamWatch report. This research can include getting your financial planner or SMSF adviser to run an eye over any new opportunities. Having an independent party review investments first can prevent emotions getting in the way of realising red flags.

Source: ACCC

A basic ‘scam' check:

• Make sure to check the name of the provider, and their financial services licence, in ASIC's Professional Registers - click here - to ensure they are compliant with ASIC's licence requirements.

• Ask for the name and address of anyone who approaches you spruiking investments - and make sure their details match up with the record in the Professional Registers listing.

• Check ASIC's "List of Unlicensed Companies" for operators well known to the regulator for not fulfilling licence criteria.

• If you have been contacted by a company from overseas, check the International Organization of Securities Commissions online alerts for warnings - you can also follow up the relevant jurisdiction for the company you are in contact with to verify their credentials through IOSCO.

The bottom line is, listening to your gut is the number one prevention method: be wary of anyone who approaches you with a new opportunity and ask "why are they coming directly to me?". Run the relevant online checks, don't send money overseas, and let someone review your decisions before jumping in. Finally, if you do get caught out, don't stay quiet: let the ACCC and ASIC know, tell your bank, and make sure family and friends are warned - knowledge helps stop scams in their tracks.