How to choose a fund manager for international equities

Summary: When choosing a fund manager, consider their long-term past performance, as well as whether they offer fresh ideas. Look at the size of the fund, the fee level, whether the team has the right people on board and whether its philosophy matches your own. |

Key take out: Look for a fund manager who is likely to outperform the index. If a manager doesn't beat the index, the same return is available in an ETF for a lower cost. |

Key beneficiaries: General Investors. Category: International investing. |

Investing overseas has become a top order priority for many local investors in the face of relatively lower earnings expectations in Australia and dimming prospects for the Australian dollar. Some investors may choose direct stock picks or alternatively investors may opt for the predictability of index funds and ETFs. However, the first step for many investors is through an actively managed international share fund.

Indeed the sheer weight of money in these funds attests to their strong attraction for Australian-based investors – the top five largest funds have a total market capitalisation in excess of $33 billion.

But how to choose? The trap with fund managers is that not all actively managed funds outperform their benchmarks. A recent study by online investment adviser Stockspot found that for funds benchmarked against the S&P/ASX200, only 35% of superannuation funds beat the market after fees in the year to October 1, 2014, while the figure for managed funds was just 22%.

We asked the experts what to consider when picking an international fund manager.

Long-term past performance

Rainmaker executive director of research Alex Dunnin says that given the underperformance of some fund managers, and the availability of low-cost ETFs, investors should look for managers who are likely to beat the index. Of course, predicting the future is easier said than done. “If they're going to beat the index it's got to be because they have a long-term history of doing that.”

Morningstar director of research ratings Tom Whitelaw says investors should consider a fund's returns over the last five years – at least. “You need that kind of horizon with international equities, or any equities,” Whitelaw says. “Often the product that performed best over the last three years is then worst over the next three,” meaning investors should not make decisions based on performance alone, he says.

Fresh ideas

Dunnin recommends looking closely at the newsletters that fund managers send out. Consider whether the information in the newsletter is “old news” that has already appeared in the newspapers or investment publications. “If a fund manager is only telling you stuff you already know, then forget about them,” Dunnin says. “A fund manager is an ideas engine, so they need to be telling you things other people aren't.”

Look for a fund manager with insights that haven't been widely reported elsewhere. For example, Dunnin says that some good fund managers were warning of the changes in the US energy market, where an increase in LNG production is reducing reliance on imported oil, three or four years ago.

“In the old days, a fund manager only had to tell you what the S&P500 closed at and you'd think they were a rockstar,” Dunnin says. Now, he points out that a child on a bus can glean richer information from their Facebook news feed. This means investors should have high expectations about the information their fund managers provide.

The right people

Consider whether a fund manager's employer is acting in the interests of the end investor, says Morningstar's Whitelaw. Is an international equities manager able to dedicate time to running their portfolio? Or will their boss congratulate them on doing such a great job with the international fund by asking them to run a long/short fund and a local fund as well? Overloading one fund manager can take away valuable time that could have been spent on the international portfolio.

Make sure the lead fund manager is well suited to an international portfolio, he adds. Find out if they have experience, knowledge and a team in place to cover the vast array of international stocks, sectors and industries, he says.

Even so, Lonsec senior investment analyst Rui Fernandes says a larger team doesn't necessarily guarantee a better result. He also says that although it's possible to manage international investments well from Australia, when it comes to niche or emerging markets, having an analyst presence in that location does help.

Fund size

Bigger isn't necessarily better, but funds with assets under management below around $200 million are likely to be on the boutique side. This is worth keeping in mind when comparing performance. A fund that manages $50 million and increases by $25 million will report a 50% jump in net assets. A $1 billion fund that increases by $25 million will have a much smaller percentage lift.

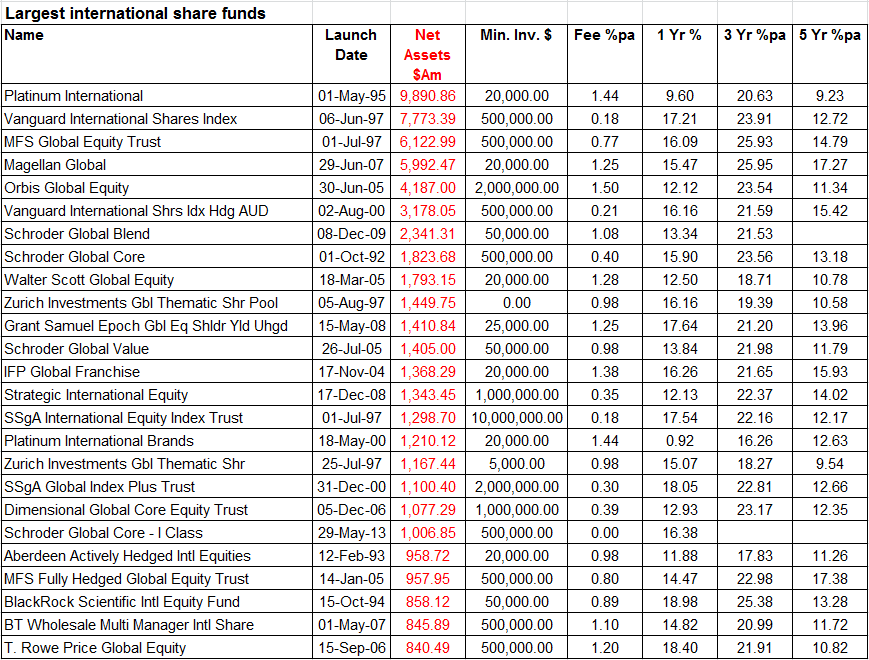

The following table shows the 25 largest international share funds available to Australian investors, ranked by net assets. Of the largest five, Vanguard International Shares Index, MFS Global Equity Trust and Orbis Global Equity are wholesale, and MFS Global Equity Trust no longer accepts applications from new investors.

Source: Morningstar. Figures to September 30, 2014.

Morningstar also offers clients research and ratings on different funds to its clients, and makes a shortlist of its top-rated funds available publicly on the Morningstar website. Lonsec offers subscribers access to ratings for different funds, while Rainmaker's sister company Selecting Super offers publicly available league tables for local and global superannuation options that offer ideas of managers worth investigating.

Suitable philosophy

Investors should look at whether a fund matches their own investment philosophy, Fernandes says. Check whether the portfolio is concentrated, with around 20 to 40 stocks, or diverse, with perhaps 100 to 200. A more diverse portfolio can be less risky, but some investors will steer away from a diverse portfolio that might dilute the benefits of strong returns in a small number of stocks. Risk is higher in a concentrated portfolio, but investors who can tolerate this may prefer a high-conviction option. “Start with how much risk you are comfortable with and what do you believe as an investor. You want to find managers to match that,” Fernandes says. “There's no magic number.”

Fernandes also suggests investors find out what fund managers think about emerging markets and how much of the portfolio can be held there. See if the fund has constraints around investing in particular sectors or regions. Investors should check if the fund's positions on these issues match their own beliefs.

As well as considering how concentrated a fund is, Morningstar's Whitelaw also recommends examining the fund manager's process. Given the vast universe of international stocks, he says investors should check whether the manager has a screening process to narrow down the range of options, helping a manager to then focus their time and effort on those remaining. This is particularly the case if the fund only has a small team.

Low fees

Morningstar research shows that the average cost of retail international share funds is 1.64%. Wholesale funds have a lower average cost, at 0.77%, but require high minimum investment amounts, as much as $1 million or $10 million in some cases.

Lonsec's Fernandes says that when it comes to fees, the lower the better. Consider that an exchange-traded fund may only charge around 0.2% in fees, he says. “You're buying an active manager because you think they've got ability or skill in picking stocks that outperform the index.”

If a manager doesn't outperform the index, the same return is available in an ETF for a lower cost. Or for those who choose to pick their own stocks, our international equities analyst Clay Carter is here to help, and you can view a list of his recommendations here.