How Sydney determines our national housing policy

As the latest housing boom has developed, it's become increasing obvious that it's concentrated purely in Sydney and Melbourne. At times, even including Melbourne has been questionable given the sheer dominance of Sydney price gains and its influence on national metrics.

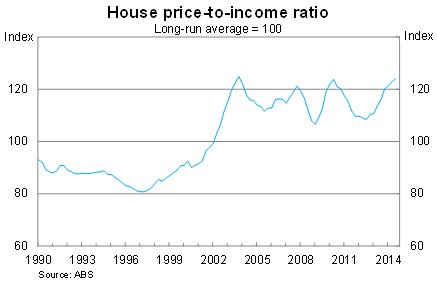

The house price-to-income ratio in Australia is approaching its peak but clearly there are a number of different underlying trends reflecting the strong activity in Sydney and the more subdued activity elsewhere.

It highlights one of the problems with mainstream analysis of the housing market -- myself included -- in that we focus on national measures when the property market is actually hundreds of micro-markets that each have their own supply and demand dynamics (even if they tend to converge over time).

Certainly, there are some broader upper-level trends but there's little reason to believe that in the short-term you'll get the same return from buying in Castle Cove as you will from Woolloomooloo or in Richmond as you would from Mentone.

Unfortunately, these breakdowns, while interesting to real estate agents and property spruikers, are impractical from a macroeconomic perspective. By virtue of being a blunt instrument, interest rates create imbalances within the property market. Interest rates are too high in some cities -- for example, Hobart -- and much too low in other cities, such as Sydney.

From a macroeconomic perspective, we tend to focus on capital city data, which accounts for around 60 per cent of Australian households. With the recent release of the state accounts, which are published annually, I thought it would be a good idea to assess how house prices have developed in each capital over the past year.

The Sydney market naturally leads the pack. According to the ABS, Sydney house prices have increased by 14.6 per cent over the year to the September quarter. Prices have increased by over 30 per cent since their trough in December 2011.

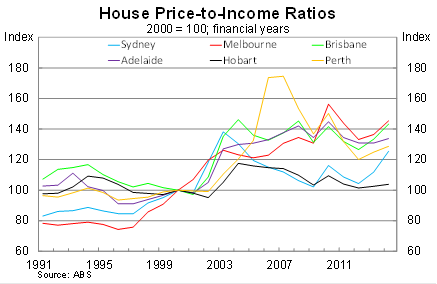

Those are impressive numbers and it's no surprise that regulators have expressed some concerns over the sheer volume of investor activity in that market. Nevertheless, the house price-to-income ratio in Sydney has not yet returned to its 2003 peak.

The graph above highlights the boom-bust nature of Australian housing over the past decade. The house price-to-income ratio in Perth for example is down over 25 per cent off its peak at the height of the mining boom.

Based on the recent decline in the terms of trade, which should effect Perth prices to a greater extent than in other capital cities, it is reasonable to believe that prices in Perth will remain subdued for a number of years as the excesses of the mid-2000s slowly exhaust themselves.

Prices in Brisbane are near their relative peak from 2004, while in Adelaide, conditions remain somewhat subdued -- as they have for a number of years now.

The end of the mining boom will also have a moderate effect on the Brisbane market -- albeit to a far lesser extent. Luckily for Brisbane, the city experienced nowhere near the irrational exuberance that came to characterise the Perth property market. If anything, Brisbane's property boom flowed almost seamlessly into the mining boom and the eventual moderation has been mild thus far.

There are a few important points for readers trying to interpret the house price-to-income graph above.

First, it doesn't show the actual price multiple; instead it is an index that shows the change over time. At various points over the past decade Sydney has had the highest house price-to-income ratio, at other stages both Brisbane and Perth have been higher.

Second, the starting point is important. I've indexed the graph against the year 2000, which gives the impression that Sydney property is among the most undervalued. Whereas if the graph was indexed against an earlier data, Sydney price multiples would be second to only Melbourne.

Third, the house price-to-income ratio reflects expectations of future price gains and income growth. High ratios make sense during periods of economic strength and become less sustainable during downturns or prolonged periods of weakness. As income growth shifts downward, it makes less sense for housing multiples to remain near their historical high.

Given the high price multiples in Australia -- among the highest in the developed world -- it is reasonable to say that no Australian capital is cheap per se. Some cities are obviously cheaper than others -- Hobart and Canberra are two clear examples based on average household income -- but usually we'd need more granular data to identify genuine bargains.

The outlook for property nationally is largely dependent on whether investors remain active in the Sydney market and on the eventual response from the RBA and APRA. At the capital city level though, prices will be driven by income growth and for cities such as Perth -- and to a lesser extent Brisbane -- the end of the mining boom.

The outlook for household disposable income remains subdued, driven by declining real wages and a much weaker Australian dollar. The terms of trade shock will weigh on income nationally and employment growth is widely expected to be subdued for at least another couple of years.

There is already some evidence that the property market is easing -- with the obvious exception of Sydney. For example, the number of new loan approvals to owner-occupiers has declined in the past eight months on a trend basis.

But readers shouldn't assume that this means that regulators won't intervene in the market.

Unfortunately, while the property market contains hundreds of micro-markets, we can't make that distinction when it comes to financial regulation or macroeconomic policy. Irrational activity in Sydney has clear and undesirable implications for financial stability at the national level and macroprudential policies remain an inevitable and necessary step towards containing risks within our financial sector.