How shale gas shows cheap energy is no saviour

In yesterday’s column I questioned the idea that Australia has a major competitive advantage in cheap energy which underpins its economic prosperity. This used statistical data about precisely which industries benefit from cheap energy in Australia, and whether these industries are really a particular strength of the Australian economy.

But what’s interesting is that there is a real live experiment we can use to examine the supposed benefits of a dramatic reduction in energy costs – the so-called ‘shale gas revolution’ occurring in the United States.

The story goes that America is currently experiencing a ‘manufacturing renaissance’ built upon a dramatic decline in the cost of gas. This shale gas boom has led to a dramatic and structural shift in the competitiveness of US manufacturing, which is allowing it to bloom again. Indeed, just yesterday I got the weekly newsletter from the Institute of Public Affairs informing me that:

“... the US manufacturing renaissance will be driven by cheap energy – as predicted by Robert Bryce in his fantastic lecture to the IPA last week.”

Bryce is an ex-journalist aligned with conservative think-tanks, who has been touring Australia promoting the idea that growth of fossil fuels is essential to economic growth and welfare, and that they are irreplaceable.

Firstly, it is certainly true that the US has seen a dramatic decline in the price of gas.

But has it experienced a manufacturing renaissance? Our charts of the week will explore this issue.

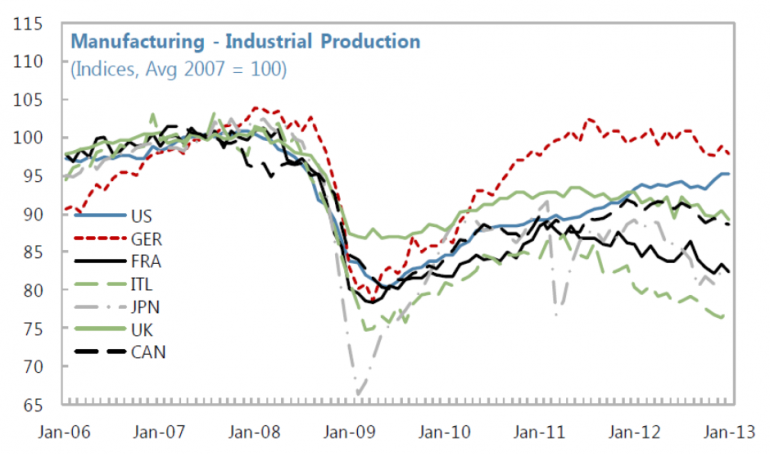

Several researchers at the IMF prepared the chart below, detailing the value of manufacturing production for the G7 nations, indexed to 2007. The substantial expansion of shale gas production and plunge in the price of gas occurred after 2007, so this should ensure it captures the period before and after the boom.

The chart reveals two very interesting things:

1) The US manufacturing sector has rebounded quite well from the sharp contraction of the GFC-induced recession, but its output is still well below 2007 levels. So not sure you’d call it a "renaissance", when you're still behind where you were five years ago.

2) Notice that the output of Germany’s manufacturing sector (the red dashed line) rebounded even more than the US sector, and they haven’t had a shale gas revolution.

Source: Oya Celasun, Gabriel Di Bella, Tim Mahedy and Chris Papageorgiou (2014) The US Manufacturing Recovery: Uptick or Renaissance?, IMF Working Paper

If the US rebound was due to shale gas then was, perhaps, the German manufacturing rebound due to its renewable energy boom which induced a merit-order effect, which depressed the price of electricity in that country?

Of course not.

Yet those that push the barrow that shale gas is inducing a US manufacturing renaissance often seem rather keen to, also, suggest that support for renewables is consistent with manufacturing decline. The performance of Germany in the chart above illustrates it’s all rather more complicated than this. There are a range of factors, of which the cost of energy is a small one, which drive manufacturing output and competitiveness.

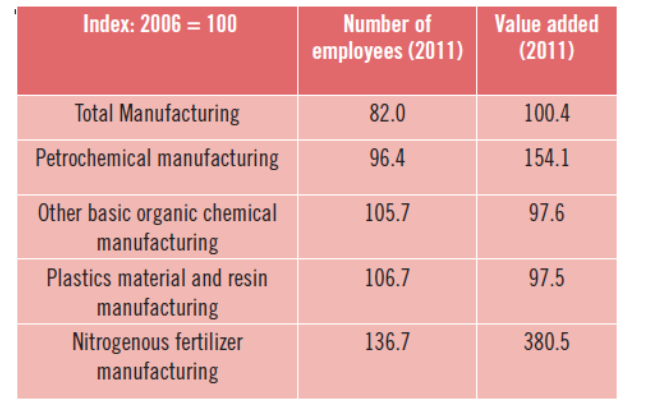

The most interesting thing is that cheap gas has had a very, very stimulative effect on some industries in the US for which gas is a major cost driver. The table below details that value added for the petrochemicals sector in the US was 54.1 per cent higher in 2011 than 2006 and nitrogenous fertiliser was up 280.5 per cent. These are huge levels of growth for what are highly mature industries and credit is clearly due to the shale gas boom because gas is a very large proportion of these industries’ costs (although a major rise in global price of nitrogenous fertilisers also pushed up value added, too). The more lacklustre performance of basic organic chemicals and plastics, where gas is also a significant input, are a little puzzling but may be due to lags in being able to expand capacity to take advantage of the decline in gas price and, of course, the major recession the overall economy had experienced.

Figure 2: Change in number of employees and value added between 2006 and 2011 for overall US manufacturing and sectors where gas is a major cost input

Source: US Census Bureau, 2011 Annual Survey of Manufactures cited by Thomas Spencer, Oliver Sartor, Mathilde Mathieu (2014) Unconventional wisdom: an economic analysis of US shale gas and implications for the EU

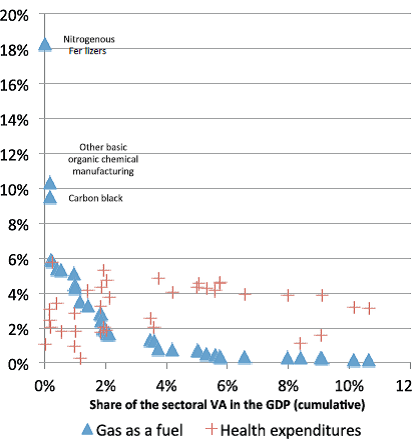

The problem, though, is that for the US economy as a whole the industries where gas is a significant input cost don't represent a significant proportion of economic output or GDP – as detailed in the chart below (which, by way of comparison, also shows the cost of health insurance borne by the major gas consuming industries). The four major consumers of gas in the table above represent just 0.5 per cent of overall US GDP and 1.16 per cent of manufacturing value added.

Figure 3: Gas and health insurance costs as a share of US manufacturing industries' value-add

Source: Thomas Spencer, Oliver Sartor, Mathilde Mathieu (2014) Unconventional wisdom: an economic analysis of US shale gas and implications for the EU

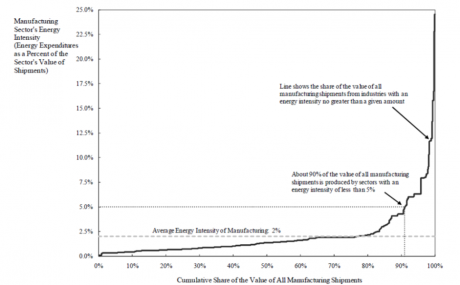

If we cast our net more broadly to consider energy-intensive industries more generally – ones which might see gains from gas price falls reducing, say, electricity or coal prices – they still don't represent a particularly big part of manufacturing economic production. The chart below shows that 90 per cent of the economic value produced by the manufacturing sector was from industries where energy costs represent less than 5 per cent of the value of their sales. The sectors for which cheap energy makes a serious difference just aren't that big a deal in economic terms.

Figure 4: The energy intensity of US manufacturing production output (click on chart to enlarge)

Source: US Government (2007)

Researchers Spencer, Sartor and Mathieu unsurprisingly observed in their report analysing the economic contribution of the shale gas boom in the US:

“The impacts of lower gas prices on manufacturing as a whole are therefore limited to a relatively small group of sub-sectors. The conclusion that US manufacturing as a whole will receive a competitiveness boost from cheaper gas prices seems exaggerated.”

The overall US manufacturing sector has seen improvements in its international cost-competitiveness in recent years, but it's not yet worthy of the title 'renaissance' and almost all of it can be explained by depreciation in the currency and declining relative labour costs per unit of economic output. Any manufacturing revival related to the shale gas boom has been largely confined to chemicals.