How mature is Tony Abbott?

Two days ago Tony Abbott did a very brave thing, hinting at the idea that we need to increase the GST and/or expand it to food, health and education services. He called for a more “mature” public debate that would recognise the important trade-offs we face in funding government services and paying for them.

He did this by highlighting the dysfunctional fact that state governments are held responsible for delivering some of the most expensive public services in hospitals, education and transport yet the federal government gets to raise almost all the taxation revenue. This division of responsibilities doesn't make much sense. State governments find themselves being pushed by the electorate to improve the quality of such services but then need to put their hands out to the federal government to fund upgrades. Meanwhile, the federal government faces the temptation to gain favour with the electorate by cutting taxes but then they support this by cutting funding to state governments. Blame shifting is the inevitable result.

States now find themselves with an increasing gap between expenditure and revenue. To address this, the obvious solution is to raise the GST, whose revenue is nominally assigned to the states from the federal government.

However, the GST is an incredibly hot political potato. No one wants to pay more for the goods and services they buy. In addition, there are real issues of fairness for low-income households if it is expanded to food and healthcare – which are unavoidable, essential expenditure items to a large degree.

Yet it is possible that, with thoughtful design and implementation, the GST could be increased and any adverse impacts on the vulnerable could be offset through changes to income tax rates and adjustments to pensions, unemployment benefits and other forms of assistance to low-income households.

But this is a complex matter to explain to the average Joe, meanwhile scaring the pants off them about the cost of food and health care going up is really, really easy.

So for Abbott to advance such a reform in funding for state government services it really needs the co-operation of Labor.

Abbott told Parliament:

"That is my hope, that just for once it might be possible for us in this Parliament, one side and the other, the national government and the state and territory governments to have a mature debate rather than a screaming match."

His problem, however, is that he hasn't set a very good example in this respect, as our chart of the week below illustrates.

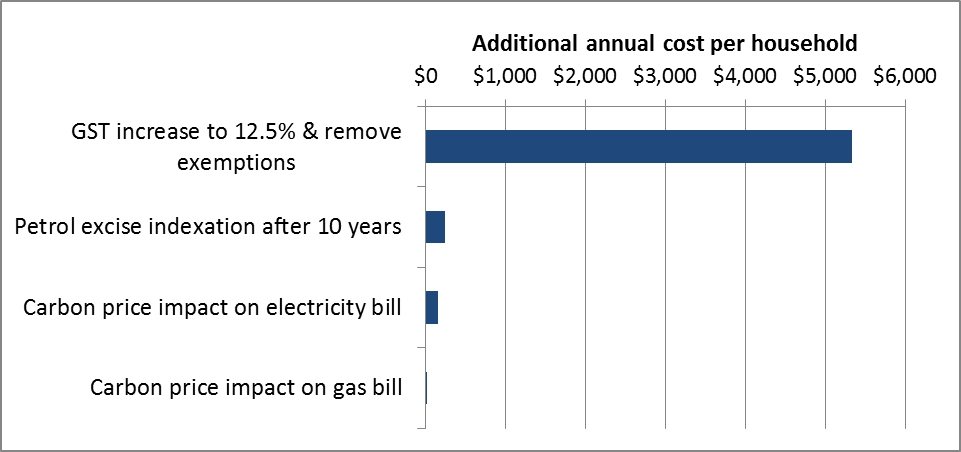

Essentially what Abbott is suggesting we should do with the GST, and what he has just done with indexing the excise tax on petrol to inflation, each represent a bigger hit to the average household budget than the "great big electricity tax", as he and his offsider Greg Hunt termed the carbon price. In addition the impact of the carbon price was offset by changes in income tax scales and increases to pensions and other government payments, just like what we could do with the GST. Abbott has shown, perhaps better than any other politician in Australian history, how choosing the route of the scare campaign is so much easier than ‘mature' policy debate.

Figure: Increased annual cost to households from carbon price, indexation of petrol excise and increase of GST to 12.5%

Sources: Federal Government Treasury estimates increase of GST to 12.5% and removal of exemptions would cost the average two-income family with 2 children $205 per fortnight. Petrol excise cost impact is based on effect of indexation after ten years based on ABS data about passenger vehicle fuel consumption and assuming 2.5% annual inflation. Carbon price impact on electricity bill based on Australian Energy Market Commission analysis and assuming average household electricity consumption of 6000 kilowatt-hours. Gas bill impacts based on Government carbon intensity estimates and Bureau of Resources and Energy Economics data on total household gas consumption.