How first home buyers are being shut out

The Australian residential property market has recently been showing signs of improvement. Investors and changeover buyers are being drawn back to the market following interest rate cuts and the positive outlook for housing. However, first home buyers are being totally left out of the equation due to a number of reasons – stamp duty, the size of deposit required and the ability to save for it, and unemployment and underemployment concerns.

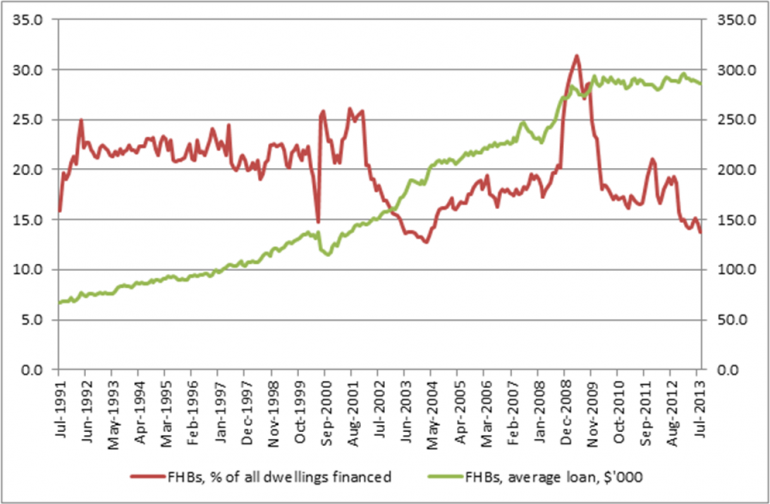

The proportion of first home buyers in the number of owner-occupied housing finance commitments fell to 13.7 per cent for August, compared to the July figure of 14.7 per cent. The August figure is the lowest in over nine years and is far lower than the long-run average proportion of 20 per cent, despite eight interest rate cuts since November 2011.

Recent changes to the First Home Owner Grant in most states and territories have added to the uncertainty and impacted on the activity of first home buyers in the market.

As part of the Intergovernmental Agreement on the Reform of Commonwealth/States Financial Relations signed in June 1999, all states and territories agreed to provide uniform financial assistance to Australians who are buying their new or established first home through the introduction of the First Home Owner Grant.

According to the recently released QBE Lenders’ Mortgage Insurance 2013 Mortgage Barometer Report, 84 per cent of first home buyers believe property prices are close to reaching or are above what they can afford and 69 per cent worry they will never be able to afford their own home (compared to 24 per cent of all respondents).

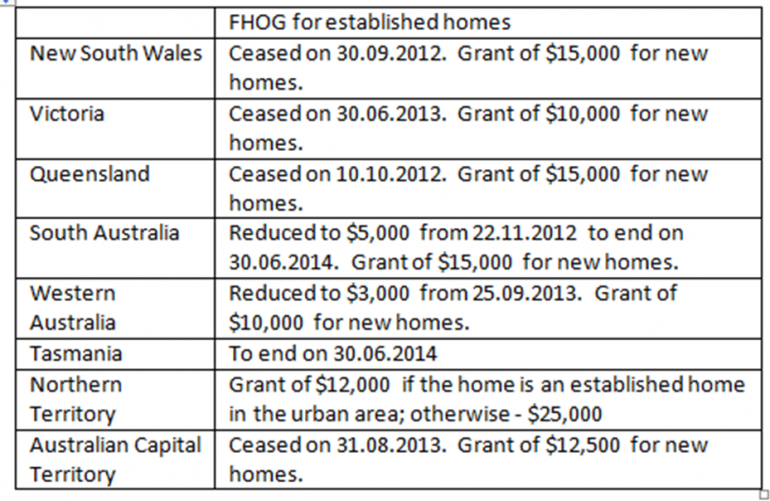

First home buyers spend 23 per cent of their gross income to cover housing costs and of all first home buyers, 82.1 per cent buy established homes. However recent changes to the FHOG will force more purchasers to decide against their preferences and buy new dwellings.

The table below shows recent changes to the First Home Owner Grant.

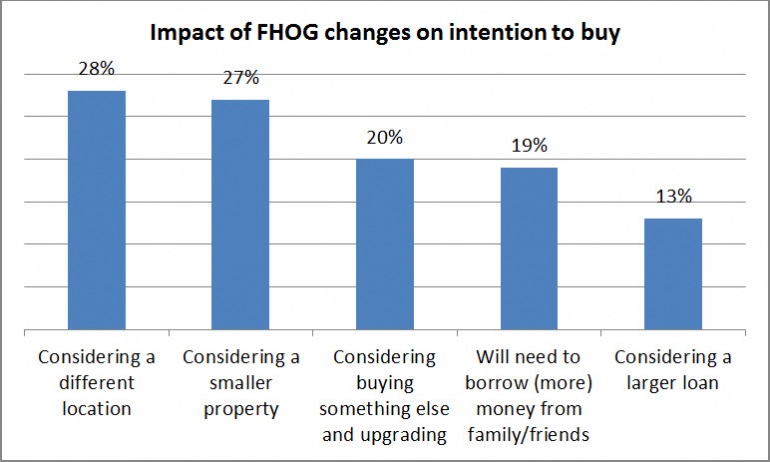

Two out of three first home buyers in New South Wales and Queensland surveyed by QBE LMI indicated the new policies made an impact on their purchase intentions.

In a recent Mortgage Choice survey, 31.8 per cent of respondents said they would continue to rent longer than desired to save for the required larger deposit. Tenants in the private rental market pay 20 per cent of their gross income towards housing. This is the highest level among all other tenure groups.

Data from the Australian Housing and Urban Research Institute shows long-term private renters make up 33.4 per cent of all private renters – a significantly higher figure than 27 per cent in 1994 – and that long-term renters have significantly lower rates of satisfaction with feeling part of their local community.

Of course there’s nothing wrong with renting if that is your choice, but for more and more young Australians wanting to buy their first home, choice is not even an option.

For an alternative take on this topic, read Stephen Koukoulas' First home buyers are not locked out.

Amanda Lynch is chief executive of the Real Estate Institute of Australia.