Housing's dangerous disappearing demand

September’s housing loan has told us what we already knew – that there is a huge upswing in demand. What they really show is how far beyond reach a house is becoming for most first home buyers.

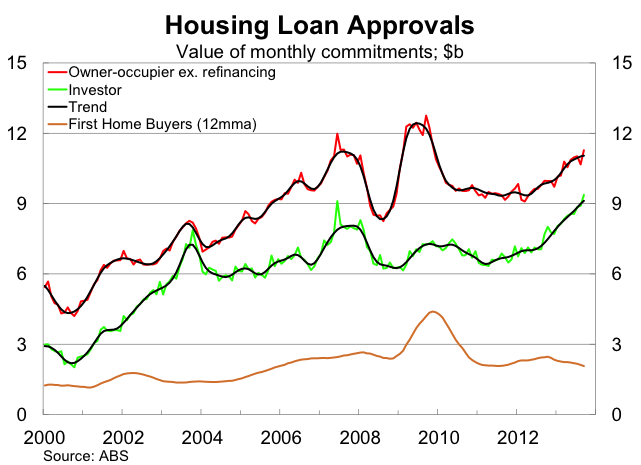

Despite record low mortgage rates, prospective first home owners continue to avoid the housing market. Just 12.5 per cent of all loan approvals were to first home buyers in September – the lowest in the series’ 22 year history. With house price-to-income ratios heading towards their peak and no first home owner boost to distort demand, young buyers have effectively been driven out of the market. This will not change anytime soon, with the labour market set to soften further and non-mining sector remaining subdued.

First home buyers may be priced out but the rest of the market has well and truly caught the property bug.

The number of loan approvals for owner-occupiers excluding refinancing rose by 5.0 per cent in September, to be 11 per cent higher over the year. Despite this the value of housing loan approvals is still 11.6 per cent below its level in September 2009 when the intoxicating days of the First Home Owners Boost finally slowed down.

It is data that will not ease concerns some have that we are in a housing bubble but given the figures for dwelling price growth in October, the report does not add a great deal to our understanding of the market. House price are set to soar in the short-term but with wage growth at a fairly low level it is hard to see this activity in the housing market being sustainable for more than another year or so.

Growth in owner-occupier approvals was almost entirely driven by loans to purchase established dwellings. Loans for new dwellings actually declined slightly, while loans to construct new dwellings rose moderately and is up 16 per cent over the year. Refinancing activity has picked up by 17 per cent over the year to September, as households continue to take advantage of historically low mortgage rates, and this should continue as long as mortgage rates remain at or near historically low levels.

The value of investor approvals was up by 5.2 per cent in September, to be 22 per cent higher over the year. Most of this has been driven by purchases of established housing, but investor approvals for new construction is also up on its 2013 average.

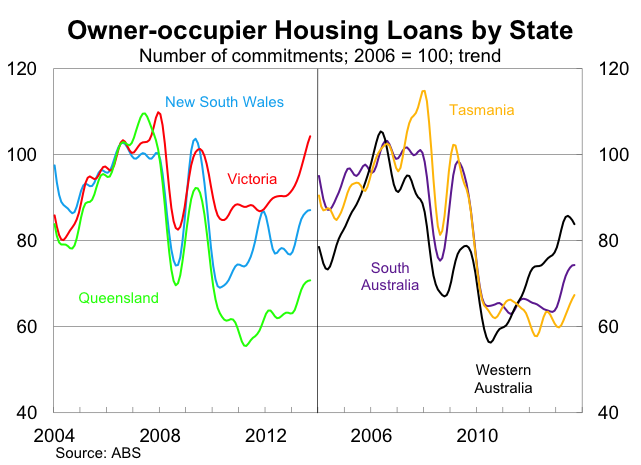

Growth in owner-occupier approvals has been fairly strong among all of the mainland states. The value of housing loan approvals rose by 13.4 per cent in New South Wales and 16.6 per cent in Victoria over the year to September. In South Australia the value of commitments is up by almost 19 per cent.

The soaring Sydney market remains the clear best performer for house price growth this year and has been the cause of some paranoia regarding the boom’s sustainability. House price gains are not being significantly driven by owner-occupier, suggesting growth is being driven by investors, many of whom may view the city as undervalued given it has not experienced, in real terms, price growth in a decade.

Approvals for Tasmania picked up in September but have otherwise been relatively subdued. In response to lagging activity, Tasmanian Premier Lara Giddings announced a doubling of Tasmania’s first home owner grant to $30,000 or around 10 per cent of the median dwelling price in Hobart. The policy will provide a timely boost to a construction industry that has been contracting for some time. However, while first home owner grants are a proven policy for increasing housing purchases and stimulating construction (though to a far lesser extent), the policy will mostly just redistribute wealth towards the already wealthy as it has with every other iteration.

The latest set of housing finance data show clearly that activity is being driven by investors and repeat buyers. I have already addressed my concerns to investors and owner-occupiers but the absence of new buyers adds another concerning element (Buyer beware of the house market bandwagon, November 6). Without first home buyers there is a limit to how long repeat buyers and speculators can drive the market. Unless that dynamic changes this run on housing will come to a screeching halt sooner rather than later.