Households feel the pinch of a struggling economy

The household sector has lost its way over the past few months and poses a significant risk to the rebalancing of the Australian economy. Trade rose moderately in June but volumes were down in the quarter and indicate that household spending may fall for the first time since 2008 when the national accounts are released next month.

The value of retail sales rose by 0.6 per cent in June, beating market expectations, to be 5.5 per cent higher over the year. Sales rebounded following four consecutive months of subpar growth.

Activity had been below expectations throughout most of 2014, with households feeling the pinch of poor income growth and concerns about job security. This was further compounded by the federal budget, which weighed on sentiment, and left most of the heavy lifting to low income earners.

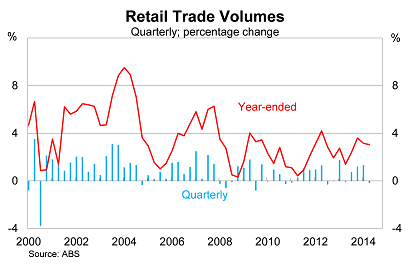

On a quarterly basis, retail volumes fell by 0.2 per cent in the June quarter, led by weakness in April and May, to be 3.0 per cent higher over the year. This was the worst result since September 2012.

Although a weak result, it ended up being considerably stronger than my initial estimates. I hadn’t expected retail prices to be so soft, rising by just 0.2 per cent in the June quarter, which was much weaker than consumer inflation over the same period.

The household sector has been soft for a number of months now and that may have prompted greater sales throughout the retail sector than is normal during this time of year. As a result, retail prices were somewhat weaker than measures of broader inflation.

Prices at department stores fell by 0.3 per cent in the June quarter, with prices for clothing and footwear down 0.6 per cent. This may partly reflect a stronger Australian dollar, which has weighed on import prices, but also broader weakness throughout the Australian economy.

When the national accounts are released, the household consumption deflator -- the price measure that distinguishes between the value of household spending and the volume -- should be closer to the consumer price index and core measures of inflation. This will provide some downside risk to real GDP and household spending.

Either way we are looking at a fairly weak result in the June quarter, with household spending set to contract or grow at its slowest pace since December 2008.

Households consumed less food in the June quarter, which also contributed to less spending at cafes and restaurants. Until recently, spending at cafes and restaurants was growing at a rapid pace -- presumably reflecting the growing influence of cooking shows on television -- and I suspect that spending at restaurants might moderate a little over the remainder of 2014 as growth eases towards a more sustainable level.

Department stores continue to struggle, with sales volumes declining by 1.3 per cent over the year. On a more positive note, spending on household goods – which tends to be the most cyclical category for spending, continues to rise and indicates that many households remain optimistic about their job security and the broader economy.

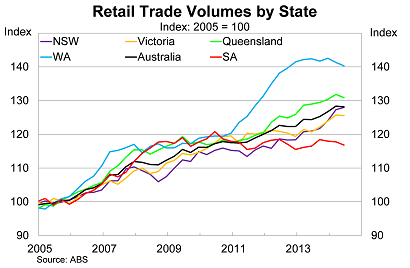

With the exception of New South Wales, retail volumes declined in each of the mainland states. Volumes rose moderately in Tasmania and Northern Territory in the June quarter. Household spending continues to moderate in Western Australia and Queensland, which is consistent with the decline in mining investment and the terms of trade easing.

The household sector remains a source of considerable risk for the Australian economy. It grew strongly throughout 2013 but has stalled over the past five months.

Households continue to be supported by low interest rates and rising asset prices but real wages are declining and the labour market remains subdued. The main risks to the outlook are primarily to the downside, with house price growth set to moderate and the mining sector set to cut as many as 100,000 jobs over the next couple of years (Don’t bank on a consumer cash splash, July 30).

The household sector remains at the centre of the Reserve Bank of Australia’s efforts to rebalance the Australian economy. But the risks to the household sector are significant and place considerable uncertainty around the RBA’s outlook for growth over the next couple of years (their official forecasts will be updated on Friday).

The pick-up in spending in June is a welcome sign but in the absence of further rate relief, I'm struggle to see how the household sector can overcome falling real wages, asset price moderation and the effects of the federal budget.