Hot income investments

Summary: There are a number of investment options available for income investors with a focus on resilience in the fact of the current market volatility. The Vanguard Australian Shares High Yield ETF is a plus, though performance lags compared with the likes of CBA. The Plato Australian Shares Income fund has delivered 8 per cent pa over the last three years, while the Plato Managed Risk fund provides a similar option designed to give more consistent income. The Betashare Australian Dividend Harvester draws investments from the ASX100 using a risk management framework, and delivered a 12.4 per cent yield in the last 12 months. |

Key take out: The Plato Australian Shares Managed Risk Fund and Betashare Australian Dividend Harvester fund have delivered strong capital resilience in the last 12 months. |

Key beneficiaries: General investors. Category: ETFs. |

We all know there's something wrong in investment land – shareholders around the world have been copping it on the chin as stock prices tumble, and even super smart bond investors like PIMCO are finding the going hard. Analysts are confused as to the causes of the problem; some believe the weakness in investment markets is part of the slow recovery at the tail end of the GFC, others believe we are at the dawn of another massive crisis in markets. This makes it very difficult for Australian retirees looking for ways to generate adequate and sustainable levels of income to live on.

At Eureka Report, income investors already have James Samson offering comprehensive coverage of income producing ordinary shares (see the Eureka Income First model portfolio here: Income portfolio home page) while Mitchell Sneddon also covers many Listed Investment Companies, which generally are strong on income was well (see the LIC model portfolio page here: LICs home page).

But what about opportunities outside these two areas? Today we look at three investments that have shown resilience during recent market volatility and which generate strong and consistent levels of income.

Bear in mind that these funds have had a very good record when conditions were ideal, past performance is no guarantee of future success.

Two of these investments are ASX listed Exchange Traded Funds, and the third is an unlisted managed fund (widely available to retail investors). The first ETF is a relatively simple product which selects and holds a portfolio of ASX listed stocks which are paying high dividend yields, while the other investments blend a range of investment strategies along with some internal risk management features which are designed to limit downside in falling markets.

Vanguard Australian Shares High Yield ETF

Vanguard Australian Shares High Yield ETF (ASX code: VHY) is a popular ETF with nearly $600 million now managed for its investors. It screens the top 100 stocks listed on the ASX and ranks them based on dividend yield – but with some additional filters to target stocks with maintainable and good quality earnings (i.e. to weed out “flash in the pan” dividend stocks). These filters include return on equity, earnings growth rate, price/earnings ratio, etc. Diversification is enhanced by limiting exposure to single sectors, to not more than 40 per cent of the fund's holdings.

VHY currently holds 39 stocks, with the portfolio being re-balanced twice yearly. Income distributions over the last 3 years have averaged 5.91 per cent (mostly franked), which puts VHY in line with distributions on major bank stocks, with the benefit of 39 stocks and sector diversification. Note that because of the high turnover in VHY, dividend growth is limited (compared to buying and holding a bank stock).

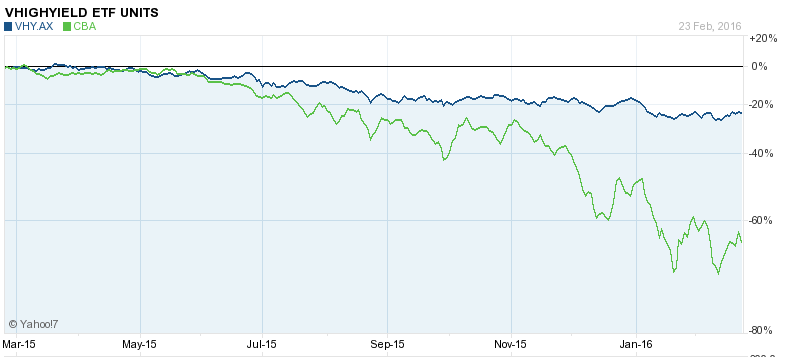

Although the income from VHY is solid, when compared to the overall performance of broad market indices like the ASX100, or even to individual stocks like CBA, performance for VHY can be seen to lag. Low fees on VHY (0.25 per cent pa) help the appeal of this ETF, and its liquidity is a plus compared to traditional unlisted managed funds.

Plato Australian Shares Income Fund

Plato is a well-credentialed Australian fund manager, with its chief executive (Dr. Don Hamson) having held senior positions at Westpac Investment Management prior to founding Plato. Unlike VHY, which simply holds ASX listed stocks, the Plato Australian Shares Fund uses a variety of strategies to generate income, specifically targeted for zero per cent taxpayers (eg. Self Managed Superannuation Funds in pension phase, and charities). These strategies include participating in off market share buybacks (where a large component of the buyback price is paid as a fully franked dividend), as well as investing in higher yielding ASX listed products like hybrid securities. Although not widely publicised, it is understood that the Plato Fund also uses derivative based investment strategies such as the “buy/write” approach (where call options are sold over underlying shares to enhance the return on them).

The Plato fund has paid a yield over 8 per cent pa in each of the last 3 years – with a 3 year average of 8.7 per cent (with franking credits attached). Management fees of 0.9 per cent pa are relatively high, with the minimum retail investment of $30,000, making this fund accessible to most investors. Distributions are paid quarterly and may be re-invested.

Plato Australian Shares Fund (Managed Risk)

The Plato Fund will fall in value as underlying investments move downwards – not ideal for investors primarily seeking income with capital stability. To cater for more risk averse investors, the Plato Fund is available in a “Managed Risk” version, which embeds a nimble and effective risk management overlay designed and managed by the global actuarial firm of Milliman. The “Milliman Managed Risk Strategy” (MMRS) is an innovative strategy, which is used globally by major insurance companies and investment funds, and has been in use for the last few years (so its effectiveness can be measured against the falls in similar unprotected investments).

Protecting capital from losses – and doing so in a cost effective way – is notoriously difficult. Buying insurance (through put options) is effective but expensive. Protecting the full value of investments using put options can cost five per cent or more of the overall cost of the portfolio. Lower cost forms of capital protection (like the notorious “CPPI” method) can also be effective but in extreme market crises the forced sell down of the underlying asset deprives the investor from prospects of capital growth in any recovery (as well as from earning dividends or other income).

The MMRS is a simple mechanism, which reduces share market exposure when volatility rises and/or price momentum starts to turn negative. It reduces exposure by short selling share index futures, and in so doing; the MMRS stabilises the volatility of the underlying portfolio. On top of this, the MMRS also creates a risk management profile that is similar to the purchase of put options (but in such a way as to avoid the outlay of costs traditionally associated with buying put option protection).

The fees for the Managed Risk version of the Plato Fund are a total of 0.99 per cent (i.e. only an additional 0.09 per cent), making this a very reasonably priced alternative. The Managed Risk version showed 30 per cent less price deterioration over the last 12 months compared to the simpler version, with capital losses of -2.2 per cent compared to -3.1 per cent for the simpler version.

BetaShares Australian Dividend Harvester Fund

The BetaShares Australian Dividend Harvester Fund (ASX code: HVST) cycles through ASX100 stocks selected based on their forthcoming dividend, and combines this with the MMRS strategy utilised by Plato. The fund is ASX listed and has paid a cash return of 12.4 per cent (plus franking) in the last 12 months.

The fund strategy aims to:

1. Harvest the dividend income and franking credits from large cap Australian shares

2. Pay a relatively consistent, strong and tax-effective monthly income stream

3. Provide at least double the yield of the broad Australian equity market on an annual basis

4. Provide investors a smoother investment ride via the potential for significantly reduced volatility and cushioned downside market risk

In its inaugural year, HVST has achieved a 12 month cash yield of 12.4 per cent with an additional 3.7 per cent of franking credits. Past performance is not an indicator of future performance

Both the Plato Managed Risk Fund and the BetaShares HVST fund have exhibited better capital resilience than unprotected strategies over the last 12 months, as well as far lower price volatility. These funds offer the potential for good income returns as well as capital resilience, which will be welcome in the event that the market skeptics are shown to be right about rising levels of risk.

Tony Rumble PhD is a Director of Ramshead Capital and receives no direct or indirect benefit in respect of any product discussed.