Homing in on the drivers of growth

Building approvals surprised on the upside as we begin a big week for the Australian economy. Tomorrow sees the release of retail trade for October and the final Reserve Bank board meeting of the year, followed by September quarter GDP on Wednesday.

But for many, all eyes will be turned to the US where payrolls for November may provide the best indication yet on the timing for the taper.

Building approvals ticked down in October on a seasonally adjusted basis. But the less volatile trend measure suggests that activity remains fairly upbeat for residential investment. The market expected a much stronger decline in October, following a sharp rise in approvals for September.

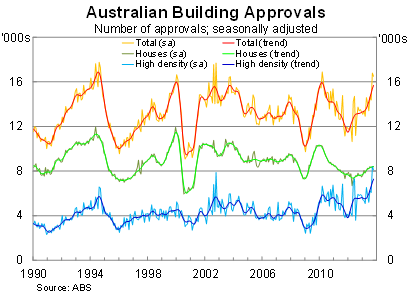

As the graph below shows, total building approvals are at a fairly high level by historical standards and have increased significantly since the trend troughed in December 2011. But almost all of this has been due to higher density approvals, which are now at their peak in trend terms. It is worth noting though that if building approvals were adjusted for population growth, the level of building approvals would be significantly below earlier peaks.

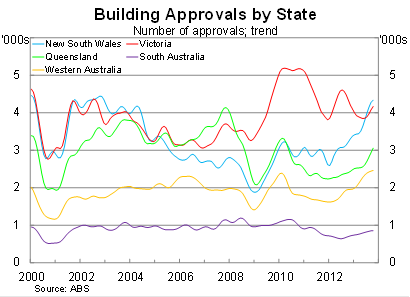

On a trend basis, approvals in New South Wales continue to increase and are now ahead of Victoria for the first time in eight years. Approvals in both Queensland and Western Australia have increased significantly, although in Queensland they remain well below their previous peaks.

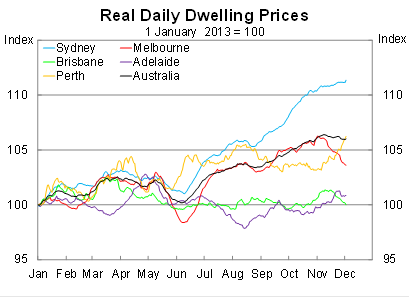

Conditions remain fairly favourable for residential investment and low interest rates will support investment in the near term. One concern for the outlook may be dwelling prices, which have slowed in most cities over November.

The latest house price boom is quickly becoming a fizzler for everyone but Sydney, with real dwelling prices in Brisbane and Adelaide barely changed in 2013 so far and Melbourne prices on the decline.

Another factor is that building high-density properties is typically less labour intensive than building the same number of houses. So this residential investment recovery, driven by apartments, may not bring with it the associated labour market improvements that previous investment upswings have brought.

Although residential investment is expected to rise in 2014 and 2015, it remains a relatively small share of GDP. As a result, I don’t see it being a big driver of the economy over the next few years – particularly if it doesn’t drive employment. Other factors such as exports, household consumption and the rate of decline in mining investment will prove to be more important factors supporting growth.

Tomorrow the Reserve Bank board meets for the final time this year. They will not meet again until 4 February. The board is widely tipped to keep rates unchanged, which for the time being is the right decision. There is still significant economic and political uncertainty in the United States, which will influence the direction of the next RBA move. Making a policy change now will be viewed as too risky given the uncertainty surrounding the United States budget and timing of the taper.

We are already seeing some evidence that the market believes the taper is forthcoming, with gold prices falling and the US dollar depreciating, while 10-year Treasury bills picked up a bit throughout November. This weekend, we will get another jobs report and a strong number could tip the Fed’s hand when they meet on December 17-18.

With the Reserve Bank unlikely to move tomorrow, most attention will be on whether it continues its war of words against the Australian dollar. The jawboning has been a success so far, with the dollar declining by 4.5 per cent against the US dollar since Reserve Bank governor Glenn Stevens upped the ante in late October. But more work is still to be done and our export-oriented industries require a further depreciation of at least another 5 per cent.