Homing in on mortgage defaults in Australia

Why does a household default on their mortgage?

It's a complex question, owing a great deal to personal circumstance, but there are two underlying theories and a unifying one.

First, there is the ‘equity' theory of default, which assumes the decision to default is based on a rational assessment of the benefits and costs of holding the mortgage. If the value of the mortgaged property falls sufficiently relative to the mortgage itself, then it may be rational to simply walk away.

Second, there is the ‘ability-to-pay' theory, which maintains that borrowers default when their income is no longer sufficient to cover their ongoing mortgage payments (plus some subsistence level of spending).

Empirically there has been limited evidence for the first theory. To the extent that mortgage holders act strategically, the level of negative equity has been quite high. In Australia, the equity theory faces some obstacles given the existence of full-recourse loans, which significantly increase the cost of mortgage default.

However, even beyond Australia, mortgageholders generally shy away from strategic default. Perhaps they are concerned with the reputational effects of declaring bankruptcy (including the effects on future loans) or maybe they believe that property prices will turn around.

Perhaps the two theories can be best viewed in tandem -- sometimes referred to as the ‘double-trigger' theory. According to this theory, borrowers only default when they cannot pay their mortgage and they have negative equity in their property.

In a recent research paper, the Reserve Bank of Australia notes that “an ability-to-pay shock … should not be sufficient on its own for a borrower to default” because the borrower can simply sell the property to cover the mortgage.

Similarly, “negative equity should not be sufficient for a borrower to default”, since prices may turn around and default is far from costless. But the combination of the two provides the perfect circumstances for a household to walk away.

The RBA was keen to test these theories further and, utilising an Australian data set, have done exactly that. The results won't necessarily be surprising but -- in the absence of other research -- it is still handy to quantify how responsive mortgage default is to a range of factors.

The research shows that loans with high loan-to-valuation ratios -- typically greater than 90 per cent -- are more likely to enter arrears. Counter-intuitively, households with LVRs of over 100 per cent are actually less likely to enter arrears, although the authors note that this is likely to reflect data limitations.

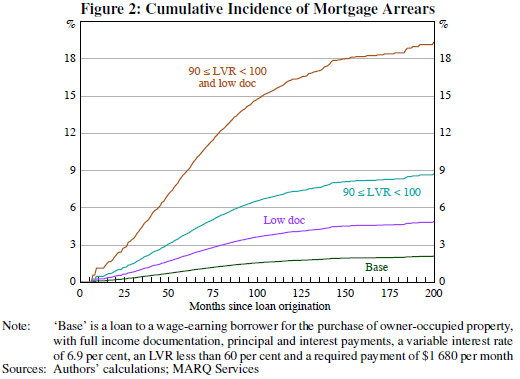

The graph below shows the cumulative likelihood for default for a range of LVRs. A loan with an LVR between 90 and 100 per cent has a 3.9 per cent chance of default after five years; by comparison, a low-doc loan with the same LVR has 8.9 per cent chance of default over the same period.

Readers won't be shocked to learn that borrowers with relatively high mortgage rates have a higher probability of entering arrears, which is consistent with riskier borrowers being charged higher interest rates as compensation for their higher risk. This can quickly become a vicious cycle -- you are more likely to default so you pay more interest, which makes you more likely to default and so on.

The authors find that having a high debt-servicing ratio -- for example, above 50 per cent -- significantly increases the probability of entering arrears. This highlights the risk of a changing interest rate environment and how important it is that borrowers do not overextend themselves to get into the property market.

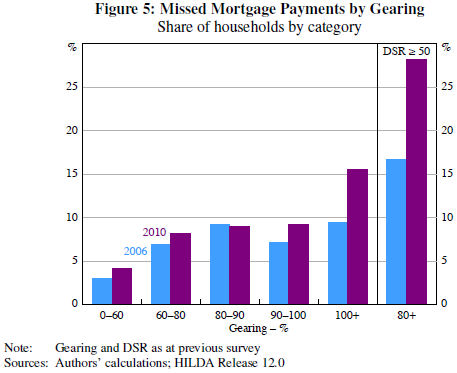

The graph below shows how debilitating the combination of high gearing and a high DSR can be. Households generally do a fairly good job of meeting mortgage repayments, with the odd miss offset by households who are ahead of schedule, but when gearing is over 80 per cent and the DSR pushes beyond 50 per cent, the likelihood of missing payments skyrockets.

Modelling indicates that having a DSR over 50 per cent means that the household is, on average, 10 percentage points more likely to miss a mortgage payment than for a household with a DSR under 30 per cent.

A borrower's credit history is also a useful indicator of their future behaviour. Households that missed a mortgage repayment in 2006 are estimated to be around 22 percentage points more likely to miss a payment in 2010.

Meanwhile, you are more likely to miss a payment if you are self-employed, reflecting the more volatile cash flows of this business type.

As I noted earlier, the results will not be a surprise to many readers, but nevertheless it is good to see the issues analysed. Australians have a good record when it comes to their mortgage repayments: a product of strong income growth, employment prospects and strong house price growth.

One factor that is important to consider when analysing mortgage arrears or defaults in Australia is that the data series are often so short that they fail to cover our last recession. There are always risks associated with drawing conclusions on unusual growth periods -- in our case, an unprecedented period of economic success.

For example, how can the model explain how households react to negative equity when that really hasn't been a problem over the course of the sample? What about the response to a significant shift in unemployment?

Given the lack of volatility across the sample size, I wouldn't be surprised if the response to a negative income shock or negative equity was somewhat stronger than the model suggests.

At the very least the models and the broader RBA analysis provide a good argument for maintaining high lending standards. The characteristics associated with missing payments are easily identifiable, leaving our banks with no excuse for creating toxic loans. But, of course, this isn't a one-way street; households also have to be aware of their limitations and the risks involved with taking on significant debt.